The Australian Financial Complaints Authority (AFCA) has released its complaint statistics for the past financial year, showing significant improvement from the big four banks.

The analysis shows that complaints about the four major banks (Commonwealth, NAB, Westpac and ANZ) fell 7 per cent in 2020-21.

The major banks weren’t the only ones to record improved figures, with seven of the 10 firms with the highest number of complaints last financial year having fewer disputes raised with them than they had the year prior to that.

Read: Common mistakes when writing a will

The Commonwealth Bank was still Australia’s most complained about financial institution with 5815 complaints, ahead of ANZ (4122), NAB (4114) and Westpac (3542).

Insurers AAI Limited (responsible for insurers AAMI, APIA, Bingle, GIO and many others) were the most complained about insurer (3193 complaints), ahead of Insurance Australia Limited (responsible for Bupa, CGU, Coles Insurance, HBF, HCF and many others).

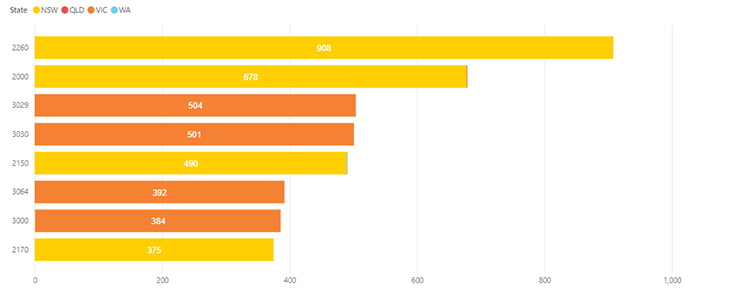

The top eight postcodes with the most financial complaints were all in NSW or Victoria.

Terrigal on the NSW central coast topped the list with 908 financial complaints, followed by Sydney with 678.

The Victorian suburbs with the most complaints were both in Melbourne’s west with Tarneit and Hoppers Crossing responsible for 504 complaints and neighbouring suburb Werribee recording 501 complaints.

Read: How to get the best deal on a used car

Sydney’s west had the next most complaints with 490, followed by Craigieburn in Melbourne’s north (392 complaints), Melbourne (384) and Liverpool (375) in Sydney’s west.

AFCA chief executive and chief ombudsman David Locke said 67,613 complaints were received last financial year, with $224.6 million paid in compensation to complainants in that time.

“While we know there are challenges ahead in the coming months across the board, I hope all firms and customers continue to do what they’ve been doing – firms actively engaging with customers they think may be struggling, and customers talking to firms before a small problem becomes a bigger one,” Mr Locke said.

Read: How to make the most out of your kitchen

The analysis found that 56 per cent of all complaints were resolved in under two months and that by six months, 90 per cent of all complaints were resolved.

“This result demonstrates that AFCA is achieving its purpose in being faster and cheaper for consumers and firms compared to an alternative such as a court or tribunal,” Mr Locke said.

“We also saw that over 70 per cent of cases were resolved in the early stages of AFCA’s process, with an agreement being reached between the complainant and firm or an outcome in favour of the complainant, without the need to progress the case to an ombudsman for a formal decision.

“This shows that firms are willing to work with AFCA and their customers to resolve issues quickly and early, which is pleasing,” he said.

“We also saw that when a complaint does progress to a formal decision from ombudsman or adjudicator, it was most likely to be decided in the firm’s favour.”

Mr Locke said AFCA also continued to see a high number of cases where consumers believed they had been misled into buying funeral plans.

Funeral plans were among the top five life insurance products complained about in 2020-21.

In the past 15 months, AFCA received 260 funeral plan complaints, more than half of them from people who identified themselves as Aboriginal and/or Torres Strait Islander peoples.

AFCA has awarded $700,000 in refunds and compensation in funeral plan cases.

Did you make a financial complaint with AFCA last financial year? Were you satisfied with how it was resolved? How would you rate you experience with the process? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.