Robert Breunig, Crawford School of Public Policy, Australian National University

Treasurer Jim Chalmers promised a Tax Expenditures Statement by the end of February – and he delivered this week, just in time, on Tuesday 28 February.

The statement contains many headline-grabbing figures about the cost of various tax breaks, including claims made against income from rental properties ($24.4 billion), the concessional or zero tax on employer superannuation contributions ($23.3 billion), concessional or zero tax on super earnings ($21.5 billion), and the tax-free treatment of the family home ($22 billion).

For some years under the Coalition, the statement was given the less-attractive title of Tax Benchmarks and Variations Statement, which was surprising given the statement was mandated in 1998 by Treasurer Peter Costello as part of the Charter of Budget Honesty.

The refurbished 200-page document has its old name back, plus a bit more. It is now called the Tax Expenditures and Insights Statement. The ‘insights’ in the title relate to who the expenditures go to.

As to whether these additional insights are really that insightful, the answer is yes in some areas – but we need to be careful about others.

Spending by another name

The idea of the statement is to record those government expenditures delivered via tax breaks, so their costs can be compared with the cost of direct expenditures.

As an example, support for Australians who take out private health insurance can either be delivered via a tax rebate or a cash payment.

A tax rebate, effectively paid out of government funds but delivered through the tax system, might be called a ‘tax expenditure’, while a cash payment might be called a direct expenditure.

Either way, the cost to the government, and the amount paid to the recipient, is the same. Only the method of delivery, and how it’s recorded, is different.

Tax expenditures are usually invisible, because there’s no line item for them in the budget papers.

That’s why Costello initiated the publication of tax expenditures.

It’s also why the institute I run at the Australian National University is called the Tax and Transfer Policy Institute – because considering direct payments, but not payments made through the tax system, would be to consider only half the issue.

Support for high earners

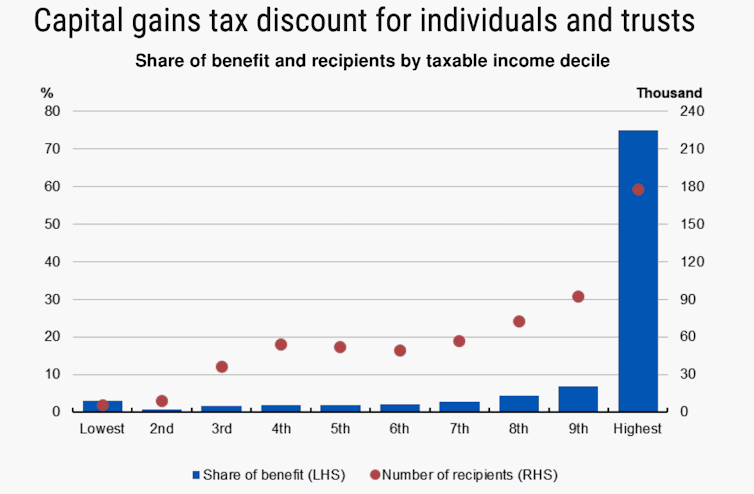

The ‘insights’ now included in the statement, along with the totals for each tax expenditure, are about who gets them, usually broken down by income and gender.

These are interesting, but not that insightful.

Guess who gets the biggest tax expenditures. Yes, you got it on one! The highest earners in the highest tax brackets.

Because they pay higher marginal tax rates, tax breaks benefit them the most.

Commonwealth Treasury, 2022-23 Tax Expenditures and Insights Statement

And guess whether men or women get the biggest tax expenditures.

Again, you got it! There are more men in the highest tax brackets than women, so men get the lion’s share of tax expenditures.

All of which points to three dangers in interpreting the tax expenditures statement.

Big expenditures needn’t mean unfairness

The first danger is to conclude that the large tax expenditures show “the rich do not pay enough tax”.

The statement says nothing about how much tax people actually pay.

In fact, Australia has one of the world’s most progressive tax systems. The top 10 per cent pay roughly half of all the income tax collected.

The second (related) danger is assuming an uneven distribution of tax expenditures means an uneven distribution of government support.

Tax expenditures tell us nothing about other forms of government support.

Australia also does pretty well in fairness. Most government spending goes to those at the bottom of the income distribution. This is true if you look at cash transfers, and also for in-kind benefits such as education and healthcare.

Using data from the World Inequality Database, I calculate Australia’s after-tax Gini coefficient – the standard a measure of inequality – is about 30 per cent fairer than its before-tax coefficient. This suggests the Australian system moves money from the more well-off to the less well-off.

It may not do it enough for some and it may do it too much for others, but there is no evidence of gross unfairness.

Abolition might raise less than imagined

The third danger is assuming that abolishing a tax expenditure would raise as much as it notionally costs.

In many cases it won’t, because people will change their behaviour and look for tax breaks elsewhere.

Even where this is not the case, abolishing two tax expenditures together might raise much less than the cost of the two added together. How? Removing one tax expenditure can mean less money for the other expenditure to give away.

The best example of this is in superannuation. If the $23.3 billion tax discount on super contributions was abolished, there would be less super in the funds to apply the discount on earnings. The earnings discount would be less than quoted.

The total of the tax expenditures set out in the statement exceeds $250 billion. Previous statements have warned about adding them together. This one does not.

Expenditures compared to what?

Each tax expenditure needs to be calculated against a benchmark – a standard tax rate that would otherwise be imposed. It isn’t always clear what the benchmark should be.

For income tax, it is assumed to be the standard set of income tax rates. But they may not be the right rates to apply to the taxation of income from savings.

A respectable case can be made for a dual-income tax system, with a progressive income-tax scale (as now) alongside a flat 10 per cent rate on earnings from savings.

The 2017 tax expenditure statement took this idea up and produced an alternative estimate of superannuation tax expenditures using a different benchmark. The cost of the superannuation tax expenditures fell 80 per cent!

One more thing. The use of trusts to avoid taxes isn’t really captured in the tax expenditures statement, in part because it is hard to work out how much tax minimisation takes place through trusts.

Often we do not know who the ultimate owners are. Loans made within trusts are not well-documented or regulated. Nor are property transfers and usage. There’s a case for a Trusts Investment and Insights Statement.

So bravo for the new Tax Expenditure (and Insights) Statement. And bravo for the new information on distributions. But please, use with care.

Robert Breunig, Professor of Economics and Director, Tax and Transfer Policy Institute, Crawford School of Public Policy, Australian National University

This article is republished from The Conversation under a Creative Commons licence. Read the original article.

Do you think tax breaks cost Australia too much? Or are they are reward for a lifetime of hard work? Let us know what you think in the comments section below.

No I don’t. Those who have worked hard, left the support of family, risked their capital, been successful and paid more than their share of income tax, deserve a break. Most people take more out of the system than they put in despite their claims that I paid tax all my working life.

So the rest of us subsidizing a $400 million SF is a good idea? Their money is not being taken from them, higher tax on anything earned on accounts with >$3m Still lower tax rate than the rest of us pay

How sad that the wealthy feel personally attacked.

It just shows how much they care about others. Why not wait to see how it pans out, instead of going gun ho attacking Albo? He is trying to make it fairer for all. I would happily vote for him in a republic if everyone wants to get rid of our Queen.

She got rid of herself, but the LNP is desperate and using a fair and overdue reform to attack the government. The tories have no constructive policies

The Tax Expenditures are no more than an opportunity cost forgone by the Government to encourage its citizens to engage in certain activities – mainly savings or building his/her wealth for rainy days or providing community service, i.e. leasing out properties for rental. These opportunity costs can be regarded as a tool for the distribution of income or wealth. Whether they are fair or not, is very much in the eye of the beholder. The sum of the Tax Expenditures does not make any sense to anyone, because it is a cost of the forgone opportunity to tax at a benchmark rate. These costs are part of government policies; be they social, economic, or political. I think most Australian taxpayers are fair and don’t mind doing the heavy lifting when needed.

To suggest that a “Tax Break” costs the Government anything is being disingenuous. As I understand it, a “Tax Break” is simply a transaction where no tax is applicable versus a transaction where tax is applicable. If it is exempt and no monies are paid to either party by the Government, it has actually cost the Government nothing.

The reasons for many “Tax Breaks” are often to ease burdens on financial activities that can be beneficial to all parts of the situation.

Note that the list of “Tax Expenditure” includes the GST on food, education and healthcare. The fact that these have been included suggests that this Government may very well remove the GST exclusions from these essentials of life. (To these exemptions it can be argued that the costs of domestic elecrtricity and gas should be included as they are essential to maintaining our safety and quality of life.)

For any Government to suggest that they need to consider these means of increasing their revenue indicates that they are desperate and cannot be trusted to manage the economy intelligently.

Of the elected members of Parliament of the present governing Party almost none have ever had the responsibility of managing a successful business and this is an indication of their real world abilities.

It would seem that you would prefer to give reduced tax rates on a SF with $400 million in it, and defend this as economically rational. Illegally driving the poorest in the nation to suicide is better management of the economy, and handing out large sums to businesses that did not need them and were sacking staff even better. Shove your economic rationalism and find some morality