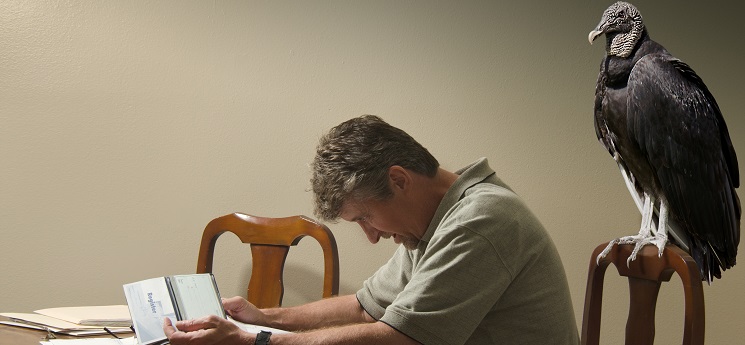

Predatory debt management companies dubbed ‘debt vultures’ are preying on Australians in financial distress as a result of the coronavirus pandemic.

Consumer Law Action Centre policy director Katherine Temple told The Age she had received many complaints from people who had signed up with these companies and fallen further into debt.

“They use high pressure sales tactics and promise the world,” she says. “They convince people that their service is the way to get on top of their debt problems.”

Ms Temple expects more people will fall victim to debt vultures as the economic impacts of the pandemic deepen.

Debt vultures, also known as unlicensed debt management providers (DMPs), charge upfront fees to help customers negotiate payment plans, restructure debts and repair credit ratings. Many do not hold a financial services licence or a credit licence issued by the corporate regulator, the Australian Securities and Investments Commission (ASIC), Ms Temple said. They target people concerned about bills, home repossession or credit reporting, promising a quick-fix ‘debt solution’.

Not-for-profit Financial Counselling Australia (FCA) says: “The reality is that often these unqualified, unregulated firms charge exorbitant fees, fail to deliver on many of their promises and leave financially struggling families with even less money.”

Similar services to those promised by DMPs are available through free, licensed financial counselling services such as the National Debt Helpline.

The federal government recently announced reforms aimed at strengthening protections for consumers targeted by predatory DMPs, but the changes do not take effect until April. The new laws would require DMPs to hold an Australian credit licence and meet the ongoing obligations imposed on credit licensees.

Karen Cox, chief executive of the Financial Rights Legal Centre, is concerned the reforms won’t cover credit repair and personal budgeting services.

In July, National Australia Bank (NAB) cut ties with unlicensed fee-charging DMPs after a big rise in the number of customers accessing hardship measures such as loan deferrals. Almost one in 10 NAB customers in financial hardship were engaged with DMPs.

At that stage, NAB said 98,189 of its home loan customers and 39,528 businesses had deferred loans through the pandemic.

“As more Australians seek help, it is important that we no longer deal with unlicensed, fee-charging debt management providers,” says NAB group executive Rachel Slade.

Two years ago, a parliamentary economics inquiry found unlicensed DMPs rarely enhanced a customer’s financial standing. It suggested the federal government introduce a licensing system for the sector.

Consumer Action Law Centre senior policy officer Cat Newton told The New Daily that banks and governments had to work together quickly on industry-wide regulation to counter debt vultures.

“With very high and hidden fees, poor-quality advice, and no requirement to meet even basic professional standards, too often these unregulated, fee-driven companies can’t be trusted to help,” Ms Newton says.

“With growing financial difficulty due to COVID-19, business will be booming for debt vultures unless the other banks, and the federal government, act quickly.”

Consumer groups welcomed NAB’s crackdown on debt vultures .

“Debt vultures exploit loopholes in the law to prey on the vulnerable and target those in desperate need,” says Gerard Brody, CEO of the Consumer Action Law Centre.

“All banks should follow NAB’s lead and stop dealing with debt vultures if they care about their customers,” he says.

Mr Brody urged the federal government’s regulatory framework for debt management firms to include an obligation to act in the best interests of their clients.

He also backed making membership of the Australian Financial Complaints Authority compulsory; licensing by regulators; banning unsolicited sales and prohibiting upfront fees for service.

“We often hear from Australian families wooed by these debt vultures with promises of fixing their credit report, wrangling their debts, and taking away financial worries. And all too often these promises are just pure fiction,” says Mr Brody.

“With growing financial difficulty due to COVID-19, business will be booming for debt vultures. We urge the federal government to act urgently, to ensure people can access quality debt advice.”

People struggling with bills and debts can contact the National Debt Helpline (NDH) by visiting ndh.org.au or calling 1800 007 007. The NDH is a not-for-profit service that helps people in Australia tackle their debt problems.

Have you had any contact with debt vultures? Do you think regulation will help save people from debt vultures?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/news/debt-vultures-in-probes-sights

https://www.yourlifechoices.com.au/retirement/living-in-retirement/is-debt-ruining-your-retirement

https://www.yourlifechoices.com.au/debt-management-firms-in-the-gun