The 1 July boost to the rate of the superannuation guarantee from 9.5 per cent to 10 per cent will benefit workers in some states more than others.

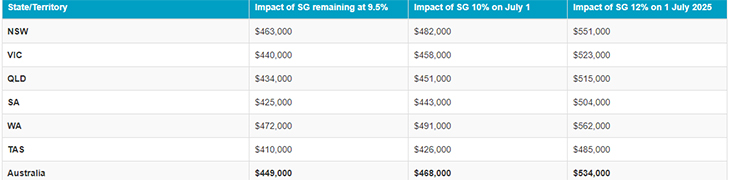

Analysis from the Association of Superannuation Funds of Australia (ASFA) released on Wednesday showed the average impact of the 1 July increase on retirement balances as well as the impact on nest eggs when the rate is lifted to 12 per cent on 1 July 2025.

ASFA chief policy officer Glen McCrea said that the coming rises in super contributions would provide all Australians with an opportunity to super-size their retirement savings and live comfortably in their golden years.

Read more: What are the different contributions you can make to super?

“The key objective of super is to provide dignity in retirement,” Mr McCrea said. “It’s clear that the Super Guarantee rise puts Australians firmly on track to achieve the dignified retirements they deserve.

“For the average Australian worker, the July super increase represents an extra $19,000 in their super nest egg at retirement.

“The long-term benefits of the system reaching 12 per cent are even greater. For the average Australian worker, the change will mean an extra $85,000 in super at retirement.”

Read more: Superannuation co-contributions explained

According to the ASFA analysis, the impact at retirement for an average worker in various states across the country is provided in the table below.

The increase in the Super Guarantee to 12 per cent will mean double the proportion of Australian workers will reach the ASFA Comfortable Standard at retirement of $545,000 for a single person.

“Currently only 25 per cent of Australians achieve a self-funded retirement,” Mr McCrea said.

Read more: Older Australians are paying too much interest on property loans

“By 2050, that number is set to double as a result of the super system moving to 12 per cent. It’s a significant shift, which will underpin Australia’s fiscal sustainability by diminishing the reliance on the Age Pension.”

ASFA also released figures to the Australian Business Network showing the top towns around Australia for the average superannuation balances across NSW, Victoria, Queensland and South Australia.

The surprising finding from the figures is that some of the best average balances come from outside the capital cities.

Of the four states included in the study, only two capital cities made the top 10 list. Melbourne was the capital city that performed best, finishing in sixth position with an average super balance of $158, 924, while Adelaide made it onto the list in 10th position with an average super balance of $157,017.

The NSW border town of Albury came out on top of the list with an average super balance of $175,435, ahead of the Victorian town of Traralgon ($169,360) and the South Australian town of Victor Harbor ($166,232).

The top 10 towns for average superannuation balances are:

| Albury, NSW | $175,435 |

| Traralgon, VIC | $169,360 |

| Victor Harbor, SA | $166,232 |

| Port Macquarie, NSW | $161,524 |

| Ballarat, VIC | $161,105 |

| Melbourne, VIC | $158,924 |

| Sunshine Coast, QLD | $158,109 |

| Toowoomba, QLD | $157,682 |

| Geelong, VIC | $157,462 |

| Adelaide, SA | $157,017 |

Why do you think regional centres have better super balances than capital cities? Do you expect to be self-funded at retirement? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.