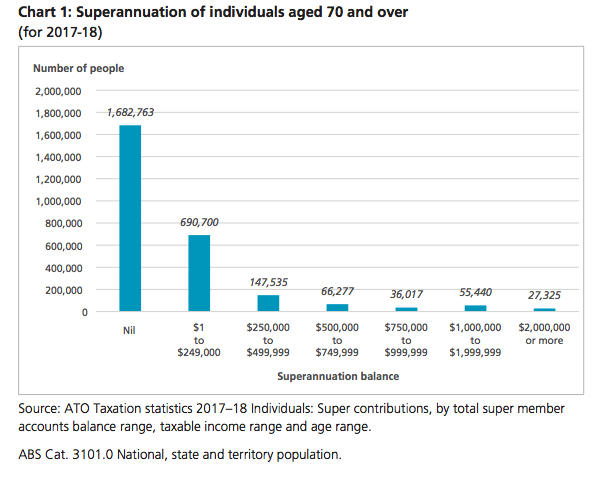

Most Australians over the age of 70 have no superannuation and most seniors die having exhausted their super long ago, according to the Association of Superannuation Funds of Australia (ASFA).

ASFA’s Superannuation Balances Prior to Death report analysed Australian Taxation Office (ATO) and Australian Prudential Regulation Authority (APRA) figures and previously unpublished data from the Household, Income and Labour Dynamics in Australia (HILDA) survey.

The recent Retirement Income Review stated that retirees tend to consume only the income derived from assets and not the assets themselves, but ASFA came to a very different conclusion.

Its report found that 80 per cent of those aged 60 and over who died between 2014 and 2018 had no super left four years before their death.

Only 15 per cent of females aged 60 and over at death had any superannuation compared to about 25 per cent of men.

A very small proportion still has a substantial superannuation balance at death and that inflates averages, the report says.

Read more: Keating says Australians are owed a super increase

ASFA says the Super Guarantee (SG) must rise to 12 per cent as legislated “so that retirees can live in retirement with dignity”.

“Some Coalition MPs and think tanks, including the Grattan Institute, have argued that compulsory super should not rise from 9.5 per cent to 10 per cent this July and then to 12 per cent by 2025, claiming it would hurt businesses and lead to lower wages,” The Australian reports.

While debate about the SG increase rages, Australians who worked largely before super started in 1992 are under pressure.

Compulsory employer super contributions did not reach nine per cent until 2002, meaning many older Australians have minimal balances. ASFA chief executive Martin Fahy says large amounts of super held by wealthy retirees “distorted” average super balances.

“There are 11,000 people with more than $5 million in their super,” he said. “We have suggested that anybody with more than $5 million in super should have to withdraw the excess of that from their superannuation and not continue to get tax breaks.”

Dr Fahy said workers in manual occupations often did not work all the way to the age pension age and ended up “eating into their super prematurely”.

“People who had modest superannuation balances have spent them because of aged care costs, healthcare costs and also the cost of living.”

Read more: Keating says Australians are owed a super increase

Homeowners without sufficient superannuation to retire comfortably could turn to reverse mortgages, the Retirement Income Review said.

Review chairman Mike Callaghan told the ABC’s 7.30 program that a pensioner who owned a $500,000 house could draw down $5000 from the equity in their home every year and fund their retirement for 25 years.

He denied people would have to sell their homes to fund their retirement.

“It is an asset there that is under-utilised that I think people should be thinking about making more use of their house to fund themselves in their retirement,” he said.

Former prime minister Paul Keating, the architect of our superannuation system, is opposed to reverse mortgages.

“You shouldn’t be forced to eat your own home but also, reverse mortgages at the moment are very expensive,” he told the ABC.

Superannuation minister Jane Hume endorses reverse mortgages.

“We don’t want to compel people to use home equity, but it should be there as a flexible option and it already is there as a flexible option,” she said.

Investopedia says “a reverse mortgage allows you to take out a loan against the equity in your home where you do not have to repay the loan during your lifetime as long as you are living in the home and have not sold it”.

Investment site simplyretirement.com.au says reverse mortgages should be considered by retirees who are “asset rich but cash poor”.

“Often this means they own their own house but struggle to make ends meet and maintain a house that has often become far too large for their needs.”

Moneymag says the main risk with reverse mortgages is that “your loan principal increases as the interest payments are added to it (or compounded), and interest rates for reverse mortgages don’t come cheap”.

Do you expect your super to last your lifetime? Have you considered a reverse mortgage? Do you know anyone who is struggling to make ends meet because they don’t have enough super?

Read more: Watchdog threatens action against ‘worst’ super funds

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.