The property boom is over and self-managed superannuation funds (SMSFs) are an “accident down the road”.

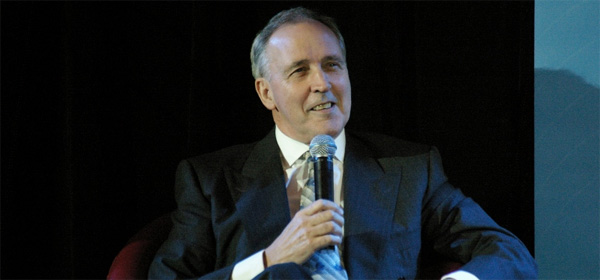

That was the clear message delivered by former prime minister Paul Keating, a key figure in the establishment of Australia’s $2.5 trillion compulsory superannuation system, in addressing a financial forum in Sydney.

“Superannuation funds being allowed to borrow and get into debt is very bad,” he said. “It should never have happened.

“I have always been opposed to it and it is an accident down the road for certain.”

About 1.1 million Australians have SMSFs with total assets of around $700 billion.

Figures from the Australian Tax Office (ATO) show that borrowing by SMSFs for property had ballooned from $2.5 billion in 2012 to $25 billion this year, The Australian has reported.

The figures showed that almost one in 10 SMSFs had access to limited recourse borrowing arrangements, which most used to buy property.

Limited recourse borrowing was banned until changes introduced by the Howard-Costello Government in 2007.

Funds that had borrowed to buy property could be vulnerable given the downturn in the housing market, Mr Keating said.

AMP Capital chief economist Shane Oliver said funds needed to be cautious if they were planning to buy properties in Sydney and Melbourne, with new analysis predicting a five per cent price drop in those cities this year.

He told the SMSF Adviser bulletin that median property prices in Sydney and Melbourne would fall by another five per cent this year, followed by further cuts through to 2020.

Population growth and demand would prevent a steeper fall in prices, but Dr Oliver believes the market is in for a “lengthy period of weak prices”.

“There remains a case to be cautious regarding housing as an investment destination for now. It is expensive on all metrics and offers very low income rental yields compared to other growth assets,” he said.

Do you have a SMSF? Have you borrowed to buy property? Are you concerned?

Related articles:

Stop the property punt

System fails women

Super and breakups