Self-funded retirees have been ‘overlooked’ by the government’s coronavirus response measures, say industry experts.

“Self-funded retirees who do not receive a pension or part pension or the Commonwealth Seniors Health Card are suffering financial hardship due to the impact of the COVID-19 crisis with little or no support from the government,” says Association of Independent Retirees (AIR) president Wayne Strandquist.

He explained that with the introduction of compulsory superannuation in 1992, the government’s intent was to encourage more Australians to fund their own retirement and reduce reliance on the Age Pension. And the move has been successful, with YourLifeChoices’ 2020 Ensuring Financial Security in Retirement survey showing that 38 per cent of older Australians are self-funded couples or singles.

But with a self-funded retirement comes risk.

Mr Strandquist said: “This has meant that self-funded retirees must bear the full investment risks of their retirement savings in the share market, property and fixed interest instead of having an Age Pension funded by the government with no risk attached.”

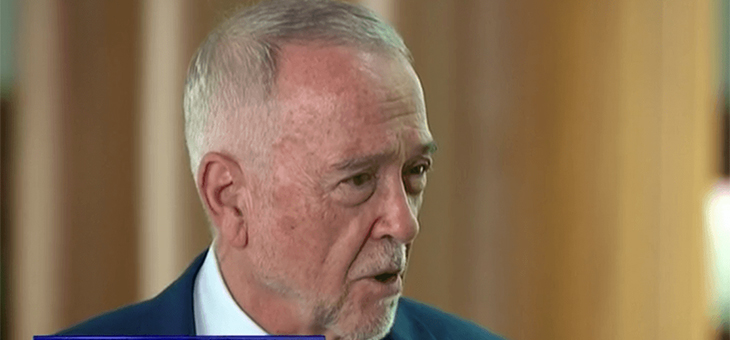

John McCallum, National Seniors Australia (NSA) chief executive, told the Australian Financial Review (AFR) that “retirees are very anxious that there are not going to be self-funded retirees for much longer”.

Professor McCallum said many self-funded retirees are complaining that they feel “abandoned” by the government.

“There is a concern that their struggle to make ends meet is not being recognised,” he said.

Mr Strandquist said the coronavirus pandemic had had a serious financial impact on self-funded retirees in the following ways:

- falls in the stock market have reduced the balances of most superannuation funds by up to 20 per cent, with younger retirees (60–75 years of age) having their retirement income streams reduced by up to 10 years

- the drawdown of share investment capital will result in lower returns and potential capital losses

- lower or no company dividends can be expected, such as already announced by leading share investments including the banks

- investments made in companies that operate in the hospitality and tourist industries are at serious risk of not being recovered

- reduced rental property income as many tenants have been stood down from work

- the RBA cash rate has resulted in the fixed interest and bank interest rates being close to nil.

“All of this means that many self-funded retirees with assets above the Age Pension threshold are now receiving less income than the full Age Pension and do not qualify for the Commonwealth Seniors Health Card and the $750 income supplement,” said Mr Strandquist.

There has been a 50 per cent increase in calls to mortgage lender Household Capital from self-funded retirees since the pandemic outbreak, its chief executive Josh Funder told the AFR.

Olivia Long, managing director of self-managed superannuation funds at Prime Financial Group and ExpertSuper, called for action.

“I’d like to see Canberra repeat the precedent set during the global financial crisis and decrease minimum pension requirements. Give pensioners the opportunity to sit on their investments until market conditions (eventually) recover.”

Are you a self-funded retiree? Do you feel you have been overlooked in the assistance packages? What would help you?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Related articles:

How share market affects your nest egg

Income for life through longevity pooling

When retirement spending peaks