Retired Australians are creaming it, wrote Leith van Onselen, chief economist at the MB Fund and MB Super, late last year.

“The next time you hear a seniors’ group demand an increase in the aged pension [sic] and other subsidies, consider the latest Melbourne Institute’s Household, Income and Labour Dynamics in Australia (HILDA) report …” he wrote for macrobusiness.com.au.

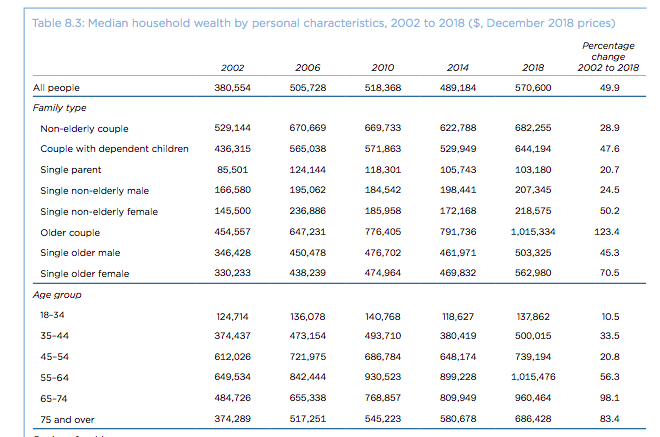

“This report showed that Australians aged 65-plus enjoyed by far the biggest increase in wealth between 2002 and 2018.”

Mr Onselen then let the charts from the HILDA report do the talking.

The HILDA survey is a longitudinal study of Australian households and started in 2001. As of December 2019, 18 years of research were available to researchers.

The distinguishing feature of the survey is that the same households and individuals are interviewed every year, allowing the researchers to see how their lives are changing over time. And the study can be “infinitely lived”, following not only the initial sample members for the remainder of their lives, but also their children and subsequent descendants

So what has provoked Mr Onselen into asserting that older Australians are “creaming it”?

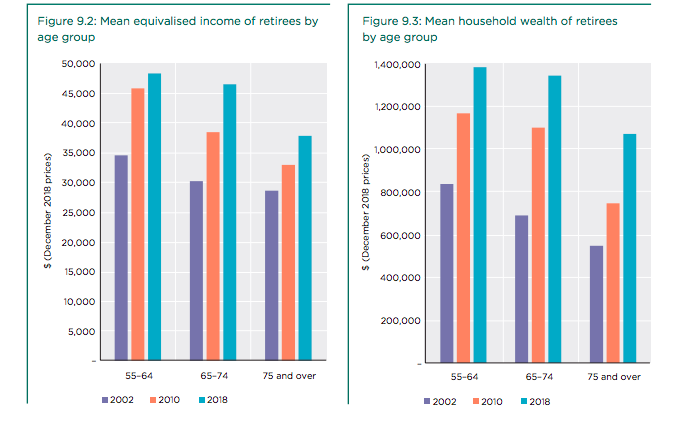

While the survey finds that retirees’ mean incomes continue to be “considerably lower” than non-retirees, they have grown markedly since 2002, with superannuation and housing the key factors.

“The mean equivalised income of retirees grew by 39 per cent in real terms between 2002 and 2018, compared with 29.7 per cent for the non-retired population,” the report says. “It bears noting that this is greater than the increase in the Age Pension over this period, indicating that other income sources were important to the growth in retirees’ incomes.”

Unsurprisingly, average wealth levels were found to be considerably higher among retirees than among non-retirees, but again it was the rate of that growth that stood out.

“Between 2002 and 2018, retirees’ mean wealth grew by 79 per cent and median wealth grew by 85.2 per cent, compared with respective growth of 55.7 per cent and 46.4 per cent for the non-retired population.”

The survey concluded that based on average income and wealth levels, the economic wellbeing of retirees had increased in both absolute terms and relative to the broader community.

The survey also yielded ‘welcome’ news on poverty rates among retirees, noting that they had fallen but “remained at least 80 per cent higher than for the non-retired population across the entire 16-year period”. But despite that alarming statistic, the level of financial stress was “much lower” among retirees than among the rest of the population.

“In 2018, 7.4 per cent of retirees reported experiencing two or more indicators of financial stress, compared with 11.9 per cent of the non-retired population,” the report said.

It is the areas of home ownership and maturing superannuation balances that have produced the biggest changes in fortune.

Home ownership among retirees defied the broader national trend. About 80 per cent of retirees were homeowners across the 2002 to 2018 period. In contrast, the proportion of the non-retired population living in owner-occupied housing declined from 69.9 per cent in 2002 to 65.7 per cent in 2018.

The figures above show that all three age groups experienced substantial increases in mean income and wealth with the 65–74 group reaping a 54 per cent increase in mean income and a 95 per cent increase in mean wealth.

But wait, there was more good news with those aged 65 and over reporting the highest levels of life satisfaction, followed by people aged 15–24. However, people aged 55–64 experienced the biggest decline in happiness since 2001 of any age group. And men’s life satisfaction remains consistently lower than women’s.

So does Mr Onselen have a point? Are older Australians “creaming it”?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/finance/news-finance/were-reluctant-to-help-ourselves

https://www.yourlifechoices.com.au/news/easing-painful-hips-and-knees

https://www.yourlifechoices.com.au/news/everyday-product-damaging-the-planet