With an election on the horizon, government social services minister Anne Ruston has moved to quell the fears being stoked up by the opposition about pensioners being moved onto the cashless debit card.

As YourLifeChoices reported last month, Labor has been calling on the government to put the minds of pensioners at ease and categorically state that it had no plan to move the controversial scheme to start covering pensioners.

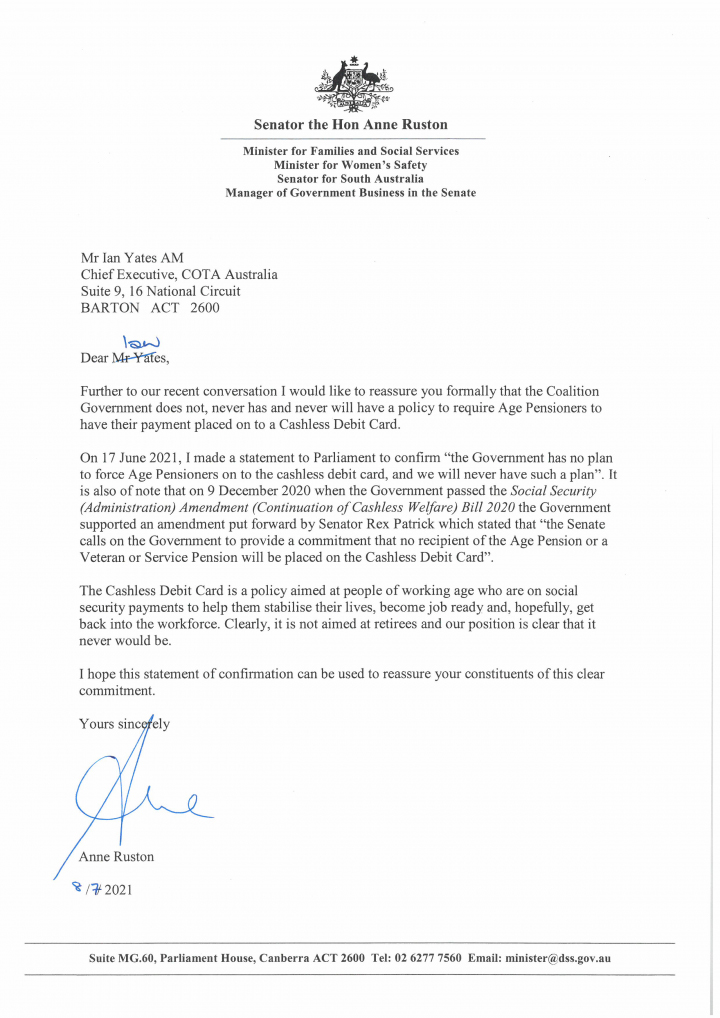

In a letter to Council on the Ageing (COTA) chief executive Ian Yates, Senator Ruston issued a statement explaining that there was never any plan to move pensioners onto the debit card.

Read: Put pensioners at ease over cashless welfare card: Labor

“I would like to reassure you formally that the Coalition government does not, never has and never will have a policy to require age pensioners to have their payment placed on to a Cashless Debit Card,” Senator Ruston wrote.

Ms Ruston also pointed to a statement she made in parliament in June confirming that the government had no intention of moving pensioners onto the scheme.

She also explained that the government supported an amendment to its continuation of the cashless welfare bill that stated “the Senate calls on the government to provide a commitment that no recipient of the Age Pension or a Veteran or Service Pension will be placed on the Cashless Debit Card”.

Read: Is it time to tap into a reverse mortgage?

“The Cashless Debit Card is a policy aimed at people of working age who are on social security payments to help them stabilise their lives, become job ready and, hopefully, get back into the workforce,” Senator Ruston wrote.

“It is not aimed at retirees and our position is clear that it never would be.”

Despite these assurances, Australians are concerned about the future of the Age Pension.

The government’s Retirement Income Review found that only 48 per cent of all respondents and just 37 per cent of people aged under 55 agreed that the Age Pension would exist when they reached retirement.

Read: PM named respondent in older discrimination case

Treasurer Josh Frydenberg admitted that the government had to make it clearer that Australians could plan for their retirement safe in the knowledge that the Age Pension would always be there for them.

“We must do more to reassure all Australians that this concern is unfounded,” Mr Frydenberg said.

David Knox, senior partner and senior actuary at Mercer, told consumer group CHOICE that both major parties should make a joint statement that the Age Pension will always be there.

He also said that both parties should agree that payments will always keep pace with a percentage of average weekly earnings to give Australians greater clarity as they plan for retirement.

Brendan Coates, economic policy program director at the Grattan Institute, also told CHOICE that politicians could do more to reassure Australians about the future of the Age Pension.

“It is incumbent on the government to get that message out there,” Mr Coates said. “The Age Pension is not going anywhere, and that’s a good thing for public policy in Australia.

“Cuts to the pension would [be] an incredibly tough sell for any party,” he said.

“An ageing Australia means that any political party that tries to reduce or abolish the pension can expect to be punished at the ballot box.”

Super Consumer Australia director Xavier O’Halloran told CHOICE that confusing messaging about the future of the Age Pension could hurt the retirements of many.

“You can understand why there’s confusion over the future of the Age Pension, given the unhelpful and unclear messages sent by some politicians, super funds, advisers and media members,” Mr O’Halloran said.

“This misinformation could see retirees have a lower standard of living as they over save in the belief that the government will cut the Age Pension.”

Do you think the Age Pension system will be around forever or do you think it will be undermined by governments in future? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.