Joey Moloney, Grattan Institute and Brendan Coates, Grattan Institute

Australia’s $3.3 trillion superannuation system is supposed to boost people’s retirement incomes. The government says as much in its proposed leglislated objective for superannuation. The system is supported by billions of dollars of tax breaks each year, ostensibly to that end.

But there’s just one problem – increasingly, much of what is saved is never spent.

Our new report, Super savings: Practical policies for fairer superannuation and a stronger budget, points out that without an overhaul, super tax breaks are set to do little more than boost the inheritances of Australians with well-off parents.

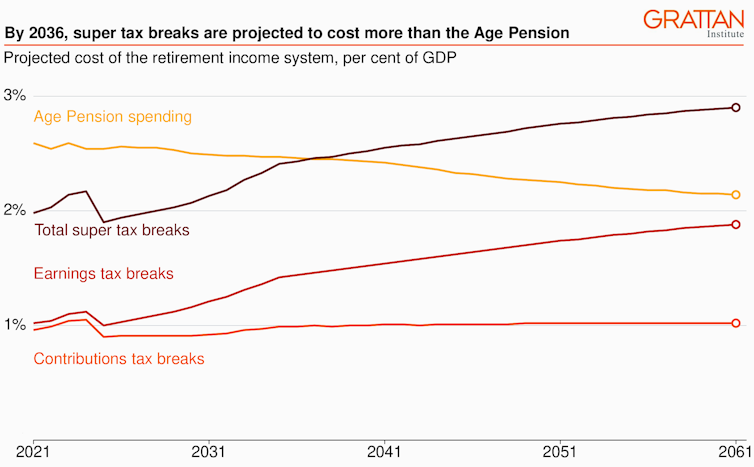

Super contributions and super earnings are both taxed more lightly than other income. These tax breaks cost the budget about $45 billion (2 per cent of Australia’s gross domestic product, or GDP) each year.

Treasury predicts that figure will hit 3 per cent of GDP by 2060, and that the cost of super tax breaks will overtake the cost of the Age Pension by as soon as 2036.

Click for notes

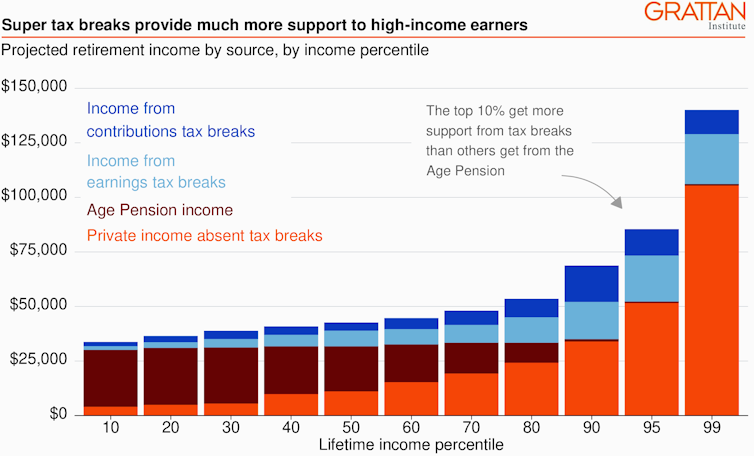

Super tax breaks are also unfair – about two-thirds go to the top 20 per cent of earners.

This means the tax breaks provide the biggest boost to the super accounts of high earners, who will almost all have a comfortable retirement regardless, and who tend to save the same regardless of the tax rate imposed.

The wealthiest 10 per cent of Australians get a bigger boost to their retirement savings from super tax breaks than poorer Australians get from the Age Pension.

Click for notes

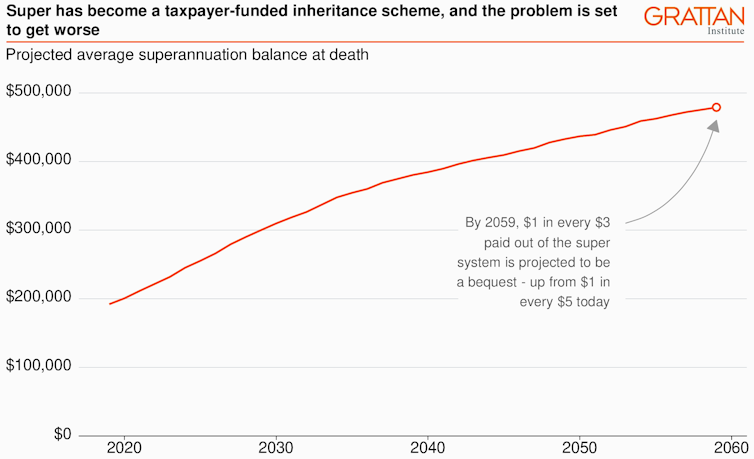

But much of what is saved for retirement never actually gets spent in retirement.

Earlier research by the Grattan Institute and the 2020 Retirement Income Review found that, for a variety of reasons, spending falls substantially during retirement. Retirees often end up leaving much of their nest egg untouched, bequeathing it to their children.

This means billions of dollars in super tax breaks simply end up boosting the inheritances received by the children of well-off parents. It makes super a taxpayer-funded inheritance scheme.

This problem is set to get worse. With the rate of compulsory superannuation legislated to rise from 10.5 per cent of wages to 12 per cent by 2025, future generations of retirees are set to retire with even larger nest eggs that they will never spend.

Treasury projects that by 2059, one in every three dollars paid out of the super system will be a bequest, up from one in every five today.

Click for notes

Big inheritances boost the jackpot from the birth lottery. They help richer children get richer. Among the Australians who received an inheritance over the past decade, the wealthiest fifth received on average three times as much as the poorest fifth.

To help reverse this, the government needs to rein in the super tax breaks.

How to make super fairer

The government’s policy, announced in February, of taxing the earnings on balances bigger than $3 million at 30 per cent, instead of 15 per cent, will help.

But the threshold ought to be lowered to $2 million. Balances between $2 million and $3 million are very unlikely to be spent in retirement, so winding back tax breaks on earnings on balances bigger than $2 million would further wind back taxpayer-funded bequests.

And there’s more. Currently, many wealthier Australians receive a larger tax break per dollar contributed to super than many low income earners.

Yet low earners have more to be compensated for. Putting money into their super cuts their Age Pension in retirement, and they live shorter lives, meaning less time to enjoy their super in retirement.

The pre-tax contributions of people earning more than $220,000 a year should be taxed at 35 per cent, instead of the 30 per cent charged to those earning more than $250,000 currently. That would still offer a 10 per cent tax break on super contributions for high earners (given the top marginal rate of 45 per cent) and at least a 15 per cent break on the contributions of low and middle earners.

And the annual pre-tax contributions cap should be lowered from $27,500 to $20,000. Contributions above this level tend to be made by people close to retirement with already high balances.

Tax earnings in retirement the same as while working

On the earnings side, the tax-free earnings enjoyed by retirees on their first $1.7 million ($1.9 million from 1 July) of their super should go.

Superannuation earnings in retirement should be taxed at 15 per cent, the same as superannuation earnings before retirement. This would save the budget at least $5.3 billion a year, and much more in future, and make taxing super more simple.

More than 70 per cent of this revenue would come from the top 20 per cent of retirees. The top 10 per cent would pay an extra $7000 to $7500 a year on average, whereas the poorest half would pay no more than $200 more each.

Both sides of politics say they agree that super shouldn’t be a taxpayer-funded inheritance scheme. But there’s a long way to go before that vision is reality.

The Grattan Institute’s new report, Super savings: Practical policies for fairer superannuation and a stronger budget was released on 2 April 2023.

Joey Moloney, Senior Associate, Grattan Institute and Brendan Coates, Program Director, Economic Policy, Grattan Institute

This article is republished from The Conversation under a Creative Commons licence. Read the original article.

Do you agree with the notion super has become a taxpayer-funded inheritance scheme? Or should people be free to do what they wish with their super? Let us know your thoughts in the comments section below.

First thing is that the Labor party said they would not touch Super BEFORE the election. If they change anything in Super they need to take it to the NEXT election and then allow Australians to decide. Also the rules that apply to self funded retires must be 100% the same as the rules that apply to union super funds.

I and my wife are retired and have been for a number of years. We have an SMSF which is increasing in size despite paying us the minimum amount required (2.5% during COVID19 pandemic). We live comfortably and have no debts (cars when needed are less than two years old and cash is paid for them).

I find it ridiculous that I travel internationally twice a year and yet the Taxation Office considers me a low income earner because my affairs are arranged in such a way to maximise income and minimise tax (all perfectly 100% legal). I do not get any Old Age Pension but if I was so inclined I could buy a large McMansion in a prestigious suburb in my city and liquidate my SMSF and claim some age pension through being capital rich and cash flow poor. Not surprisingly I have moral problems with this approach.

I have worked and saved for my retirement and chosen to save for the rainy day rather than spend the majority of my income. Whatever tax reform is undertaken it needs to reward those who have saved at the expense of high levels of consumption.

We are seeing here a tall poppy syndrome in demonizing those who have taken care of themselves during their lives. Why should there be an increase in the rate of income tax because a person has an income above a certain threshold?

Notice that the people who have accrued high amounts of savings are generally not costing the Government their Age Pension. On that basis, these people should be encouraged to share their secrets and see more people entering that regime of assets.

Seriously, it is no-ones business but their own as to how much savings that they accrue and how they spend their money. (Remember that those with high levels of savings are not likely to be buying the base model cars and may even be over the LCT level and be gifting to the Government high amounts of tax on that purchase.)(Note that the GST on those cars includes a tax on a tax.)

Any attempts to cut these methods of increasing a persons savings and investment opportunities will almost certainly have unintended consequences where the Government will lose more than they will gain.

Seems to me there is 3.3 Trillion dollars that the government just can’t wait to get their hands on it and as usual they will waste it