The rebranded Pension Loans Scheme – now known as the Centrelink Home Equity Access Scheme (CHEAS) – aims to give older Australians more confidence to tap into home equity to enhance their retirement living standards.

The reduced interest rate and, from July 2022, the ability to take out a lump sum capped at 50 per cent of the annual rate of Age Pension have been well received by many over 65s and retirement advocates.

“The government is committed to finding new and innovative ways to support older Australians in their retirement,” said social services minister Anne Ruston.

“Home ownership is a bedrock of our society with Australians working hard to accumulate wealth in the form of real estate equity.

“The Home Equity Access Scheme allows Australians over the Age Pension age – whether they are pensioners or self-funded retirees – to unlock this equity using a trusted government product to boost their disposable income in retirement.

“The new name also seeks to make sure that all retirees, not just those on a pension, know they can benefit from the Scheme if it suits their circumstances.”

The name change also removes the word “loan” from the name of the scheme, making the emphasis of the program a welfare scheme rather than a government reverse mortgage which Centrelink puts on the applicant’s home to secure the loan.

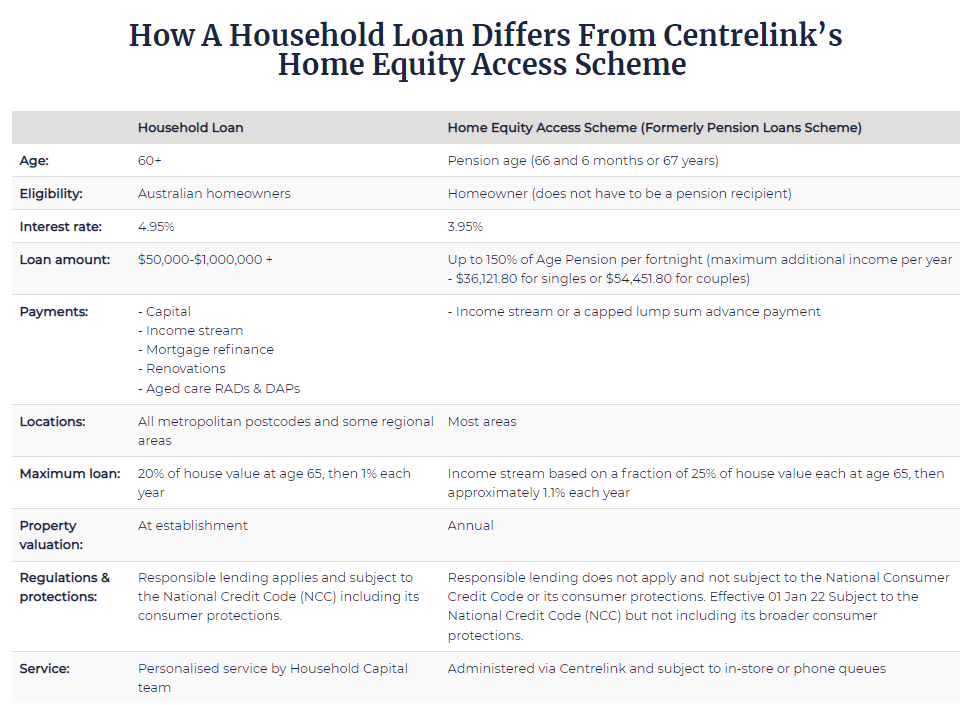

To be eligible for the government scheme, you have to be a resident who owns Australian real estate and be of Age Pension age but not necessarily receiving a pension payment.

Eligible recipients can get a non-taxable fortnightly government loan up to a maximum value of 150 per cent of the rate of the Age Pension. The maximum additional income available per year would be around $36,121 for singles or $54,451.80 for couples.

The new rebranded government scheme has been marketed as a useful top up for asset rich cash poor retirees – those who may have significant wealth wrapped up in property but little disposable income or who do not qualify for the Age Pension.

Home equity specialists Household Capital has welcomed the government’s plan.

“The new Centrelink Home Equity Access Scheme is great for retirees of pension age to access a modest top up via a Centrelink reverse mortgage” said Josh Funder, CEO of Household Capital.

Household Capital offers home equity access to Australians over 60 – six and a half years before they’ll be eligible for the government scheme.

And eligible applicants can borrow up to $1 million in a lump sum rather than the maximum lump sum payment of 50 per cent of the annual maximum rate of Age Pension.

“Most Australian retirees with home values around $700,000 need access to home equity to meet multiple needs,” says Mr Funder .

“For example, paying off the bank mortgage, renovating the home, giving to kids for first home deposits or funding aged care, as well as topping up income.

“Providing greater access to home equity, as well as flexibility and choice to meet multiple needs, is where the private market has innovated to meet the requirements of baby boomers across Australia,” said Funder.

Household Capital’s lending is backed by the security of the responsible lending code, with all transactions subject to the National Credit Code (NCC). The same protections are not offered by the government scheme, which revalues the home annually.

“Where the government changes to the Centrelink HEAS have really helped, is for those retirees with lower home values, who have very simple needs now and in the future, as well those living in rural and remote areas and those retiring with a very high mortgage balance,” says Mr Funder.

And any dealings older Australians will have when accessing the HEAS will be with Services Australia (Centrelink) staff rather than a dedicated personalised service team offered by Household Capital.

“What we need now is a genuine national commitment to raise awareness of the role of home equity in funding retirement for all Australian homeowners as private property of retirees and as the third pillar of retirement funding,” says Mr Funder.

“What we don’t need is a pre-election advertising campaign for what some seniors worry is a compulsory Centrelink reverse mortgage.”

Household Capital’s Household Loan offers flexibility, choice and personalised service to Australians over 60, along with lifetime occupancy and other consumer protections. Would you like to find out if you are eligible for a household loan? Why not use this online calculator to see your accessible home equity?

Household Capital is a YourLifeChoices preferred partner.

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.