The Australian Securities and Investments Commission (ASIC) has tightened the rules regarding superannuation retirement calculators to ensure that they are adjusted for inflation.

The new requirements will start on 5 December this year to give calculator providers a workable transition period.

The amendments require superannuation and retirement calculator providers to adjust for inflation in estimates by using either:

- the default inflation rate set out in the instrument for superannuation and retirement calculators; or

- an alternative inflation rate, as long as certain disclosure requirements are met.

The default inflation rate set out in the instrument is the rate used by ASIC’s MoneySmart superannuation and retirement calculators. It includes a component that reflects changes in the cost of meeting increases in community living standards.

Adjusting for the cost of meeting increases in community living standards may assist users to better decide if future retirement assets or income will be adequate compared to their standard of living.

ASIC will amend the instrument in June each year to reflect any changes in the default inflation rate used by ASIC’s MoneySmart superannuation and retirement calculators. This rate is reviewed and updated annually.

The option of using an alternative inflation rate recognises that there may be instances where it is appropriate for a superannuation and retirement calculator to use a different inflation assumption – for example, to take into account:

- the wage profile of the likely users of the calculator; or

- the provider’s wage growth outlook.

If the alternative inflation rate used does not include a component that reflects the cost of meeting increases in community living standards, the superannuation or retirement calculator must explain the implications of not taking into account the cost of meeting those increases.

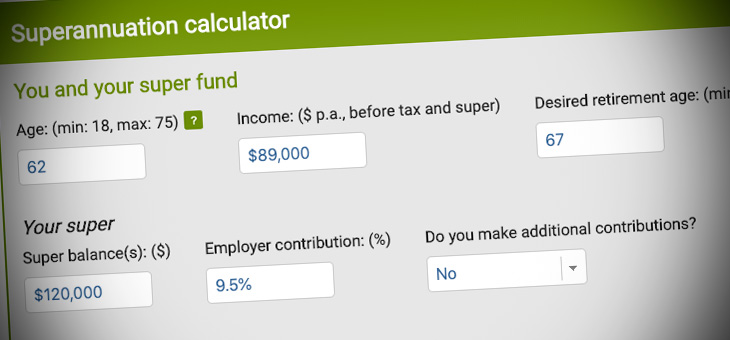

Superannuation and retirement calculators can be a useful and cost-effective educational tool through which users can better understand their financial circumstances and goals.

The amendments to the instrument will promote the comparability of superannuation and retirement estimates, while providing flexibility for providers to use a different inflation rate assumption, where it is reasonable to do so.

Until the changes start on 5 December 2019, superannuation and retirement calculators must disclose whether or not estimates take into account changes in the cost of living.

Which retirement calculators do you use? Does yours take inflation into account?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

The growing ‘unretirement’ trend

Australia’s hottest retiree postcode

More bad news for retirees

Disclaimer: All content on YourLifeChoices website is of a general nature and has been prepared without taking into account your objectives, financial situation or needs. It has been prepared with due care but no guarantees are provided for the ongoing accuracy or relevance. Before making a decision based on this information, you should consider its appropriateness in regard to your own circumstances. You should seek professional advice from a financial planner, lawyer or tax agent in relation to any aspects that affect your financial and legal circumstances.