Long-term trends such as the digitisation or economies and work automation, which have been sped up by the COVID-19 pandemic, are having a big impact on the growth of retirement savings, according to a leading superannuation research house.

The analysis comes on the back of news that the remarkable recovery in super fund performance continued throughout March, despite a slower than expected vaccine rollout and some regulatory uncertainty around the use of some vaccines.

Superannuation research house SuperRatings explained that markets would remain volatile, but it was looking like the theme of 2021 would be one of ongoing recovery as the jobs market improved and economic activity picked up once again.

Read more: Super funds fight for changes to reforms

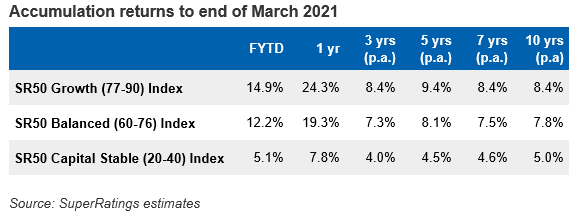

According to SuperRatings data, the median balanced option rose an estimated 2 per cent in March, while the median growth option rose an estimated 2.4 per cent and the median capital stable option rose an estimated 0.9 per cent.

Over the 2020-21 financial year to date, the median balanced option returned 12.2 per cent, reflecting the strength and speed of the post-pandemic recovery, which extended through to the end of the March quarter.

“The March returns data reinforced the success that super has seen in rebuilding from the depths of the pandemic last year,” said SuperRatings executive director Kirby Rappell.

Read more: Most people exhaust their super years before they die

“The real bright spot has been the bounce back in the labour market, which has restored confidence to households and helped reboot consumer spending.

“The reopening of the economy and the low or zero rates of community transmission we have experienced in Australia in recent months have galvanised the recovery.”

Read more: Retirement funds scheduled for $100,000 boost

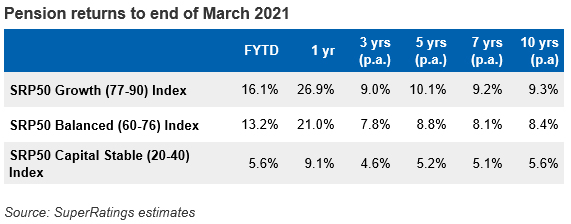

Pension returns were also positive in March.

The median balanced pension option returned an estimated 2.1 per cent over the month and 13.2 per cent over the financial year to date.

The median pension growth option returned an estimated 2.5 per cent and the median capital stable option gained an estimated 1.0 per cent through the month.

With the critical JobKeeper support now at an end and banks requiring mortgages to be serviced after a brief hiatus for those in need, it remains to be seen what the immediate economic fallout will be, but so far households appear to be holding up well, Mr Rappell explained.

“The vaccine story has been key to the recent rise in markets and super fund balances,” he said.

“However, there will likely be a period of adjustment, including some scarring effects from business closures and job losses, that we will need to navigate as we enter the new normal, but these should prove temporary.

“Overall, while the pandemic is certainly not over, we do foresee a period of greater stability for members.”

How did your superannuation or pension fund perform in March? Have you been happy with the way the market has recovered in the past 12 months? What do you expect to happen for the rest of 2021?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.