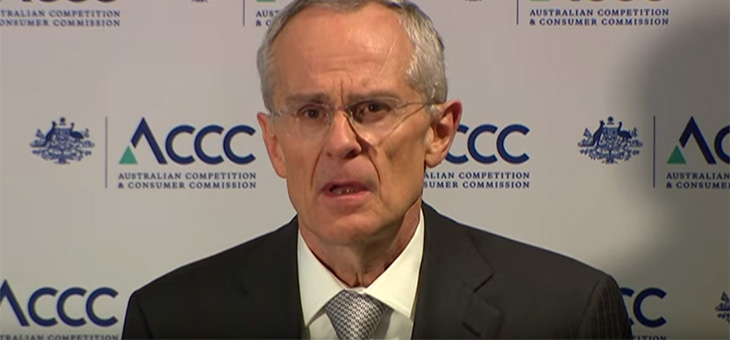

The Australian Competition and Consumer Commission (ACCC) says it will go ahead with planning a controversial new inquiry into the banking sector regardless of government concerns about the probe and without approval from Treasurer Josh Frydenberg.

Documents obtained by The Sydney Morning Herald and The Age outline the ACCC’s plans for the inquiry.

These same documents reveal the regulator’s concerns that “there may be a perception that we are commencing the inquiry before the Treasurer has formed a view on whether it should proceed”.

The new royal commission will investigate digital financial entities, such as Afterpay and neobank Xinja and will review barriers to entry in retail banking currently dominated by Commonwealth Bank, ANZ, Westpac and National Australia Bank.

Unsurprisingly, the new probe has the Big Four upset. However, the ACCC is forging ahead, noting the resistance in banking circles and the notion that there is ‘inquiry fatigue’ in financial circles.

“There have been media reports of inquiry fatigue from some banks. Consulting with them in advance of a direction may increase such fatigue, and some banks may be reluctant to engage before a direction is issued,” state the documents

The ACCC plans to approach a range of financial sector companies for their views on competition in the sector.

The “highest priority” of these companies include ING, neobank Xinja and the Customer Owned Banking Association.

Other “potential targets” include pay-as-you-go providers Afterpay and Zip Co, ME Bank, America’s Citigroup, and neobanks 86 400 and Volt Bank, as well as specialist suppliers including home lenders Tic:Toc, Pepper Group, La Trobe Financial and Cuscal.

“We are currently discussing potential options for our next inquiry, including the various approaches we might take and which stakeholders we would seek to engage with,” said an ACCC spokesperson.

Do you agree that there are barriers preventing a fairer banking system?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

Royal commission omissions

One in 50 fleeced by bank

What is open banking?