The Age Pension increase set to hit bank accounts of millions of older Australians is aimed at keeping up with the cost of living.

And by YourLifeChoices calculations, it would do just that, assuming no surprise bills or expenses, such as car repairs or major health issues.

“I find the Age Pension reasonable and can live fairly well on it. The big problem is when extra costs occur, such as insurances or car expenses, etc. These extras are my biggest problem,” a YourLifeChoices member told us in our Older Australians Wellbeing survey.

Read more: Age Pension increases: 20 March 2021

But it’s not extra costs that make this latest pension increase all for nought.

That honour goes to the steadily diminishing interest income derived from term deposits and savings accounts.

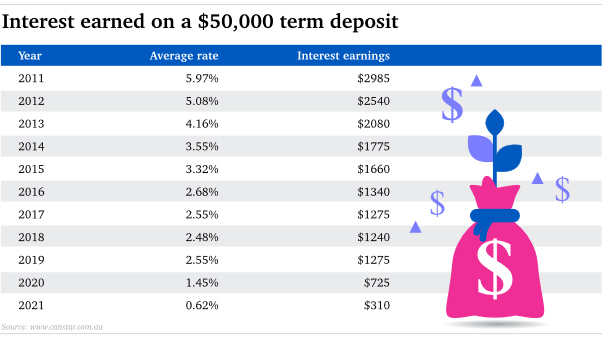

Age Pension payments may have increased almost 30 per cent in the past decade – again, to cover the rising cost of living over those years – but any advantage in having a payment that covers the basics in life has been blunted by average term deposit interest rates dropping from 6 per cent to 0.6 per cent in the same period.

And the official interest rate most likely won’t rise before 2024, says the Reserve Bank of Australia (RBA).

Australian retirees who typically rely on the interest earnt from cash deposits have seen this interest diminish over the past 10 years.

Read more: Age Pension payments in 2021 – what you need to know

“It’s a frustrating predicament for retirees in particular, many of whom know first-hand what it was like to earn 15 per cent interest on something as simple as a term deposit,” Ratecity.com.au research director Sally Tindall told The Australian.

The recent Retirement Income Review found that the average retiree couple has between $50,000 and $100,000 stashed away in non-super assets, most of which sits in bank deposits.

Since 2011, the couple’s combined pension has increased from $26,300 a year to $33,700.

Retirees can expect almost $2700 less from a $50,000 term deposit now than in 2011, down from $2985 to $310, says research group Canstar.

“For anyone who is on the pension with a bit tucked away, or a partly self-funded retiree, the income from your bank savings has been decimated,” said Canstar group executive of financial services Steve Mickenbecker.

“In the last 12 months some banks have reduced rates on savings accounts 12 times or so. That’s startling.”

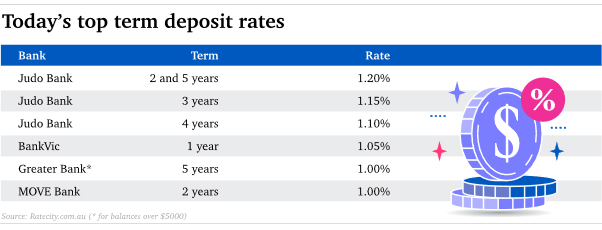

Older Australians shouldn’t expect the government nor the RBA to bolster their retirement income, says Mr Mickenbecker, adding that they should look past the big four banks for the best available rate on offer.

Read more: Services and rebates that can save you hundreds

“You are not going to lose your money just because you don’t know the bank,” he said, adding that almost all deposits in Australia were government guaranteed.

Ms Tindall suggests shopping around for a better deal will be worth the effort, even though very few financial institutions are offering attractive savings rates.

“There are still a handful of banks offering ongoing savings rates above 1 per cent – which sounds ridiculously low, but at least they’re a fraction ahead of inflation,” she said.

A far cry from the days of deposits earning 15 per cent interest.

Heavy hitting seniors advocacy groups such as COTA Australia are also relatively powerless to stop the sliding interest rates, despite older Australians being the hardest hit.

“There’s a certain degree of anger,” said COTA chief Ian Yates.

“But the Reserve Bank is not doing it to hurt pensioners. It’s doing it for macroeconomic reasons for the whole economy.

“At the moment, quite a lot of part pensioners are doing quite well because of their money in super, managed funds and the stock market.

“For some people it’s a bit of belt tightening, but for other people they were relying on it.”

How much has your retirement income been affected by the RBA cuts? Do you think the Age Pension is enough to live on?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.