The pension increase you got last month covers you for inflation between the start of the year until 30 June. But inflation marches on relentlessly.

We’ve talked about it before. The additional pension you are now receiving does not compensate you for the increase in the cost of living during the first six months of the year – or nine months, really. Because compensation did not come through until almost three months after the 30 June.

True, if you are single on a full rate Age Pension, you are now getting $38 a fortnight more, but you weren’t getting $38 a fortnight more at the time. So, for 20 fortnights, you had to find those $38 yourself. That’s $750, you’ve had to find. The alternative was to go without things you normally bought.

It’s always been possible for the government to index the pension every quarter. The Australian Bureau of Statistics (ABS) calculates the Consumer Price Index (CPI), or the rate of inflation, every three months.

Read: Is money in the bank really as safe as houses?

And surely, the Department of Social Services could employ a bright year six student to calculate the pension increase a bit more quickly than it does at the moment.

The reason the pension doesn’t get indexed quarterly and the increase doesn’t come through more quickly is a simple one. It’s cheaper for the government.

The ABS has been under pressure to move from calculating the rate of inflation every quarter to calculating it every month. It has now done so, and about time.

Australia was one of only two OECD economies (the other is New Zealand) that was not producing a monthly CPI.

But the main reason why the ABS has so moved has nothing to do with the pension or with pension indexation.

Read: Age Pension payment rates

The main purpose of the CPI is to help the Reserve Bank of Australia (RBA) set interest rates. The RBA does this every month. Until now, it had done so based on a quarterly CPI. It’s anybody’s guess why it didn’t set rates on a quarterly basis, but it didn’t. Now, it can make its monthly decision on sound advice.

The reason why it took Australia so long to move to monthly CPIs was cost. The ABS collected information by visiting shops and phoning businesses. That’s how it used to work. Now the ABS uses Google, or as it puts it, “scanner data and web-scraping (automated) data collection techniques”.

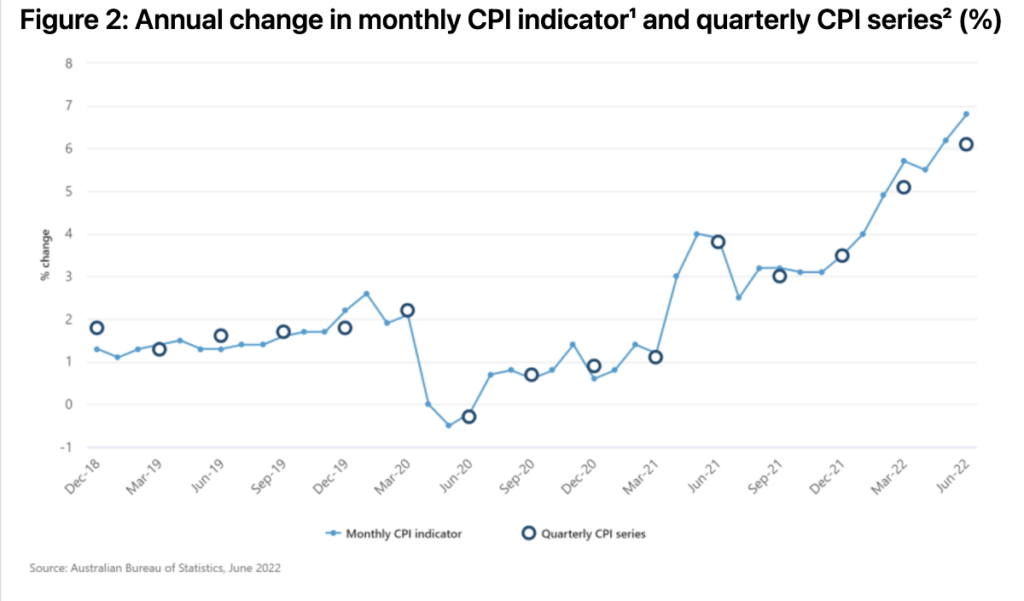

Still, the ABS hasn’t quite pulled it off. It’s not totally satisfied that its monthly CPI is as good as its quarterly one. This is why the monthly CPI is called the “monthly CPI indicator”. The perfectionists at the ABS expect they’ll have to apply corrections to their monthly CPIs, something they wouldn’t contemplate for their quarterly CPIs except in extraordinary circumstances.

Read: ABS to introduce monthly CPI reporting

But when you look at the graph below of quarterly CPIs and monthly CPIs (retrospectively calculated), the monthly CPI is pretty spot on. Sometimes a little bit lower, sometimes a little bit higher.

So, if it’s good enough for the RBA, isn’t it good enough for the Department of Social Services?

If it’s good enough to base the setting of the RBA’s cash rate on it, isn’t it good enough to use it in pension indexation?

The Combined Pensioners and Superannuants Association has previously argued the case for more timely indexing of the pension on the basis of non-ABS inflation data. Now that the ABS has come to the party, what’s holding back monthly pension indexation?

Timely pension indexation would fix a lot of pensioners’ cost-of-living problems.

It’s time for timely, Prime Minister.

Paul Versteege is policy manager at the Combined Pensioners and Superannuants Association. This article is republished with permission.

Would you like to see monthly indexation of the Age Pension and other government benefits? Do you support the argument for that to happen? Why not share your thoughts in the comments section below?

Monthly might be a stretch but I have been calling for quarterly indexation for some time. Six monthly is simply far too long in inflationary periods.

I agree with you David. Monthly is asking a bit, but every six months is far too long. In a volatile financial environment, we are in now, it is better to have up-to-date quarterly indexations.