Most health insurers reset their extras limits on 1 January. That makes December the perfect time to review your health insurance policy and see if there’s a better deal for you.

And if you’re always paying out-of-pocket expenses at the dentist or physio, or hit your limits halfway through the year, you’re probably on the wrong policy – and paying for it.

More of us hold extras cover than hospital cover, which makes sense when you think about how regularly we visit the dentist, optician or physio.

But very few Aussies take the time to work out if they can get a better deal.

How can I get a good deal on my extras?

Let’s say you buy a pair of $200 prescription glasses every year. Health fund ‘A’ covers your annual optical expenses, up to $150. Health fund ‘B’, on the other hand, offers a yearly limit up to $200.

That means health fund ‘B’ will cover the entire cost of your glasses, while under health fund ‘A’ you’ll need to fork out $50 to cover the cost.

Now imagine repeating that across dental, physio and other treatments. You can quickly end up paying out hundreds of dollars unnecessarily.

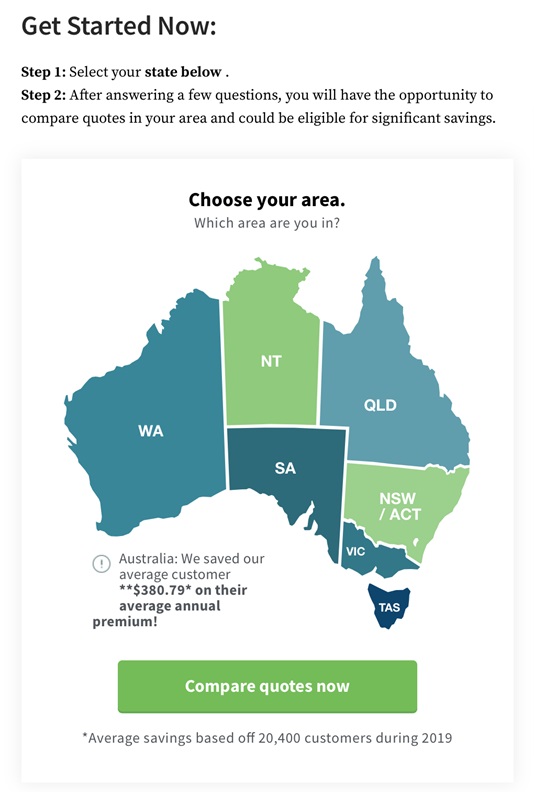

Getting value for money shouldn’t be this confusing, which is why the team at Health Insurance Comparison makes it easy to quickly find the extras packages that give you more back at the best price.

How do you know if you have the right level of extras cover?

If you get to the end of the year without hitting your extras limits, you might want to drop your level of coverage to save on your monthly premiums.

But if you exceed your annual limits before the end of the year, then it’s worth comparing policies to see if you could save money on your out-of-pocket expenses.

It’s a delicate balance, but it pays big to get it right.

Most health funds reset their annual extras limits on 1 January, so it’s a perfect time to compare insurers to find a better extras plan. Get started today.

Disclaimer: This article is opinion only and should not be taken as medical or financial advice. Check with a financial professional before making any decisions.