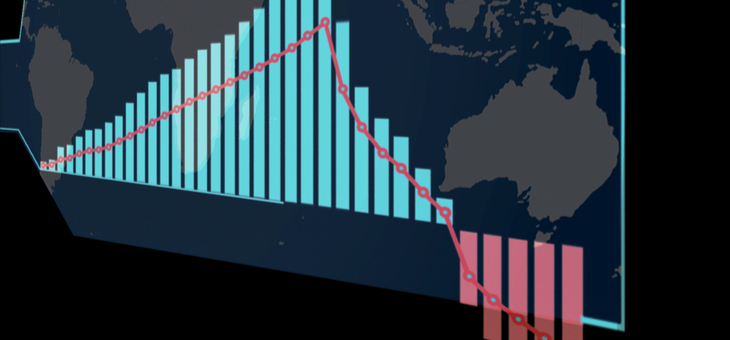

Research house SuperRatings predicts a negative result for super this financial year but expects the results to be milder than the global financial crisis (GFC) years of 2007-08 and 2008-09.

Super fund members experienced a fall of 12.7 per cent in 2008-09, which remains the largest annual fall since the introduction of the superannuation guarantee in 1992.

SuperRatings estimates predict that the current fall in the financial markets will lead to a fall of 4.3 per cent, some way off the dark days of the GFC.

SuperRatings executive director Kirby Rappell said the GFC provided some important lessons for the current financial crisis caused by the COVID-19 pandemic.

“Members might not be feeling like winners at the moment, but the history of super tells us the biggest mistake we can often make is to cash out and miss the recovery,” Mr Rappell explained.

“When we look back as far as the GFC, the recent fall in super fund balances appears stark, rivalling the GFC for the depth and speed of the decline. However, what is also apparent is the strength of the recovery following the GFC and the period of largely uninterrupted growth that members enjoyed over the subsequent decade.”

According to SuperRatings, an initial superannuation balance of $100,000 invested in the median balanced option at the outbreak of the GFC in August 2008 would now be worth an estimated $184,035 (as at the end of April 2020).

In contrast, a member invested in the median cash option would have grown their savings to $135,006.

“While cash returns are steady and safer during a crisis, over the long term they cannot deliver the growth that most members require in retirement to meet their objectives,” Mr Rappell said.

As markets saw less volatility in April, super funds saw some of March’s losses reversed.

According to SuperRatings estimates, the median balanced option rose 2.7 per cent in April as share markets recovered from their March bottom and the national conversation moved towards a staged reopening of the economy.

These figures reinforce the findings from Rainmaker Information, which YourLifeChoices reported on Tuesday.

“While the large swings in the market and the wave of negative economic news has made it difficult to block out the shorter-term noise, consumer sentiment indicators show households recognise that the negative economic effects, while significant, should be temporary,” Mr Rappell said.

“It’s clear the economy has been hit incredibly hard, and it has been pleasing to see the effort and resources super funds have directed at supporting members during these times.

“Markets appeared to show an eerie sense of calm, thanks in part to the fiscal and monetary response from the government and RBA, but also due to the success of social distancing and other measures in containing the virus.

“Happily, the conversation has turned to how we can safely reopen key sectors of the economy, but it would be fair to say apprehensiveness remains.”

Mr Rappell said SuperRatings was closely monitoring how funds are positioned to manage any further fallout.

“April saw some of March’s losses reversed, and it has been pleasing to see how most funds’ portfolios have responded to this challenging period,” he said.

“However, we’re having more conversations with funds to determine their level of preparedness should the situation deteriorate.”

While the median balanced option rose 2.7 per cent in April, with the extent of the falls in February and March the return since the start of 2020 is -8.1 per cent and the rolling one-year return is -2.5 per cent.

The median growth option, which generally has a higher exposure to shares and other risk assets, is down an estimated 9.7 per cent since the start of 2020 and 3.2 per cent over the past year.

The median capital stable option is down an estimated 3.5 per cent since the start of 2020 and is flat over the past year.

Pension returns have fared slightly worse. The median balanced pension option is down an estimated 8.5 per cent since the start of 2020, while the median growth option fell 10.3 per cent and the median capital stable option was down 3.7 per cent.

How has COVID-19 affected you? How will you come out the other side? Why not tell us in the YourLifeChoices Life in a post-pandemic world survey? You could win a $500 Webjet gift card.

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

Super returns defy virus gloom

COVID-19 to hit retirees hardest

Early super access and the pension