Australia is phasing out cheques by 2030, but banks are moving well ahead of the federal government’s timeline.

With less than 1 per cent of payments made this way, who will it affect?

Announcing the government’s plan last year, Treasurer Jim Chalmers said the shift would be “gradual, coordinated and inclusive”, adding that cheques were costly for banks to process.

Now Brisbane pensioner Michael Coogan will have to cover that cost.

Mr Coogan uses cheques to pay his rent.

When his bank stops processing cheques this week, he will have to pay a fee just to pay his rent.

Other banks will still process cheques for now, but the cost to do so starts at about $10.

“Of course, there will be people who use BPAY but I’m not comfortable with it,” Mr Coogan, who lives with his wife in Brisbane’s north, said.

“We don’t do any banking online because we’re not familiar enough with computers. Computers don’t figure largely in our lives.”

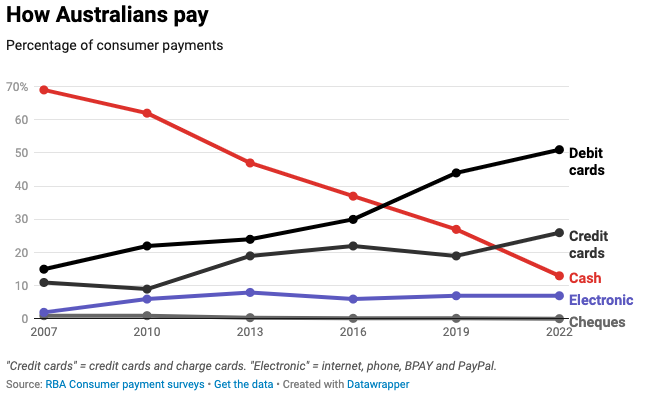

Cheque transactions make up just 0.2 per cent, according to a Reserve Bank of Australia (RBA) 2022 survey. The percentage of consumer payments by cheque were half that (0.1 per cent).

The use of cheques has dropped almost 90 per cent in the past decade, according to the Australian Banking Association (ABA).

The average cost for banks to process a cheque exceeds $5 and the Treasurer says it will only increase as fewer people use them.

In a consultation paper on “winding down” the country’s cheque system released last December, Dr Chalmers admitted that like many “productivity-boosting reforms”, the costs would be “felt more acutely by small segments of the population” – mostly more vulnerable Australians, and those without a reliable internet connection.

Still a “hasty or disorderly exit that leaves vulnerable cohorts of the community behind is in no-one’s interest”, he said.

The consultation closed this month, although some banks have already ended, or announced plans to end cheque services well ahead of the government’s timeline.

‘Don’t just support mortgage holders’

National Seniors Australia CEO Chris Grice said cheques were the “canary in the coal mine” for how a shift to a cashless economy will affect vulnerable people.

“Any society can embrace change but you’ve always got to bring everybody with you, and the concern is we’re leaving a cohort behind by racing towards this digital economy,” he said.

Mr Grice wants banks to reopen the branches they’ve closed so customers can get support in person to go digital.

“It would be good to see a number of banks across the country start to really look at their customers who have been customers for 40, 50, 60 years,” he said.

“The banks have got to really make sure that as a system they are providing support to the entire community, not just the cohort that have mortgages.”

In the six years to 2023, more than 1600 bank branches have closed and hundreds more regional ones are at risk, according to an analysis by AreaSearch.

National Seniors Australia will meet in Canberra today, with politicians including north Queensland MP Bob Katter, who made headlines after a federal parliament cafe refused to let him pay cash for his lunch earlier this month.

So where does that leave Mr Coogan and his wife?

They will now have to pay rent via a third party platform for about $8 a quarter.

He said it adds up for a couple on a fixed income.

“Every cent counts, and to all those 33-year-olds out there, one day you will be 53 and 63 and you’ll discover that your income shrinks, the ability to borrow evaporates, and your credit cards will be questioned,” Mr Coogan said.

Paying to pay rent

In laws to be passed by Queensland parliament this year, agents will have to provide a fee free way for tenants to pay.

Tasmania, South Australia, Victoria and New South Wales already have similar rules.

Tenants Queensland CEO Penny Carr said the end to cheques could push more renters onto the third party platforms, where there is a fee for their transactions.

“There are third party contracts where, in effect, the agents are subcontracting the rent payment and revenue collection requirements and also cost-shifting on to the tenant,” Ms Carr said.

“It just makes sense that you shouldn’t be charged for paying your rent.”

In a statement, the ABA said banks recognised a “very small number of customers” still used cheques and were “ready to support them to transition to other easier and more accessible forms of payments”.

“This support includes being up-front and transparent with customers about future policies around cheques, so they have sufficient notice to switch to other payment options,” a spokesperson said.

2020 Australian Broadcasting Corporation. All rights reserved.

2020 Australian Broadcasting Corporation. All rights reserved.

ABC Content Disclaimer

Bank computers go down.

Internet goes down.

Many areas still have sub standard mobile reception upon which many eftpos terminals operate now.

If we have no cash, what is the option expected to be available when one or all of the above services are unavailable?

A cashless society can be criticised the same as wind and solar power along with electric cars. The infrastructure is not ready and may not be for some time.

What do we do now if the power goes out? Shops do not sell, can’t open register. It’s not the end of the world if you can’t buy your milk the second you need it. You be an adult and understand that sometimes in life you have to wait for things.

I haven’t touched cash for years now, electronic banking goes down rarely and mostly only for hours not days, I’m sure you’ll survive, I have.

Well luck you. Not everyone shares your opinion though and much prefer to use cash. I have seen how dangerous going cashless can be, especially those that use tap and go, they quickly lose track of how much they have spent and what funds they have access to before they begin to become overdrawn on their account. I have heard of some who have multiple credit cards and are continuously using one card to pay off another. At least wit cash we know what funds we have avalable.

Greg must be a city dweller. If you live out in the outback, and travel a lot out there the internet is a hit & miss affair, so cash has to be used. Country people and the older population that doesn’t (and rightly so) trust the internet and computers have to be a large part of this equation, and catered for. It is also about time that the banks actually practiced customer service and keep branches open – closing them is purely a money grabbing action.

Bob Katter is a politician. But he disgraced himself by doing nothing. He let himself be taken for a ride publicly (what a stunt it would be if he had had guts). On the $50 note stays: The Australian Note Is Legal Tender Throughout Australia And its Territories. So, ‘Legal Tender’? Do I see it right? Rejected for payment at the Federal building? If so, the Government should take plastic Australian Notes off circulation and declare the ‘Australian Dollar Is Unit Of Account Throughout Australia And Its Territories.’ I noticed that Federal Agencies long ago did not accept Australian Notes for payment. So, they persistently discredit the declaration printed by the RBA. Who is to oblige? Due to the lax security of electronic transactions, international scammers will take Australians to cleaners who are already scamming around $1 billion annually. Where is the Australia Card? On a national scale, through such ‘electronic’ currency, we will go bankrupt as a country. Where is the Australia Card? Nowhere to be seen since 1988. Is the Government afraid of the 1 million ghosts residing here for years? It is like a 1 million backlog in Medicare/Centrelink cases, which the Government could not manage.

Hellooooo? Are memories so short that we’ve forgotten how the major Optus outage recently pretty much brought the country to its knees? No money from ATMS, no card sales, people couldn’t purchase necessities by card payment; small businesses lost thousands because they couldn’t process card payments ………. and the banks and the pollies seriously want to get rid of cash?????

As a famous movie Dad once said “Tell ’em they’re dreamin'”.

I use cash at least 90% of my shopping. I have my annual bills taken directly from bank, but every day shopping – cash only. This week I have bought a new freezer – paid cash. Paid delivery driver – cash. Sold my old freezer – got cash. Took cans I collect to collection station – got $81 cash. Used that cash to put petrol in the car.

TWICE in the past week I have been held up in the queue at the shopping centre because the shopper could not get internet access, once to their phone, other to their wrist phone. Being inside a large shopping centre, the checkout guy said ‘ this happens all the time’. Of course, that then holds up everyone. I live in an area with a high concentration of seniors, and luckily, most if not all stores welcome cash, often having signs up saying this. We have a local Sunday Produce Market – many stalls have signs saying either ‘we welcome cash’ or ‘cash only’. Yes, there will be some who will say ‘black economy’ – not a problem.

There are good reasons to go cashless, but there are better reasons not to. If a country has a tyrannical government and goes to a centrally controlled digital currency, coupled with behavioral scoring, the state will own the people and all freedom, privacy will be lost, perhaps forever. If that tyrannical government decides it wants to starve people to death, it will be able to by banning all alternative means of payment thus denying them people all financial resources. Combine this with total surveillance and going cashless can and likely will result in total government control of every movement that anyone makes, and not just the elderly.