The federal government’s Pension Loans Scheme (PLS) was not exactly the hottest ticket in town several years back.

The scheme was created almost 40 years ago to help boost retirement income. But as of March 2021, just over 4000 participants had used it – a low take-up given there are four million or so Australians of Age Pension age who could use it to boost their retirement income.

Eligible people (anyone of Age Pension age but not necessarily receiving a pension) can receive a maximum lump sum advance equal to 50 per cent of the maximum Age Pension from July 2022.

Based on current Age Pension rates, that is about $12,775 per year for singles, and about $18,960 for couples combined.

Read: Actuaries call for home to be included in pension assets test

A maximum of two advances totalling up to the cap are permitted in a year, for those who don’t want to take an advance in one instalment.

The government also announced that from July 2022, it would introduce a ‘no negative equity guarantee’ for PLS loans.

That will mean PLS borrowers, or their estate, will not owe more than the market value of the property, in the rare circumstances where their accrued PLS debt exceeds their property value. That will bring the PLS in line with private sector reverse mortgages.

The government charges an annual interest rate – currently 4.5 per cent and down from the 5.25 per cent charged before 2020 – that compounds each fortnight on the outstanding loan balance.

Meteoric increases in the value of real estate in the past 18 months makes the PLS and commercial reverse mortgages even more attractive to older homeowners who don’t want to move or downsize. And that applies to homeowners in regional areas as well as in cities.

Read: Pension Loans Scheme gets a makeover, but is it enough?

Paul Rogan, founder of PLS specialist Pension Boost, says: “The recent surge in regional property growth benefits those already living there, particularly seniors.”

He says research shows seniors are less willing to downsize and move to a new area due to the dislocation it creates and emotional upheaval that results from moving away from friends, networks, and the communities they’re familiar with.

“With the PLS, seniors can boost their income in retirement by releasing some of the equity they have in their home (or other property) by up to 150 per cent of the full Age Pension rate.”

He offered the following case study.

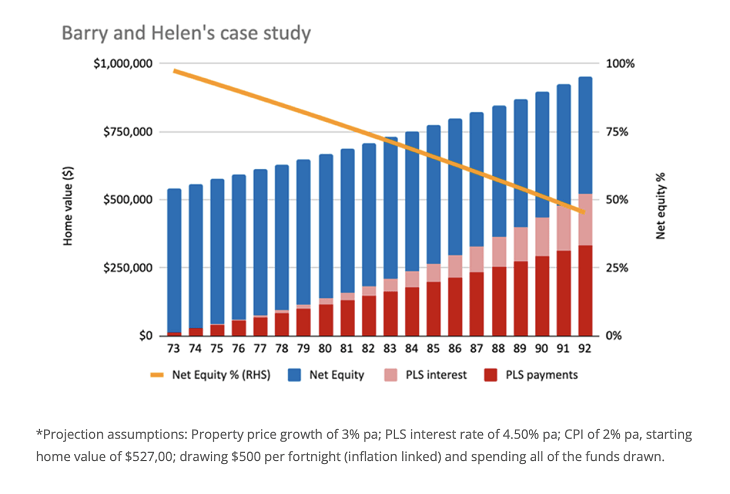

Barry and Helen are both 72, receive a full Age Pension and live in Colac, Victoria. The average house price there is $527,000 – up from $419,000 a year ago (a 28 per cent increase) and $315,000 five years ago (a 67 per cent increase). The pair would like to access the PLS to give them a better quality of life.

Read: Fears about an ageing Australia a ‘scurrilous exaggeration’

While they could access up to $718 per fortnight ($18,670 per year), they decide that $500 per fortnight ($13,000 per year) would be adequate. Modelling forecasts* they could access this amount, linked to inflation, for up to 24 years and after 20 years when they are 92, they are projected to have 45 per cent (or $431,000) net equity remaining in their home.

Research carried out by the University of NSW says further interest rate cuts should be considered.

The researchers say that while the interest rate is lower than that of commercial reverse mortgages in Australia, it is higher than the mortgage rates for owner-occupied mortgages “because no repayments are made until the loan is settled, which is typically when the person has passed away”.

*Projection assumptions: Property price growth of 3 per cent per annum; PLS interest rate of 4.50 per cent per annum; CPI of 2 per cent per annum, starting home value of $527,00; drawing $500 per fortnight (inflation linked) and spending all the funds drawn.

Have you considered the Pension Loans Scheme or a commercial alternative? Are the interest rates on these schemes fair and reasonable? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.