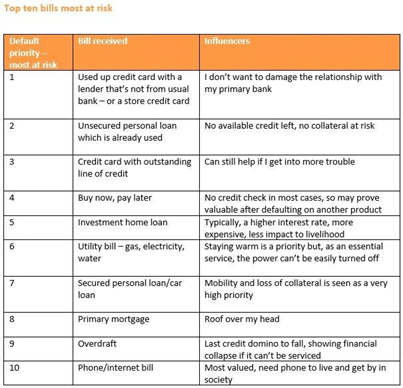

Researchers at the University of Sydney have released a ranking report that highlights which financial products are more valuable to consumers when they start to feel the squeeze financially, and which ones they are more likely to leave unpaid.

In a joint study with credit bureau illion, released last month, the researchers were able to establish what they called a ‘pecking order of defaults’ when it came to prioritising bill payments.

They did this by confirming the type of credit, its perceived value, the depth of relationship with the financial provider, and the ease with which payment could be avoided.

Read: Retirement dos and don’ts in the face of rising inflation

Dr Andrew Grant, senior lecturer in finance, analysed Australasian data from illion’s consumer bureau and other financial sources to confirm the financial products that are more valuable to consumers under stress.

“We have found that ultimately, preserving an open line of credit – some level of liquidity – is very important when it comes to financial stress,” he said. “It is probably not something people have actually thought about until it directly affects them. For instance, one credit card can be maxed to the limit while the other may still have $10k on it.”

The study is a particularly pertinent one in the current financial climate, with interest rate rises and inflation at the highest level in decades.

A separate report released last week by the Australian Council of Social Service (ACOSS) found Australians on welfare were being forced to choose between paying rent, buying groceries and getting medical care as the cost of living soars.

Read: How the psychology of inflation makes things worse

The report found that those on Centrelink payments were skipping meals and even foregoing hot showers to save on electricity bills.

ACOSS acting CEO Edwina MacDonald said the Jobseeker payment of $48 a day was still too low, despite the Albanese government raising it from $46 a day recently. That figure is considered to be below the poverty line.

Ms MacDonald wants that amount raised to $73 a day.

“This is having a real impact on people’s health. People on low, fixed incomes were already struggling with basics before the cost of living skyrocketed,” she said.

Michael Landgraf, manager of bureau analytics at illion, said the research confirmed that consumers made choices that immediately benefitted them.

“Making credit repayments on products that appear to hold the highest utilitarian value is seen as most important. Consequences such as continued access to credit and a loss of livelihood drive these choices,” he said.

The report took in consumers in both Australia and New Zealand, and found that the hierarchies were similar on either side of ‘the ditch’.

Read: Grow your own veg to beat the cost of living

Dr Grant said: “We wanted to find out what would make a person default on their home payments. What we have uncovered is that it’s really only when all other options are exhausted – after that person has already defaulted on other products, and has no choice.”

He said the findings were really important to financial providers, especially with rising interest rates.

Finance minister Katy Gallagher has said there’ll be no increase to Jobseeker in the October budget but the rate of welfare payments will be revisited in May next year. But Ms McDonald said action needed to be taken now and those struggling on welfare simply can’t wait until May.

“’Economists and commentators speak reassuringly of ‘buffers’ but there is no buffer when your income is $48 a day, she said.

Has the financial climate forced you to delay bill payments? Which ones can you put aside until later? Why not share your experience and thoughts in the comments section below?

As at August 2022 there were 470,900 job vacancies and 487,700 unemployed people in Australia, with hospitality job vacancies alone reaching 178,000!

JobSeeker was meant to help while seeking jobs, not maintain a lifestyle!