A couple would like to apply for the Age Pension, but think they have too many assets to qualify. How can they reduce their assets under Centrelink rules?

•••

Q. Ron

We are a couple well past the age of retirement but who want to retire.

Unfortunately, when we contacted Centrelink they said we have too many assets to qualify for the Age Pension.

We have an investment property earning about $1300 a month in income, about $70,000 in a nest egg and a combined $160,000 in super. How can we reduce our assets to pass the assets test?

A. Ron hasn’t supplied the cost of the investment property, but that’s clearly tripping up his chances of qualifying for the Age Pension.

The first thing Ron and his wife should do is transfer any loans they have to the mortgage on the investment property. The debt amount is offset against the value of the property and reduces the value of the ‘asset’.

Another way to reduce your asset burden is to revalue any other assets. Cars, furniture and collectables devalue very quickly, especially furniture.

Centrelink only wants your asset’s resale value, not the replacement or insurance value.

This is the price you could get for them at a yard sale or online. A quick scroll on an online selling site will show even beautiful antiques are only going for a few hundred dollars.

Cars are also only valued at trade-in costs. Check online for how much your made and model is selling for and adjust your valuation accordingly.

You could also take out a funeral bond. Funeral costs you pay in advance – including burial plots – normally don’t count in the assets test.

However, there are a few exceptions and rules, check them out here.

Nest egg

You can also invest some of that nest egg in your own home through renovations.

As your principal residence is exempt from the assets test, spending some money on improving its value will not count towards the assets test.

Ron and his wife can also give away some of their cash. Under Centrelink rules you can give away $10,000 in one year or $30,000 over five financial years, which can’t include more than $10,000 in a single financial year.

And you don’t have to give away just cash. You can also give away what’s considered an asset under the assets test, such as a vehicle or artwork.

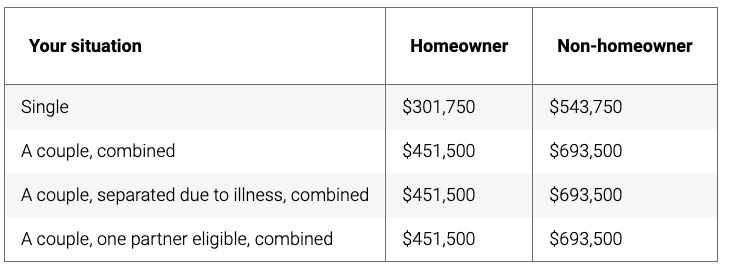

Asset limits for a full Age Pension as of 1 July 2023

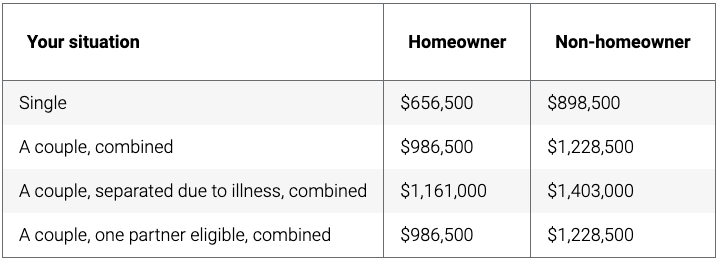

Asset limits for a part Age Pension

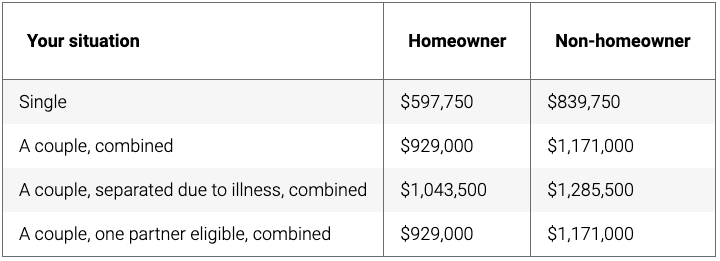

Asset limits for a transitional rate of pension

Have you ever revalued your assets? Did it increase your Age Pension payments? Why not share your experience in the comments section below?

Also read: Explained: Age Pension Work Bonus

Disclaimer: All content on YourLifeChoices website is of a general nature and has been prepared without taking into account your objectives, financial situation or needs. It has been prepared with due care but no guarantees are provided for the ongoing accuracy or relevance. Before making a decision based on this information, you should consider its appropriateness in regard to your own circumstances. You should seek professional advice from a financial planner, lawyer or tax agent in relation to any aspects that affect your financial and legal circumstances.