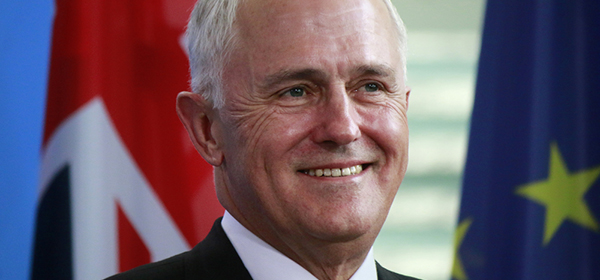

The battle for the hearts and minds of retirees and pre-retirees ahead of the 2019 Federal Election seems to have already begun with the Turnbull Government reportedly set to guarantee tax rates for older Australians and superannuation rules.

A special taskforce on ageing would also be established, News Ltd has reported, amid warnings that nursing homes require expenditure of around $33 billion over the next decade.

The motivation for the policy information is that the latest Newspoll shows support for the Government among Australians over 50 has dropped from 50 per cent at the 2016 election to 40 per cent.

In recent weeks, Labor announced that if elected, it would remove franking credit refunds from the tax system, a policy it estimated would save $59 billion over 10 years. The policy was spruiked as a means to ‘hit the rich’, but was quickly amended after a public outcry that retirees were unfairly hit.

Just days later, Labor amended the policy to exempt 300,000 full and part Age Pensioners.

It made no admission the policy was flawed, saying the changes were fine-tuning and would reduce estimated revenue only from $11.4 billion to $10.7 billion in the first two years, and from $59 billion to $55.7 billion in the next decade, a fall of $3.3 billion.

Labor’s retreat was described by most political analysts as smart and strategic. However, some continue to pick holes in the policy.

Personal finance advocate Noel Whittaker, writing for Fairfax Media, says Labor’s revised policy is still unfair on older Australians.

In The Age, he offers two key case studies:

- The Browns own their home, have $75,000 in the bank and a share portfolio worth $710,000, returning dividends of $32,000 and franking credits of $13,700. They are eligible for a fortnightly Age Pension of $19 combined. Their total annual income would be $47,700.

- The Smiths’ finances mirror the Browns except that they have shares worth $800,000 returning dividends of $36,000 and franking credits of $15,400. They are ineligible for an Age Pension. Their total annual income, with franking credits, would be $51,400.

“Under Labor’s proposals, the Smiths would lose $15,400 a year in franking credit refunds, reducing their net income to $36,000 plus interest of $1500.”

YourLifeChoices has asked the three main political parties for their policies relating to older Australians ahead of the May Federal Budget.

What issues do you want the Government to address?

Related articles:

Labor backflip spares pensioners

How do franking credits work?

Wealthy get richer