The first phase of COVID-19 assistance from the banks is approaching an end, but the industry has offered a new phase of support to those still struggling.

When the coronavirus crisis first hit, banks offered customers who were struggling a six-month loan repayment deferral period, but the end of that assistance period is rapidly approaching.

More than 800,000 Australians have deferred their repayments throughout the crisis.

Banks, though, have recognised that many customers are still not in a secure financial position as a result of COVID-19 weakening the economy and have announced a new phase of support.

While customers who have returned to some level of financial stability will be required to restart paying their loans, some customers will be eligible for an extension of their deferral for up to four months.

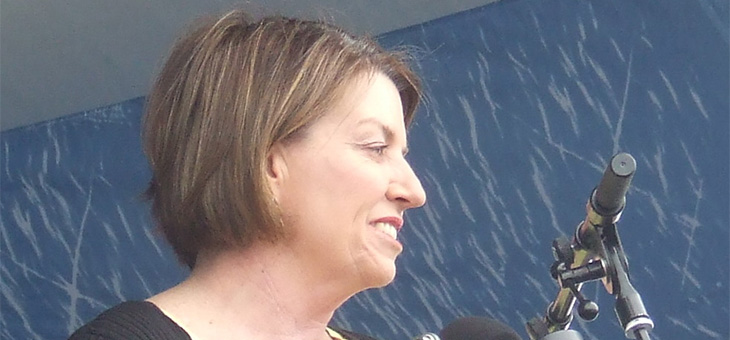

Australian Banking Association (ABA) chief executive Anna Bligh said in the long run it was best for the financial wellbeing of customers to return to full loan repayments and pay off their debt as soon as possible, but recognised that this would not be able to work for everyone.

“Those who are able to repay their loans will resume doing so, which is in the best interests of those customers and allows support to be directed to those who need it,” Ms Bligh said.

“Encouragingly, many customers have already chosen to resume making repayments.”

Customers with reduced incomes and ongoing financial difficulty due to COVID-19 will be contacted as they approach the end of their deferral period, to ensure that wherever possible they can return to repayments through a restructure or variation to their loan.

If these arrangements are not in place at the end of a six-month deferral, customers will be eligible for an extension of their deferral for up to four months. Customers will be expected to work with their bank, during this extra time, to find the best solution for them.

A deferral extension of up to four months will not be automatic; it will be provided to those who genuinely need some extra time. Many customers may need less than four months to either restructure their loan or get back into full repayments.

Options may include:

- extending the length of the loan

- converting to interest-only payments for a period of time

- consolidating debt

- a combination of these and other measures.

If during, or at the end of any deferral, customers continue to be severely financially impacted, and are unable to make repayments, they will be assisted through their bank’s hardship process to determine the best long-term solution for their individual circumstances.

“This next phase of bank support will avoid a ‘cliff’ for customers in September and give them the breathing space they need to work with their bank and get back on their feet financially,” Ms Bligh said.

“Australia’s banks supported their customers as the country entered the COVID-19 crisis and they are determined to support their customers on the way out of the crisis,” she said.

In relation to credit reporting, for customers who recommence repayments on their existing loan or enter into a new repayment arrangement, their credit report will not be impacted, provided they meet the new repayment arrangements. If you are granted an extended deferral period approved by your bank your credit report will not be impacted.

The Consumer Action Law Centre (CALC) and other consumer groups have welcomed the announcement from the banks, saying it would be a weight off the minds of many.

The consumer groups have offered the following advice to anyone experiencing financial difficulty:

– If you can afford to resume payments, even at a reduced amount, the earlier you can do that the better.

– Talk to your bank openly about your financial position. Banks have a range of options that might assist.

– If you need more assistance, talk to a free and independent financial counsellor by ringing the National Debt Helpline on 1800 007 007.

As well as calling on other utilities, telcos and other financial services providers to extend their current assistance packages, the consumer groups are calling on banks to recognise that:

– There will be groups of people who are going to need longer term and more flexible hardship arrangements.

– There were groups of people pre-pandemic with persistent credit card debt. Lenders should be providing specific assistance, including interest rate reductions, debt waivers and refund of interest, where people have been trapped in long term, persistent credit card debt.

– Access to assistance should be as simple as possible, acknowledging that financial difficulty will affect peoples’ ability to pay not only loans but other household bills.

Do you think the banks are doing enough to help people struggling with reduced incomes get back on their feet?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

https://www.yourlifechoices.com.au/finance/banking-and-investment/noel-whittaker-on-riding-out-the-storm

https://www.yourlifechoices.com.au/finance/banking-and-investment/money-101-risk-and-return

https://www.yourlifechoices.com.au/finance/news/covid19-recovery-could-take-years