Colonial First State Investments has been ordered to pay a penalty of $20 million for misleading communications with members of the FirstChoice Fund and has already started making payments to members who suffered losses as a result.

The Federal Court found Colonial was involved in misleading or deceptive conduct when it told its members that legislative changes required Colonial to contact them and obtain an investment direction to stay in the FirstChoice Fund when that was not the case.

It had also misled members by failing to tell them that if Colonial did not receive an investment direction from a member, it was required to transfer that member’s superannuation contributions into a MySuper product.

Read: Super setback, but fees fall

The court found that the misleading communication was intended to encourage members to stay with the FirstChoice Fund rather than move to the MySuper product.

The MySuper provisions required trustees such as Colonial to pay default contributions from 1 January 2014 into a MySuper product and transfer ‘accrued default amounts’ from 1 July 2017 to a MySuper product.

Trustees were exempt from these requirements where they had received a valid investment direction from a member to retain them in a superannuation product rather than transitioning to a MySuper product.

Read: The changes that could take our super system from B+ to A

Colonial has already paid more than $67 million to remediate the losses suffered by 5815 members who received these calls.

Around 70 of the members who received a remediation payment were affected by the misleading calls considered in the Federal Court case, while 5745 members received similar calls to the ones described in the proceedings.

Colonial’s remediation program is continuing and will be extended to cover the 12,911 letters sent to fund members that were found to be misleading by the court, with the total remediation figure expected to increase well beyond $67 million.

Read: What to do if your super fund is underperforming

Australian Securities and Investments Commission (ASIC) deputy chair Sarah Court said the penalty was a timely reminder to trustees not to mislead members for their own benefit.

“Trustees have an obligation to provide their members with balanced and accurate information that enables them to make informed decisions about their retirement savings,” Ms Court said.

Colonial’s penalty came as a new report criticised the way that all superannuation funds communicated with members.

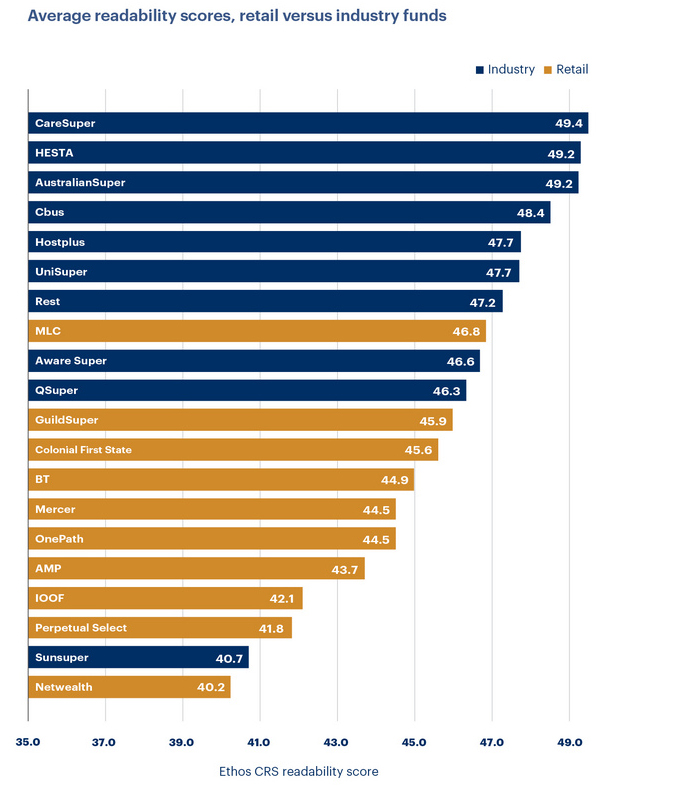

The 2021 Readability Scorecard, compiled by Ethos CRS, found that not one superannuation fund came close to meeting the perfect readability score of 100, with no fund even achieving a score of 50.

Industry super funds were considerably better at producing readable communication for their members compared to retail funds, with the top seven funds on the list all being industry funds.

CareSuper was best with a readability score of 49.4, ahead of HESTA and AustralianSuper (both 49.2).

The retail super fund with the highest readability score was MLC (46.8), which was only good enough for eighth place overall.

Ethos CRS chief executive Chas Savage said: “These findings suggest that super funds have work to do if they are to engage clearly and effectively with fund members.

“The decision to invest with the right superannuation fund is an important one.

“All super funds face the challenge of delivering complex information to a diverse range of members – and levels of financial literacy vary widely. This means that super funds must be clear when discussing the financial services they provide, the performance of funds they manage, and the rights and responsibilities of fund members,” he said.

“Australians are vitally interested in their financial security, but are not analysts. Super funds should take the step of producing more readable content.”

How much communication do you receive from your super fund? How much of it do you understand? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.