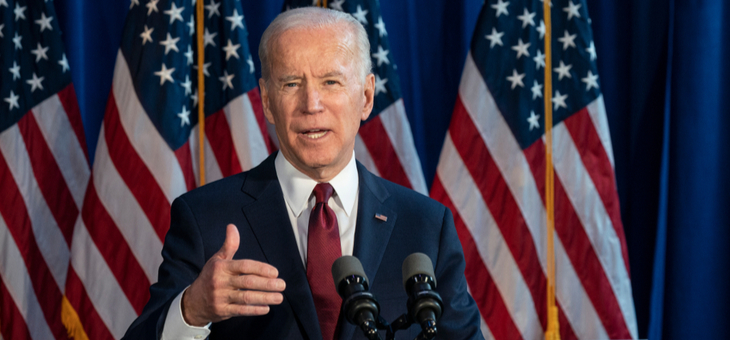

Donald Trump may not yet have conceded the presidency, but Joe Biden has been declared President-elect after turnarounds in key states.

Mr Biden has been declared the winner, which most of America and the world – apart from Mr Trump – have accepted. Mr Trump is mounting a series of legal challenges in a bid to reverse the result.

And while it’s early days yet, Aussie fund managers say this election is the perfect outcome – and markets here and worldwide have already shown improvements since the announcement of Mr Biden’s win.

Early indications are that Australian sharemarkets will have a firm opening this morning as markets move past the uncertainty of the US presidential election.

“Although a Biden win was pretty much priced in by the markets, his victory will eliminate uncertainty – which they loathe – and they will rally further as a result,” chief executive of financial adviser deVere Group, Nigel Green, told The New Daily.

“Even possible legal challenges from Trump will be dismissed by investors, who will instead be focusing on the renewed certainty and stability that a Biden White House will bring.”

Economists are also excited because the President-elect will be a steady influence as he steers the US back to ‘normality’, while the prediction of a Republican-controlled Senate would block any anti-business reform.

“While there is a possibility that the Democrats could win control of the Senate via runoff elections in Georgia, the most likely outcome is that Democrats will retain control of the House with Republicans retaining the Senate,” said economist Shane Oliver.

This is a case when split government is a good thing for investors, Atlas Funds Management chief investment officer Hugh Dive told The Age.

“It’s a constrained Biden administration,” he said.

“The divided Congress [would] stop some of the outlandish policies like the Green New Deal, replacing all the buildings, all that wish list stuff.”

Not even not-quite-outgoing Donald Trump will cause any long-term market volatility, says Mr Dive.

“It will create a lot of noise and play well to his base, but this is not Nicaragua, this is not a country where you can cling to power. That stuff will fade out.”

A Republican-strong Senate would hinder the Democrats from pushing through some of their more radical policies, such as higher corporate taxes and greater regulation of the technology industry.

“It’s hard to put [through] radical legislative change when you have a split presidency and Senate,” said Investors Mutual investment director Anton Tagliaferro.

“So, at the moment, there’s a bit of a relief rally where some of his [Mr Biden’s] more radical policies won’t be able to pass.”

The markets are happy, too, having already enjoyed a strong week of trading on the promise of the ‘fairytale result’, and Australian stocks are looking at big increases on Monday.

Investors may look to increase shares in new energy technology, as Mr Biden will likely seek to stimulate the US economy on the back of new energy investments, meaning Aussie resources such as nickel and lithium could soon be in demand.

“[President] Trump seemed to be pushing more into the old world, opening up coal and doing more oil wells,” said Holon Global Investments research director Tim Davies.

“[Mr] Biden seems more focused on shifting and looking forward with the new energy policies.

“Electric vehicles will be a huge growth area,” Mr Davies said.

And progression on climate action is not the only way a Biden-led administration will help Australia.

While our own government’s follies are mostly to blame for sour relations with China at the moment, improved relations between the US and China should mean we will no longer be “caught up as collateral damage in the US-China trade dispute” according to Australian Industry Group chief executive Innes Willox

The US election result has been the cherry on economic improvements across the board over the past couple of weeks.

Australian share futures are looking at a 15 point increase, the ASX200 finished 0.8 per cent higher on Friday, and 4.4 per cent up on the week – its best performance since early October.

Wall Street performed well last week, despite US election uncertainty.

The weekly ANZ-Roy Morgan consumer confidence index, which indicates future household spending, has risen for nine straight weeks to its highest level since March.

The Reserve Bank’s decision to cut the cash rate to a record-low 0.1 per cent has been labelled as a kick in the guts for retirees but overall should have positive market effects.

The Big Four banks didn’t pass on the reduction to their customers’ variable rate mortgages but reduced the rates on their fixed-rate mortgages.

The monthly Westpac-Melbourne Institute consumer sentiment survey for November will be issued this week, but last month’s was the biggest positive response to a budget in at least 10 years.

Things are looking up.

But what does it mean for Australian retirees?

“Australian retirees who are playing the long game should not fear the election outcome. US monetary policy (interest rates governed by the Federal Reserve) is independent of politics and will remain highly supportive for growth assets like shares and property,” Muirfield Financial Services managing partner Melinda Planken recommended just prior to the election.

“Our underlying recommendation is for investors to remain flexible and focused on longer term outcomes.”

How do you think the US election will affect your retirement? Are you pleased with the result?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/podcasts/mind-your-own-retirement/retirement-incomes-post-covid19

https://www.yourlifechoices.com.au/retirement/retirement-income/aussies-urged-to-check-their-super

https://www.yourlifechoices.com.au/government/centrelink/calls-for-deeming-rate-cuts