The first few years of retirement can often, for the lucky ones, be packed with wish-list purchases and a bit of fun, frivolous spending. But, according to MoneyTalks, there are some potential purchases before which you should take a deep breath and reconsider.

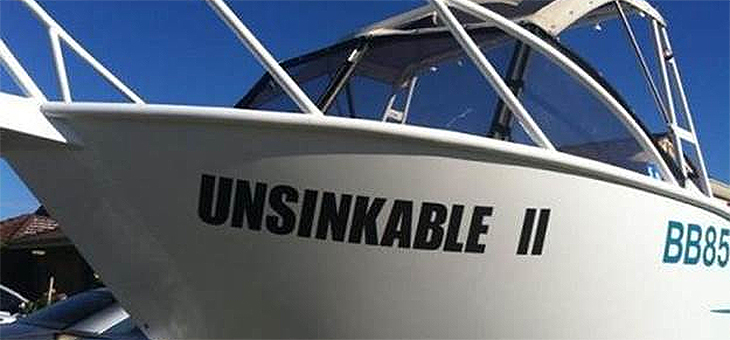

1. Boat

I love this: there’s an old saying that goes “the two best days of owning a boat are the day you buy it and the day you sell it”.

Unless it’s been a life-long dream, and so long as you do all the research, knowing full well what owning a boat entails, then you may wish to reconsider this purchase. Maybe rent one when you feel the need to fish, hit the high seas or pull a few friends around on skis. You’ll save a lot of money in the long run.

2. Timeshare

While timeshares aren’t as common as they once were, every now and then you may be asked to join the timeshare ‘cult’.

Some smiley salesperson will pop up and present a timeshare as ‘an incredible opportunity to own a piece of paradise that you just can’t pass up’. Here’s a tip: pass. Do you really want to holiday in the same place every year? Do you want to be beholden to taking your holidays at a time agreed upon between total strangers? Yes, you can exchange timeshare with other timeshare holders, but there’s a reason you don’t hear much about timeshares any more – they’re often one of the most regretted retirement purchases.

3. Extended warranties

You’ve got a good deal on a new television and you’ve handed over your credit card to pay for it, but the sell is still on. That’s when you hear the retailer say, “Would you like to pay for the peace of mind of an extended warranty?” Say no. Your item is most likely covered by sufficient product warranty, or your credit card or existing insurance may cover you for most occurrences and accidents the extended warranty claims to cover.

4. Desktop computer

Do you really need to take up all that desk space with a desktop computer? Nowadays, your laptop or tablet – even your smartphone – can do most of what a desktop computer can do. Unless you need it for business, video or photo manipulation or some specific purpose that requires a bit of computing power, you’ll regret buying a new desktop.

5. Expensive camping equipment

While the idea of careening around the country and camping under the stars may sound like a retirement dream, chances are you’ll probably get out once or twice a year, so expensive camping equipment, three-bedroom tents and flashy cooktops are a waste of your money. A small tent, good sleeping bag, cheap inflatable mattress and a few sticks for cooking will do you just as well and will most likely add to your camping experience.

6. Camcorder

Similarly, the desktop computer – your smartphone may take as good a video as any camcorder. And unless you plan to make cinema-quality video productions, your smartphone will suffice.

7. Home exercise equipment

Why buy a treadmill when you can go for a walk or run outdoors instead? Similarly with home gym equipment: the money you’ll pay (for how often you’ll actually use it) could be directed towards a gym membership instead.

8. Single-use kitchen gadgets

Sure, your single-use coffee maker will save you a heap of money in café-bought lattes, so too a dough mixer could save you money on pizza, pasta, bread or cakes.

But how often do you think you’ll use a juicer, food dehydrator, waffle maker or milk frother? Probably not enough to justify the cost – or the space in your kitchen.

9. Pools and hot tubs

How many people do you know who’ve said buying a pool was one of their biggest wastes of time and money? I know a few. I also know a few who love their pool, spa or hot tub, so it’s truly a subjective thing, but for many there’s a short novelty period before the upkeep and lost space begin to override a pool or spa’s usefulness.

10. Buying basic items on credit

Unless you get great rewards for using your credit card, save it for bigger purchases and not for grocery or clothes shopping. If you do use it for smaller, standard items, pay them off as soon as possible or your fresh fruit and veggies could cost you a bomb.

What has been your biggest purchase regret?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

How to avoid shopping surcharges

Credit card switcheroos that work

Shopping tip that could save you $1000s