The debate over company tax cuts is heating up ahead of the Federal Budget, with the Coalition seemingly fighting an uphill battle to get its gift to big business through to the keeper.

If you believe the Government’s party line, its corporate tax cut will save the economy through an assumed philanthropic attitude demonstrated by the beneficiaries of the concession.

Yet history has proven otherwise. Australia experienced its lowest unemployment in the 50s when the company tax rate was 46 per cent. Right now, it’s 30 per cent and the Government wants to drop it to 25 per cent.

While the Government may believe that big business will use the money made through tax cuts to create new jobs, re-invest in businesses and potentially keep manufacturing onshore, the reality will probably be different. The cuts are more likely lead to share buybacks, increased dividends to shareholders, profits heading offshore, and mergers and acquisitions that will only serve to widen the gap between rich and poor.

The proposal to cut company tax has its supporters, mainly the Government. Some MPs are willing to support the tax cuts to a certain extent, such as Senator Derryn Hinch, who supports a tax cut for companies with a turnover of up to $500 million – but only if banks are excluded.

Should tax cuts go through, banks stand to earn up to $9.5 billion a year. Seems a strange reward for the unscrupulous acts and scandals being highlighted in the royal commission into banking.

Senator Pauline Hanson has also weighed in on the debate. She wants savings made by banks from tax cuts to fund the stability of the financial system, so taxpayers don’t have to foot the bill should banks crash. And she also believes the savings should be used to compensate victims of dodgy banking practices.

“I would like to see the money quarantined from the company tax cuts,” said Ms Hanson.

“That the money is actually paid back to those people who have suffered at the hands of the banks.”

Senator Hanson said the banks should also cover the cost of the royal commission.

Financial Services Minister Kelly O’Dwyer doesn’t think a “new taxation system that’s based on a morality tax” is the answer.

“I mean, let’s get a little bit real here,” she told ABC’s Insiders yesterday.

Independent Senator Tim Storer stymied passage of the tax cuts legislation last month. Labor and the Greens also oppose the tax cuts, but the Government is determined to revive the concessions. Labor Shadow Assistant Treasurer Andrew Leigh published a paper that shows companies paying less than 25 per cent tax are shedding jobs while those that pay more than 25 per cent are growing their workforce by around two per cent a year.

“Across a cross-section of profitable Australian firms, I find no evidence that those which pay a lower effective rate of tax create more jobs,” wrote Mr Leigh.

Even voters – including Coalition voters – are opposed to it, say the findings of a recent Australia Institute survey.

And while the Government’s position on company tax cuts may already have been difficult to defend, it could now be almost untenable.

However, economists say that there’s a way to get tax right so that society benefits – potentially, most of all, age pensioners.

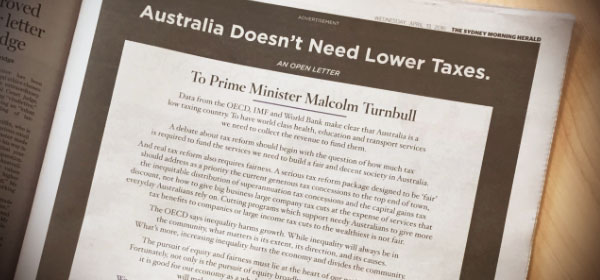

An open letter signed by 47 economists and prominent Australians has told the Government that ripping revenue from the economy is not the answer, stating that Australia has a revenue problem and that we should be looking to increase tax intake not reduce it.

The public would be the victims of this shortfall and the only way to make it up would be to raise other taxes and to cut public services.

The letter’s signatories believe that a strong society, with a solid education, health and infrastructure spend is the best way to create jobs and growth. Tax cuts would only serve to increase inequality, damage Australia’s innovation program and lead to stagnant growth. The group claims that we should be looking to increase taxes, bringing the country up to OECD tax levels so we can improve society, not just the balances of shareholders and power portfolios of corporate chief executives. In fact, Australia is one of the lowest taxing countries in all of the OECD.

Even the Government’s intergenerational report, used to create modelling for its economic policy, shows that current taxation levels will keep us in the red for at least three more decades.

A article written by The Australia Institute’s Executive Director Ben Oquist, published in The Sydney Morning Herald, explained how findings from a research paper from his colleagues Rod Campbell and Cameron Murray revealed that “if Australia had the same tax to GDP ratio as the United Kingdom we could triple the Age Pension.”

Mr Oquist wrote: “If we had OECD average levels of tax we could build two new NBNs every year. If we had the same tax level as Denmark, we could increase education and health spending fourfold.”

The debate over company tax cuts will rage on until the Federal Budget, and yet to this point it seems the ‘nays’ have it.

Do you think company tax cuts are the answer? Is the Government fighting a losing battle? Why do you think it keeps trying to push a policy that is A: so unpopular and B: one which has so much evidence piled against it?

Related articles:

Tax cuts will hurt Age Pension

Copmany tax cuts not the answer

Royal Commission takes first scalp