How would you feel if you were paying for a product that you didn’t know you’d purchased and, when you came to use it, it didn’t work and potentially left you financially vulnerable?

If that sounds like a bad deal, it’s exactly what’s happening today with some forms of life insurance in your superannuation. Millions of Aussies have no idea what they’re paying for and could be denied payouts even if they think they’re covered. It’s why even corporate regulator, the Australian Securities and Investments Commission (ASIC), calls it ‘junk insurance‘.

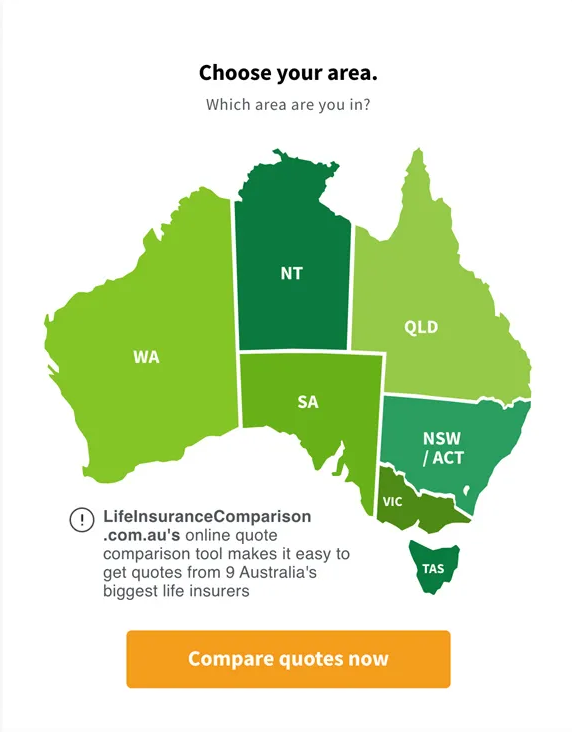

If you want to have confidence that you’re actually covered for life insurance, it can pay to compare policies and check you’re actually getting a good deal. Our expert team at Life Insurance Comparison can help you understand what you’re covered for.

One of the biggest issues is the Total and Permanent Disability (TPD) cover that comes built into some superannuation products. It’s meant to pay you a lump sum if you can no longer permanently work due to illness or injury.

But ASIC found that some policies were declining more than 70 per cent of TPD claims. In ASIC’s words, they were effectively “junk insurance”.

Why are you paying for ‘junk’ life insurance in your super?

It’s a government requirement for super funds to provide life cover in your retirement savings. Typically, this is term cover and TPD.

That may sound great – you have life insurance and it’s being paid for by your super. But there’s a catch.

Claims on some TPD policies are assessed on what’s known as an Activities of Daily Living (ADL) test. This means you have to be unable to do two of the following to successfully make a claim.

- bathing and showering

- dressing and undressing

- eating and drinking

- using a toilet

- moving from place to place by walking, wheelchair or with the assistance of a walking aid.

That’s a pretty high bar. ASIC noted that three in five claims were denied under an ADL test, with mental health claims among the most common rejections. To quote ASIC’s report: “Consumers with these common conditions cannot rely on the TPD cover they are paying for.”

How you can fight back against junk life insurance?

ASIC says 9.6 million Aussies hold a default life policy in super but fewer than half of us have actually read our super statements. That means millions of us have no idea what our life insurance actually covers us for.

But it doesn’t have to be like this. You can have peace of mind that you’re covered if you’re too ill or injured to ever work again, or worse, and it can be affordable.

By using the expertise of the team at Life Insurance Comparison, you can find life and TPD cover that fits your budget and has a higher likelihood of paying out when you need it most.

Our team can even find you a suitable life cover that can work with your superannuation.

So ditch the junk and protect you and your loved ones from the financial impact of illness, injury, or worse. Get peace of mind with Life Insurance Comparison today.

*ASIC, Insurance in Superannuation 2019-20, p.8 December 2019 [PDF].

**ASIC, Holes in the safety net: a review of TPD claims, p.31, October 2019 [PDF]

Disclaimer: This article is opinion only and should not be taken as medical or financial advice. Check with a financial professional before making any decisions.