People are withdrawing funds from their superannuation accounts – whether legally or illegally – at rates never seen before. While some might be for good reasons, is withdrawing your super to help fund your beauty – or any other goals – a smart idea?

The arrival of COVID-19 in March 2020 heralded a new era for Australia’s superannuation system. Due to unprecedented economic and social circumstances, thousands of people were locked in their homes, unable to work or meet their everyday expenses.

You were always able to apply for early release of some of your super if you met certain financial hardship requirements, but soon after the pandemic began the Morrison government relaxed super withdrawal rules even further, allowing people to withdraw up to $20,000 in two payments.

Since then, funds have poured out of the super system. More than $36 billion was withdrawn during COVID and just last week YourLifeChoices reported on the Australian Taxation Office’s (ATO) crackdown on illegal early withdrawals from thousands of self-managed superannuation funds.

Of course, much has been made of the push to allow younger Australians to use their retirement accounts to pay for house deposits, or at least as a low-tax investment vehicle to help them get there.

But did you know there is another legal channel for withdrawing super early that is much more lax about your reasons for doing so? And that it’s currently being used to fund cosmetic surgery procedures?

Releasing funds on ‘compassionate grounds’

There are a number of reasons you can be granted early release of your super, most of them financial. Severe hardship, permanent incapacity, or being diagnosed with a terminal illness all qualify.

But there is a far more nebulous category available, ‘releasing funds on compassionate grounds’, and it is being used more and more to fund today’s dreams with tomorrow’s money.

The reasons that fall under this category are broader, and allow for more than you might expect. According to the ATO, super can be released early for the following compassionate reasons:

- medical treatment for you or your dependant

- medical transport for you or your dependant

- modifications to your home or vehicle to accommodate yours or your dependant’s special needs arising from a severe disability

- palliative care for you or your dependant

- death, funeral or burial expenses of your dependant

- preventing foreclosure or forced sale of your home.

While this list of exemptions probably seems reasonable to most, the broad nature of the ‘medical treatment’ exemption is leading to some unintended outcomes.

To qualify for the medical treatment exemption, a patient needs to require the surgery for a chronic medical condition; must have no other means of paying for the surgery; and the surgery must not be available through the public system.

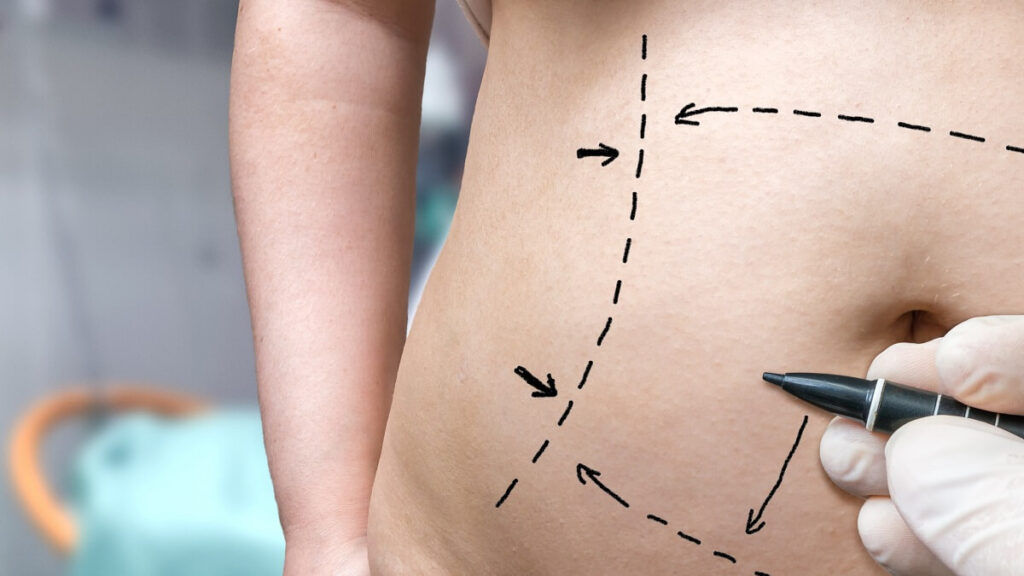

Surgery for purely cosmetic reasons is technically not allowed, but more and more people are qualifying to use their super for procedures such as tummy tucks and breast lifts, says plastic surgeons Gold Coast Plastic Surgery.

“Superannuation is accessible for patients who need to undergo surgery for a serious medical condition and they are unable to fund the surgery themselves,” the clinic says.

“Usually, people who make successful claims to use their super for surgery include those who wish to undergo plastic surgeries for medical purposes like breast reduction, tummy tuck, breast implant removal and weight loss.”

Basically, if you can prove to the ATO that your cosmetic surgery is medically necessary, then you may qualify to use your super to fund your plastic surgery.

But is it a good idea?

Withdrawing your super early for any reason carries with it the same problem – you’re missing out on potentially decades worth of compound interest and therefore may be thousands worse off in retirement.

Investment group AMP advises people to consider the long-term implications of an early super withdrawal and not just the short term.

“While compound interest is very powerful when it’s working to build your super balance, it can be equally powerful in magnifying the impact of a withdrawal now on your super balance over the longer term,” says AMP.

“And because super is a long-term investment, the amount you stand to forfeit could be larger the younger you are.”

So you would need to ask yourself if the potential lift to your health and self-esteem (which may well be substantial) is worth more to you than potentially tens of thousands extra in retirement.

Have you withdrawn any of your super early? What were your reasons for doing so? Let us know in the comments section below.

Also read: Majority run out of super before life expectancy age

Disclaimer: All content on YourLifeChoices website is of a general nature and has been prepared without taking into account your objectives, financial situation or needs. It has been prepared with due care but no guarantees are provided for the ongoing accuracy or relevance.

Before making a decision based on this information, you should consider its appropriateness in regard to your own circumstances. You should seek professional advice from a financial planner, lawyer or tax agent in relation to any aspects that affect your financial and legal circumstances.