You’ve worked hard and are starting to think about life after full-time work. You have nearly $500,000 in superannuation and are thankful that Australia introduced compulsory superannuation contributions when it did. But you can’t stop yourself wondering: Do I have enough?

You’re not alone. Survey after survey finds that the fear of outliving one’s savings is one of the top fears for retirees. YourLifeChoices’ 2020 Ensuring Financial Security in Retirement survey found that of the 3000 respondents, only 13 per cent were confident their current savings and income would last for their lifetime.

You find plenty of articles on the topic, how much super do I need to retire?, but very little to help you work out what do with your super when you do retire.

From the government to the superannuation industry to the media – everyone is obsessed with saving for retirement, but without enough attention given to what comes after retirement. Yes, it is important to do whatever we can to maximise our retirement savings but for many of us, there is not much we can do, other than keep an eye on our superannuation, make sure we are in a good fund, and make additional contributions if possible.

Preparing for retirement is much more than asking, ‘Do I have enough?’

The purpose of saving for retirement is to produce income in retirement, but retirement income was mentioned only once in the recent Federal Budget, and that was a reference to the deferral of the Retirement Income Covenant. This covenant was first announced in the 2018 Budget and, if ever implemented, will require fund trustees to consider the retirement income needs and preferences of their members. It is now due to commence on 1 July 2022.

It’s time to start focusing more attention on what happens to Australians after full-time work, to start having more discussions about what comes next.

The key question to ask is: How much income will I have when I retire and how long will this last?

To help answer this question, you need to have some idea of what life after full-time work will look like, how long you might expect to live, and how to convert your retirement savings into retirement income.

Life after full-time work

Leaving full-time work is not an ending but a new beginning. Those contemplating retirement should start thinking about what comes next. The transition from full-time work involves understanding not just financial goals but also non-financial goals such as health, family and purpose.

Understanding life expectancy

Once you have started thinking about what life after full-time work might look like, it is time to assess different strategies and products. When considering the most suitable solution, first you need to estimate how long you could live.

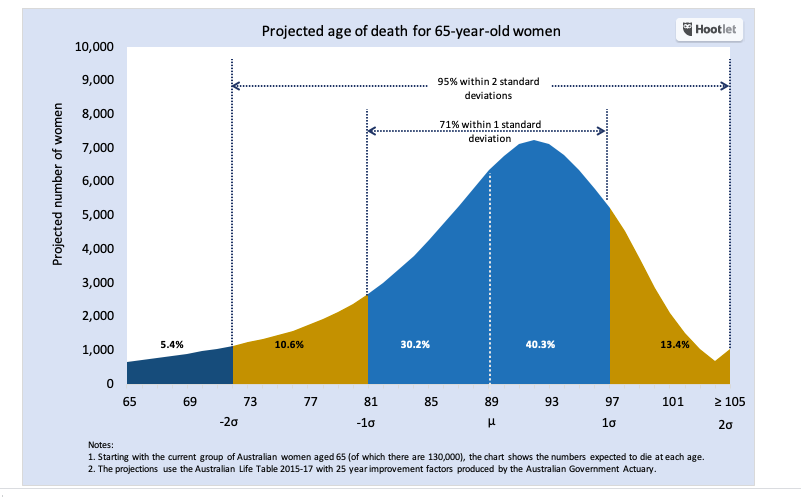

Of all the risks in retirement, longevity risk is the one least understood. In simple terms, it is the risk of outliving your savings. Many base their retirement planning on life expectancy without understanding what this actually measures. It is the average for how long a group of people are expected to live based on age and gender.

Consider an average 65-year-old female born in 1955. She needs to plan to live to age 89 for a 50/50 chance her retirement plan will last as long as she does. What if she wants to be 80 per cent confident that her financial plan will cover her entire lifespan? Then she needs it to last to age 95. That’s around 10 years longer than the simple life expectancy. If she has a partner? Then they really need to plan for one of them to reach 100 to be confident.

The chart below shows the distribution of projected lifespans for Australia’s current population of 65-year-old females using mortality rates published by the Australian Government Actuary.

Producing retirement income

Pre-retirees and retirees need to consider the products that might produce retirement income. Unfortunately, there are limited retirement income product options in Australia, especially if you’re concerned about longevity risk.

The products offered by most superannuation funds are, at best, only a partial solution and a poor or inadequate one for those who live a long life. The current standard product offer is an account-based pension that does not protect against longevity risk.

One of the consequences of the account-based pension is the tendency to underspend in retirement. The majority of retirees draw down the minimum allowable amount – not because that amount fits their plan but because they are worried about drawing down more. This may result in an unnecessarily frugal retirement. If people had more certainty around their level of income and how long it would last, they could potentially spend with more certainty and have a more enjoyable lifestyle.

An Australian retiree looking for a more certain retirement income stream has little choice but to purchase a lifetime annuity. That might be suitable for some, but we need more choices to recognise that people’s needs in retirement vary.

Superannuation is not super yet

Increasing retirement balances is important but only half the journey. The primary objective of saving for retirement is not to accumulate wealth but to provide retirement income. The delivery of quality outcomes includes helping to convert retirement savings into suitable income streams, including protecting longevity and other risks. This is where more innovation is required, especially when it involves combining retirement savings, the Age Pension and other assets to create retirement income.

It is incumbent on the financial services industry to improve its retirement offerings with products, services and tools to better help Australians convert their hard-earned retirement savings into retirement income.

Have you investigated buying an annuity? Have you changed you mind about such products?

Stephen Huppert has had nearly 30 years’ experience in superannuation, wealth management and life insurance. He works as an independent consultant and adviser partnering with institutions big and small that are committed to improving the retirement outcomes of Australians.

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/retirement-affordability-index/giving-retirees-the-confidence-to-spend

https://www.yourlifechoices.com.au/retirement-affordability-index/cracking-the-nest-egg

https://www.yourlifechoices.com.au/retirement-affordability-index/retirements-holy-grail

Disclaimer: All content in the Retirement Affordability Index™ is of a general nature and has been prepared without taking into account your objectives, financial situation or needs. It has been prepared with due care but no guarantees are provided for the ongoing accuracy or relevance. Before making a decision based on this information, you should consider its appropriateness in regard to your own circumstances. You should seek professional advice from a financial planner, lawyer or tax agent in relation to any aspects that affect your financial and legal circumstances.