While most of us have felt some financial impact from the pandemic, it’s older Australians who have best weathered the storm of 2020. According to one research study, older Australians are more confident than younger Australians about the economic impact of COVID-19 on their retirement. In this article, we share some insights to help you spend confidently in retirement.

The impact of a pandemic on our spending

Having less to spend money on in 2020 has been good news for our spending habits. A study by McCrindle found that 41 per cent of Australians have managed to save more money than usual in 2020. While we spent more money on food delivery, home improvements and health services, we spent significantly less on public transport, gym/fitness and travel. Much of what we did spend was online. According to Australia Post, online shopping has grown 75 per cent from 2019.

While the increase in online shopping might sound alarming, we’ve developed plenty of good spending habits during the pandemic. According to research by McKinsey, we’re being more mindful about what we buy, and we’re planning ahead more. The pandemic has also inspired us to learn how to make things ourselves, rather than ‘buying in’.

Spending on travel and leisure remains a priority for retirees

For retirees, spending on travel and social activities is a top priority once essential expenses have been covered. But it seems that border closures in 2020 have left many Australians desperate to get on the road. According to McCrindle, Australians who saved more than usual during 2020 are planning to spend their extra savings on travel.

With no signs of international borders opening, those who are used to heading overseas are staying local. Almost two in five Australians are expected to travel within their own state and territory within the next two months, helping to rejuvenate regional communities affected by drought and bushfires and COVID-19.

In retirement, making sure your expenses are covered before you start to splurge is essential to managing your budget over the long term.

Making sure you have the Age Pension ‘gap’ covered

As you age, it’s only natural that you’ll spend less on things such as leisure and travel. But did you know that your spending on everyday essentials is likely to stay steady, as costs such as healthcare increase with age? It’s important to remember that although your needs will change later in retirement, you’ll still need to plan for expenses that you didn’t expect.

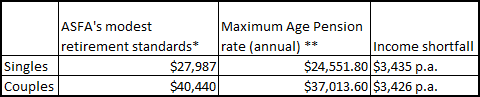

For most retirees, even the maximum Age Pension payment isn’t enough to cover a modest retirement lifestyle, according to the ASFA Retirement Standard:

If one day your retirement savings run out, and you’re relying on the Age Pension to cover your day-to-day expenses, you may have an income shortfall. Taking the time now to understand your income options is one of the best things you can do for your retirement.

A set-and-forget approach to retirement income

A smart retirement income plan can support your spending needs throughout retirement. Combining different sources of income, such as your super, the Age Pension and a lifetime annuity, can provide you with an added layer of protection in retirement and help to make sure your everyday expenses are covered.

Find out more about Challenger lifetime annuities here or use the Challenger Retire with Confidence tool to learn how a comprehensive retirement income plan could work for you in retirement.

Do you regard yourself as a confident retiree? Or do you believe you will be? Have you sought financial advice?

Challenger is a YourLifeChoices preferred partner.

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/finance/superannuation/news-superannuation/senator-urges-retirees-to-use-their-savings-more-efficiently

https://www.yourlifechoices.com.au/finance/five-smart-moves-for-empty-nesters

The information in this article is provided by Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670 (Challenger Life), general only and has been prepared without taking into account any person’s objectives, financial situation or needs. Because of that, each person should, before acting on any such information, consider its appropriateness, having regard to their objectives, financial situation and needs. Each person should obtain and consider the Product Disclosure Statement (PDS) before making a decision about whether to acquire or continue to hold the relevant product. A copy of the PDS can be obtained from your financial adviser, our Investor Services team on 13 35 66, or at www.challenger.com.au All references to guaranteed payments from Challenger refer to the payments Challenger Life promises to pay under the relevant policy documents. Neither the Challenger group of companies nor any company within the Challenger group guarantees the performance of Challenger Life’s obligations or assumes any obligations in respect of products issued, or guarantees given, by Challenger Life.