The Reserve Bank of Australia (RBA) knows that the negative consequences of low interest rates disproportionately affect retirees, but believes they must bear this burden for the good of the economy.

An internal RBA document, released last Friday in response to a Freedom of Information request, shows the extent to which older households are affected by the lower interest rates.

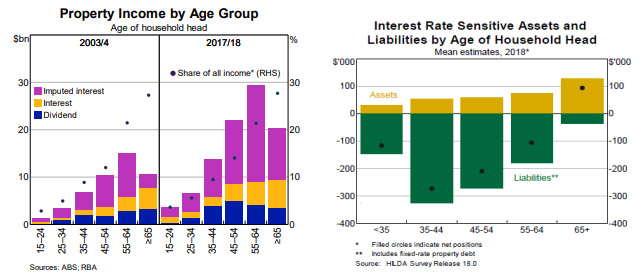

The document explains that interest income is a more important source of income for older Australians, with those aged 55 and over receiving two-thirds of all the interest income in Australia. That share of interest income has been stable for 15 years.

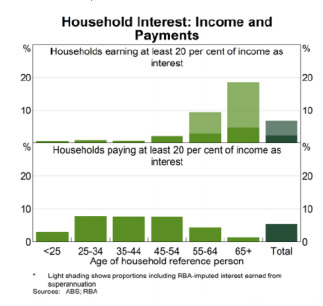

It also quotes Household, Income and Labour Dynamics in Australia (HILDA) figures that showed that 5 per cent of households where the head of the household was 65 or over earned more than 20 per cent of their income directly from interest.

Interest income for those aged 65 and over accounted for 7 per cent of gross regular income and for people aged 75 and over interest income accounted for 10 per cent of gross regular income.

While the document acknowledges that the income hit placed on this sector was significant and would require retirees to draw down more of their savings to maintain the same lifestyle, it explained that low rates were necessary to support government borrowing and the economic recovery.

The analysis did concede that the low return on financial investments could push retirees to consider riskier investments such as equities.

The RBA also claimed that self-funded retirees, who make up roughly 40 per cent of households above retirement age, also received indirect benefits from the stronger economic conditions and higher asset prices with housing accounting for around half of the wealth of older Australians.

According to the RBA analysis, house values could jump 30 per cent over the next three years with “larger effects in local areas in which housing supply constraints are binding, mortgage debt is higher and there are more housing investors”.

High unemployment was cited as the biggest risk to the economic recovery and the RBA explained that low interest rates could help reduce that risk.

While there was no outlook for when interest rates may rise, the RBA said it was watching to see if the low interest rate environment created a credit-fuelled asset bubble, but explained that it didn’t see housing prices as a major risk as much of the demand was being driven by owner-occupiers rather than investors.

Has your retirement income suffered as a result of low interest rates? Is it fair that retirees are being asked to bear the burden for the economic recovery? Have you been tempted to try investing in riskier investment options such as equities?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/finance/news-finance/the-top-five-things-this-leading-economist-thinks-will-happen-in-2021

https://www.yourlifechoices.com.au/finance/elon-musk-named-worlds-richest-person-or-is-he

https://www.yourlifechoices.com.au/finance/news-finance/were-reluctant-to-help-ourselves