Investing based on your age and stage of life might seem like a good idea, but a new report suggests that it could actually cost you a significant amount of money when you reach retirement.

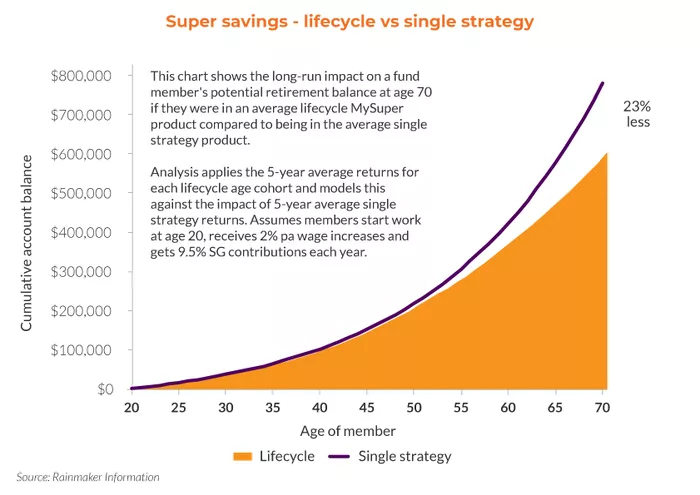

Choosing a typical lifecycle MySuper product throughout a member’s working life could reduce their potential retirement savings by 23 per cent at age 70, according to a new report from Rainmaker Information, which roughly equates to $170,000 in foregone savings based on current figures.

Lifecycle superannuation products are those that invest members’ money differently depending on their age. For example, younger members will have more of their superannuation allocated into equities and property and older members will have more allocated into bonds and cash.

These products operate differently to the more traditional single strategy MySuper products that use the same investment strategy regardless of the age of the member.

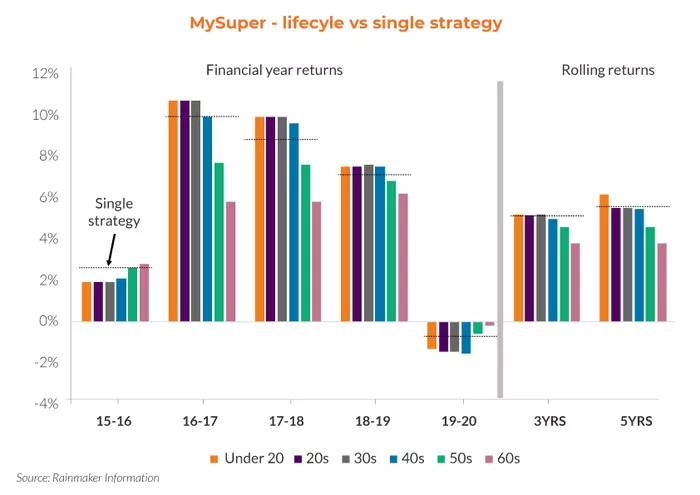

Rainmaker Information’s latest Superannuation Benchmarking Report found that single strategy MySuper products at least matched, and often beat, the lifecycle MySuper index across all age groups over the three and five-year performance periods to 30 June 2020.

“While the best lifecycle products perform very well, there is massive disparity between these and low-performing lifecycle products,” said Alex Dunnin, executive director of research at Rainmaker Information.

Over the three-year performance period to the end of November 2020, there was a 3.3 percentage point gap between the top placed product and the bottom placed product.

Mr Dunnin explained that the COVID-19 pandemic made the situation worse, with the difference in returns over the 12 months to 30 November 2020 growing to 5.5 percentage points.

Of the five lowest-performing lifecycle MySuper products, four were retail and one was a not-for-profit fund.

Of the five top-performers, four were not-for-profit funds and one was a retail fund.

Despite the current performance figures, Mr Dunnin said that the idea behind lifecycle products remained compelling.

“As you get older your investment risks are dialled down and a greater proportion of your MySuper savings are allocated to more conservative assets like bonds. There is less chance of losing money,” he said.

“But the strategic problem in the lifecycle sector is not the concept behind them, but the huge variation in their outcomes. That is, as a group, they don’t seem to be actually working properly. Their leading products are nevertheless extremely impressive.

“Too many lifecycle products are struggling to deliver on their promise. Heatmaps produced by the superannuation regulator, APRA, have found pretty much the same thing.”

Mr Dunnin said some advocates of lifecycle MySuper have argued that it’s not possible to compare lifecycle investment strategies, and that it’s only when members retire that we’ll know if they’ve achieved their goals.

“But that’s absurd. It will be like telling parents that the first time they will ever see their child’s school report is after their child has left year 12,” he said.

“If lifecycle products, as a group, don’t improve, there’s real risk that pressure could grow for the regulator to prohibit them from being offered as default MySuper products.”

Do you have your superannuation invested in a lifestyle product or a single strategy product? What was the reason for your choice?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/finance/superannuation/news-superannuation/super-funds-go-to-war-with-the-government

https://www.yourlifechoices.com.au/finance/superannuation/news-superannuation/senator-urges-retirees-to-use-their-savings-more-efficiently

https://www.yourlifechoices.com.au/finance/superannuation/news-superannuation/call-for-low-income-earners-to-receive-a-5000-super-top-up