Despite the negative sentiment towards baby boomers and their fortunate position in life – unlike younger generations – the majority retiring now will have only relatively modest super balances. This is due to the fact that the superannuation guarantee (SG) was introduced at only 3 per cent in 1992 and did not reach 9 per cent until 2012. Most retirees have not contributed at higher levels throughout their working lives.

Where the boomers win, however, is in the value of the family home. Older generations have had the benefit of rising property values over recent decades, with the consequence that a large proportion of their wealth is in the family home.

What the Retirement Income Review uncovered about the importance of the family home

This issue was covered in some depth in the Retirement Income Review (RIR). In examining the three pillars of the Australian retirement system – the Age Pension, compulsory superannuation and private savings – the review pointed out that: “The home is the most important component of voluntary savings and is an important factor influencing retirement outcomes and how people feel about retirement. Homeowners have lower housing costs and an asset that can be drawn on in retirement.”

At present, about 80 per cent of retirees are homeowners. This is a particularly high rate of home ownership by international standards that not only benefits individuals but the wider economy. Home ownership lowers age pensioners’ living expenses and means that the system is very cost effective for Australian taxpayers. At 2.4 per cent of GDP, Australia has one of the lowest cost public pensions systems in the OECD.

Read more: Super is meant for your retirement, not your offspring

For most Australians, the family home is not only of huge personal and psychological importance, but it is also a major store of wealth. As housing is exempt from the Age Pension assets test and capital gains tax, for many it is a preferred form of retirement savings. At present, around 15 per cent of age pensioners live in homes valued at more than $1 million, although the vast majority of these are in Sydney or Melbourne where property prices have escalated in recent years. Many retirees in this situation may be termed ‘asset rich and income poor’.

The family home is a store of wealth that can be used

With the family home constituting such a large component of private saving, it is likely that an increasing number of retirees will draw on this precious asset to improve standards of living in retirement, provide additional resources for those wishing to age at home, or as a way to pay out the remaining mortgage at retirement.

Government schemes

There are two government measures that encourage retirees to access the value of their home – the Home Equity Access Scheme (previously the Pension Loans Scheme) and the downsizer contribution.

The Home Equity Access Scheme (HEAS) is effectively a reverse mortgage for age pensioners and self-funded retirees, designed to supplement retirement income up to 1.5 times the maximum Age Pension per fortnight. There are no regular repayments through the life of the loan, and income from the scheme is not assessable in the Age Pension means test.

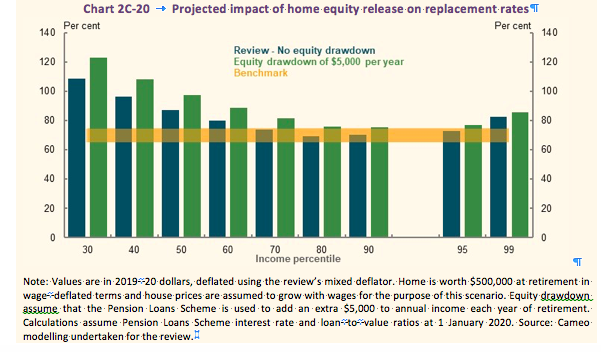

The impact on the capital value of the property is less than you might think. While interest rates are higher for reverse mortgages because there are no regular repayments, the net interest cost after allowing for some increase in property value, is quite modest. The RIR gives an example of a retiree who draws $5000 each year throughout retirement against equity in a home worth $500,000. By the time the retiree is 92, the property has an accumulated debt of only around a quarter of its value.

The downsizer contribution allows people aged 60 and over [a change from 65 years was made in the 2021 Federal Budget] to enhance retirement incomes by increasing super balances on selling the family home. Provided the home was held for at least 10 years prior to sale, a person can contribute up to $300,000 to superannuation from the proceeds. This could mean a combined $600,000 boost to superannuation balances for a couple.

Private sector schemes

In the current economic environment, a variety of new forms of private sector home equity access products are attracting more interest from both age pensioners and self-funded retirees. These include reverse mortgages, home reversion or equity release products. Each is slightly different, as discussed on ASIC’s Moneysmart website.

Private sector reverse mortgages offer the choice of income stream, line of credit, lump sum or a combination of these. A lump sum could be used for purposes such as paying out a mortgage at retirement, covering the cost of large expenses such as home renovations, assisting younger members of the family with a home deposit or education expenses, or providing additional resources for in-home or residential aged care.

For an increasing proportion of older Australians with mortgage debt at retirement, refinancing with a specialist reverse mortgage provider is an attractive option. Loan repayments can be drawn against equity in the home instead of being repaid in cash, thereby preserving superannuation balances for retirement income. Importantly, unlike a regular home loan, a reverse mortgage does not require regular repayments and a borrower cannot default for missing payments.

Prior to 2012, reverse mortgages were not subject to product specific legislation and were regulated at the state level resulting in highly variable customer experiences and product designs that generated unexpected outcomes for customers and misaligned selling practices. However since 2012, federal legislation has provided significant consumer protections, limiting loan-to-value ratios, guaranteeing occupancy and ensuring people cannot have negative equity in their homes. There are fairly strict limits on what you can borrow against the home, starting at 20 per cent of equity at age 60 and increasing by 1 per cent with each year of age. These measures ensure in all but the most extreme economic scenarios, homeowners can expect to own a majority of their home equity by the time they reach 90 years of age.

Home reversion is a property transaction rather than a loan, where you agree to sell a portion of your property to a provider or investor in return for a lump sum payment. Any future growth in property value is shared, based on the percentages of ownership. The home reversion provider pays a ‘discounted’ amount for the share of equity, which can be much lower than the current market value. For example, you could sell 50 per cent of the future value of your home, but only receive somewhere between 25 per cent and 40 per cent of the value up-front, depending on your age.

Home reversion is not subject to the same protections as a reverse mortgage under the National Credit Consumer Protection Acts (NCCP). There may also be limited availability based on location for this product compared to a reverse mortgage.

Not so well known are equity release contracts, where you can sell a portion of your home to one or more investors, in return for a lump sum or a regular income stream. All maintenance, repairs and insurance costs are shared between the owner and the investors. Every five years, an additional small part of equity is used to pay a notional rent to the investor as return on their investment. While the owner retains the title of the property and the right to continue living there, they may also choose to rent the property out and retain all the rental income.

With equity release products, you need to keep track of your borrowed portion. Geographic restrictions do not apply, so equity release can occur anywhere provided property investors can be found. These may be family or friends, self-managed superannuation funds or unrelated parties.

Read more: How to give retirees the confidence to spend

A little-known but valuable feature of an equity release product is that they also qualify for the tax-free downsizer contribution allowance, allowing retirees to stay in their home but contribute funds from the sale of a portion of their equity into their superannuation accounts.

Each equity access product has different features that may or may not suit an individual retiree’s needs. Everybody’s circumstances are different. As the Moneysmart website points out, it is essential to get independent advice regarding how such a transaction might affect your Age Pension entitlements, bequests, etc. There is also a fact sheet from Service Australia to assist.

What is the efficient use of retirement savings?

Throughout the RIR, there are references to the efficient use of retirement savings – that is using retirement savings to provide needed funding in the form of both income and capital. This statement has often been misinterpreted to mean that retirees should reach the end of their lives with all retirement savings exhausted, but that is not the case.

It is pointing to the fact that once people reach retirement, they often become very cautious about spending down their retirement savings. Many live frugally in the belief they should preserve the capital they have saved, spending only returns and dividends, and with a concern that they will ‘run out of money’ before they die. This approach is well motivated in that people feel they are being financially responsible and do not want to be a financial burden on others. But often, this approach means that savings intended for retirement funding, including capital, go unspent and create an unintended bequest for future generations.

Read more: Why middle-income earners are the big losers in retirement

As the RIR points out, in each decade of retirement we spend less. Concerns about providing for future costs are largely unfounded, as in this country we enjoy a generous system of ‘social transfers in kind’. These are benefits in terms of the health and aged care systems, tax concessions such as SAPTO [Seniors and Pensioners Tax Offset], social security benefits such as the carer’s pension, and discounted state and local government services such as concessional pricing for public transport, discounted utilities, car registration and council rates.

In many ways these transfers represent a fourth pillar of the retirement system and they are not insignificant. Indeed, the RIR found that the average value of such benefits is greater than the full Age Pension for people over 65.

The purpose of the government encouraging and supporting retirement saving is to ensure that people can live well in retirement, not save for the next generation. By all means leave a bequest, but ensure that this is not at the expense of living well yourself. Drawing equity in the home to ensure you can enjoy your retirement with both adequate housing and funding is another example of using retirement savings well.

Conclusion

For most people, staying in their home and community is an important priority in later life. The additional income that can be generated from the wealth stored in the family home can ensure a higher standard of living in retirement and is especially important for those who have not had the benefit of higher superannuation contribution levels for much of their working lives.

Would you sacrifice a more comfortable retirement in order to leave a legacy? Are you prepared to use your home to deliver a better lifestyle in retirement?

Dr Deborah Ralston is a Professorial Fellow at Monash University, where she is a member of the steering committee for the Mercer CPA Global Pension Index. She is a member of the Reserve Bank of Australia Payments System Board and holds a number of non-executive director roles. In 2019, she was appointed by Treasurer Josh Frydenberg to the three-member panel for the Retirement Income Review.

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Disclaimer: All content on YourLifeChoices website is of a general nature and has been prepared without taking into account your objectives, financial situation or needs. It has been prepared with due care but no guarantees are provided for the ongoing accuracy or relevance. Before making a decision based on this information, you should consider its appropriateness in regard to your own circumstances. You should seek professional advice from a financial planner, lawyer or tax agent in relation to any aspects that affect your financial and legal circumstances.