We all find it hard to avoid a freebie but when it comes to health cover these are the last things you should be thinking about.

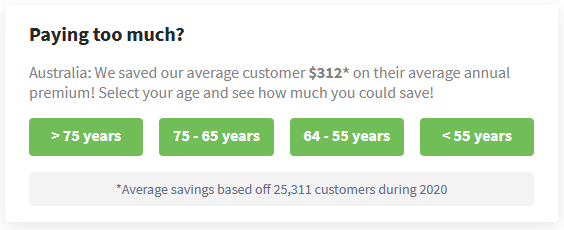

That’s why thousands of savvy Aussies are using Health Insurance Comparison to compare health funds side-by-side and getting expert guidance on whether that free Fitbit is really worth it. Last year, our customers saved an average of $312 when switching health cover.

Shopping for health insurance should be easy and transparent, so you know exactly what you’re getting. But if you’re thinking about switching, health insurers will often throw sweeteners at you, which can make it hard to work out if you’re getting a good deal.

The truth is that while some of these incentives are great deals, they mean nothing if you’re paying top dollar for unsuitable coverage.

Any of the following should set off alarm bells in your head:

- The health fund doesn’t have a no-gap policy to help avoid gap fees.

- Your cover includes cataracts but you’re in your early thirties.

- Your cover includes pregnancy but you’re a 60-year-old man.

- You’ll use up your extras limits in one dentist check-up.

- Your extras limits are so generous you’ll never even come close to using them up.

Choosing health cover is an important decision, not one that should be rushed. You may have noticed that incentives come with an expiry date, designed to encourage you to make a purchase as soon as possible.

This can be stressful, which is why it’s smart to ignore these bonus deals until you’ve narrowed down your options.

Start your insurance search by focusing on what you want out of your health fund. Use Health Insurance Comparison’s service to compare policies from our panel of trusted insurers that offer similar features, such as extras you know you’ll use.

The service provides you with personalised policy matches so you can compare coverage on a level playing field, without any distractions. Shopping for health insurance should be easy and transparent, so you know exactly what you’re getting.

If you’re deciding between two very similar policies, a bonus deal may be the thing that helps you make a final decision, and that’s fine. Just don’t let it lead you astray.

It only takes a few minutes with Health Insurance Comparison to see if there’s a policy from our panel that’s hundreds of dollars cheaper. Now that’s a real incentive.

Get Started Now:

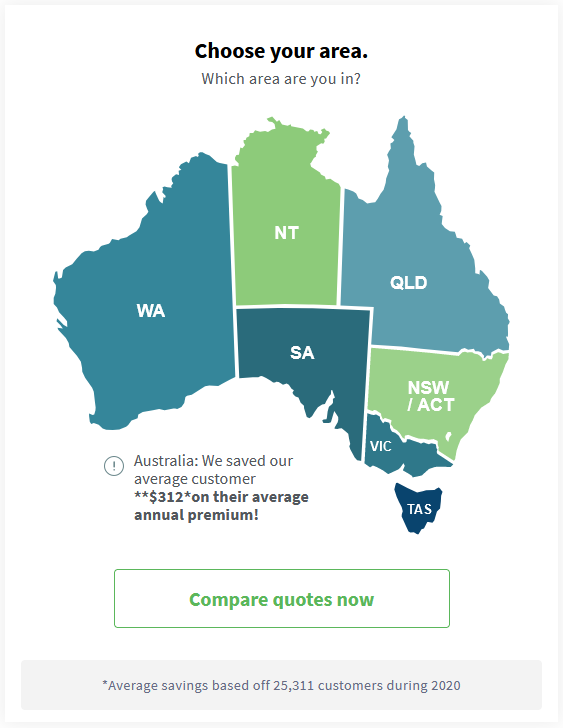

Step 1: Select your state below .

Step 2: After answering a few questions, you will have the opportunity to compare quotes in your area and could be eligible for significant savings.

This article is opinion only and should not be taken as medical or financial advice. Check with a financial professional before making any decisions.