The Australian Bureau of Statistics (ABS) announced higher than expected Consumer Price Index (CPI) figures on Wednesday, and that could spell good news for pensioners.

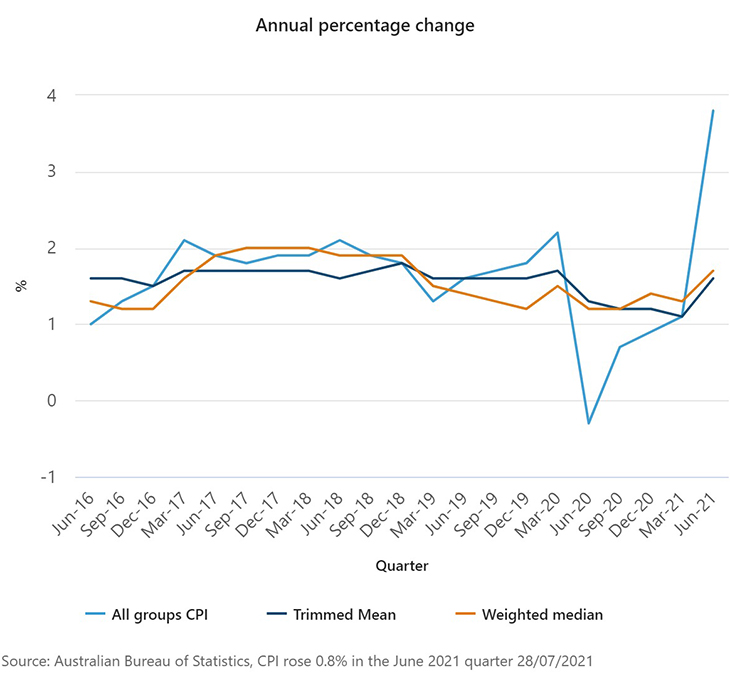

Australian consumer prices rose by a much stronger than expected 0.8 per cent in the June quarter and inflation has soared 3.8 per cent since the same time last year.

The actual level of the pension increase that pensioners might expect in September will still be a matter for the Department of Social Services to determine, but the latest CPI figures suggest the increase could be at least 1.4 per cent, according to Combined Pensioners and Superannuants Association policy manager Paul Versteege.

Read: One million Australians to be excluded from Centrelink payments

Indexation is based on the greater movement in either the CPI or the Pensioner and Beneficiary Living Cost Index (PBLCI).

The PBLCI measures the effect of price changes on the out-of-pocket living expenses experienced by households whose main source of income is government payments. The ABS will release the PBLCI figures in August.

If the PBLCI figures are higher than 1.4 per cent, the increase will go up by that amount in September.

“The inflation spike in the June quarter will carry through into the pension,” Mr Versteege told YourLifeChoices.

“The CPI change during those two quarters was a 1.4 per cent increase. We don’t yet know what the living cost index has done, but a minimum of 1.4 per cent is in the bag.”

Read: The forgotten assets that could lead to pension denial

To put that 1.4 per cent increase into perspective, the March indexation increase delivered an increase of $8.40 per fortnight for single Age Pension recipients receiving the full Age Pension and was just 0.89 per cent. That same Age Pension recipient could expect somewhere in the order of a $13.34 increase per fortnight with the September indexation.

The higher-than-expected inflation figures may have come at the right time for pensioners, given that economists are talking about the possibility of Australia going back into recession as a result of the Sydney lockdown.

Treasurer Josh Frydenberg told ABC News Breakfast on Thursday that Australia would record negative growth for the September quarter, but said results in the December quarter would hinge on how successful NSW was in getting on top of the virus.

According to the ABS inflation figures, the most significant price rises in the June quarter were fuel (+6.5 per cent) and medical and hospital services (+2.4 per cent), which were due to the annual increase in private health insurance premiums.

Read: Age Pension boost and other 1 July changes

Electricity prices (+3.3 per cent) also rose due to the continued unwinding of the West Australian government’s $600 electricity credit.

Price rises were seen across a range of food items including vegetables (+5.5 per cent), fruit (+4.7 per cent) and beef (+3.6 per cent), due to a variety of factors including flooding in growing regions of NSW, a shortage of pickers and a lower supply of beef.

Head of price statistics at the ABS, Michelle Marquardt, said COVID was still wreaking havoc on inflation in Australia.

“The annual CPI movement was significantly influenced by COVID-19-related price changes from this time last year,” Ms Marquardt said. ” Key drivers included the full unwinding of the federal government’s free childcare package implemented in the June quarter last year, as well as a full return from the drop in fuel prices seen in the same quarter.

“These ‘base effects’ led to a sharp increase in the annual CPI movement.”

Matt Grudnoff, senior economist at The Australia Institute, has hosed down fears that inflation might be out of control .

“Don’t panic,” he told YourLifeChoices. “It’s just a leftover from some weird things that were happening in the economy during the height of the recession last year.”

He explained that in the June 2020 quarter last year, there was a massive drop in the CPI.

“The quarterly change was -1.9 per cent. We had what is known as deflation,” he said. “This is when average prices fall. But this was largely driven by two things. The first was the government making childcare free. Childcare is one of the goods and services that is measured in the CPI and it fell so much that it dragged down the average. The other big drop was petrol prices. You might remember that petrol prices dropped back below a dollar a litre in some places. This was because the world was locking down, nobody could drive around much and so demand for oil crashed world-wide.”

But both were temporary, he said. “By the next quarter (September 2020), the government had abandoned paying for childcare, which saw a massive rebound in its price. And as the world started to open up, the oil price, and hence petrol prices, were increasing back to where they were pre-pandemic. This saw a dramatic increase in the CPI. For that quarter the CPI increased by 1.6 per cent.”

How much do you think the Age Pension will increase by in September? Should the government increase the base rate of the pension to deal with some of the COVID-related price shocks? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.