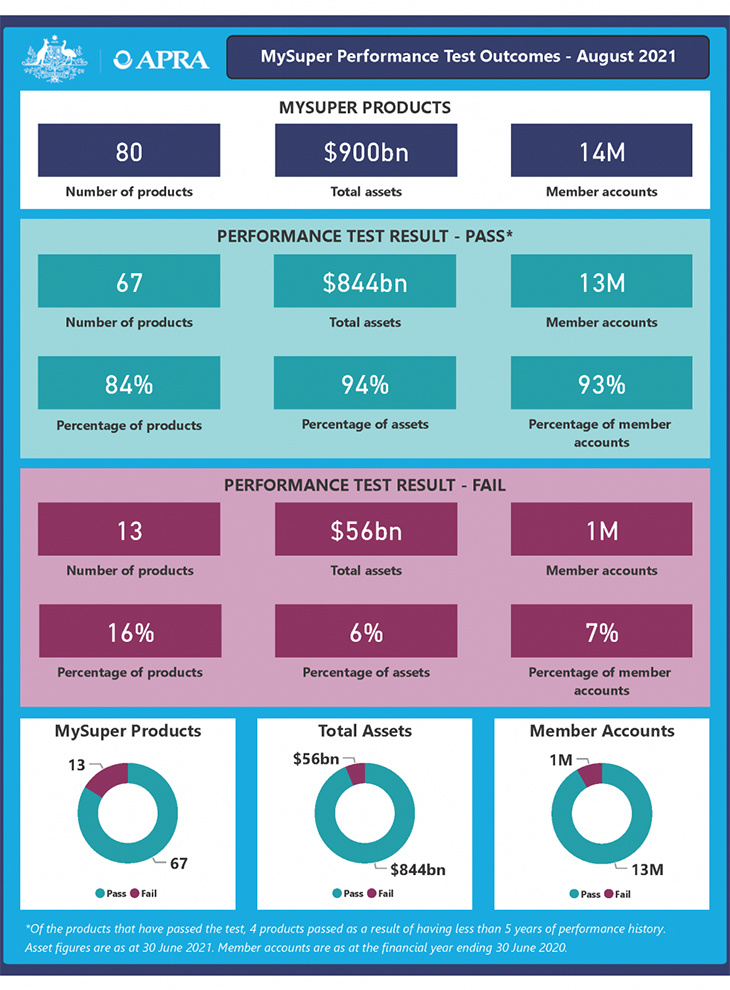

The day of reckoning arrived for superannuation funds on Tuesday when the Australian Prudential Regulation Authority (APRA) released the results of its performance tests, with 13 funds found to be failing the benchmarks.

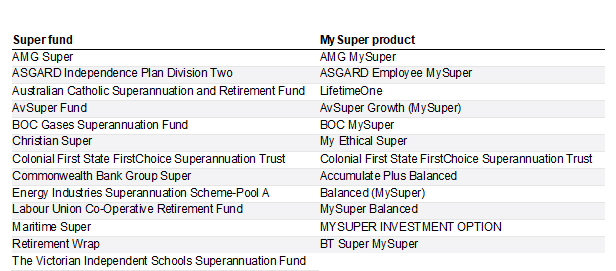

The unlucky 13 funds that were responsible for products that didn’t meet the Your Future, Your Super benchmarks, included Christian Super, a fund for Victorian teachers from independent schools, a BT Super fund, a Colonial First State super fund and a fund established for Commonwealth Bank employees.

APRA executive Margaret Cole said that 76 MySuper products with at least five years of performance history were assessed against the objective benchmark and that 13 of these failed to meet that standard.

Read: Will your super fund still be in business in five years?

“It is welcome news that more than 84 per cent of products passed the performance test, however, APRA remains concerned about those members in products that failed,” Ms Cole said.

“Trustees of the 13 products that failed the test now face an important choice: they can urgently make the improvements needed to ensure they pass next year’s test or start planning to transfer their members to a fund that can deliver better outcomes for them.

“APRA has intensified its supervision of trustees with products that failed the test and has requested they provide a report identifying the causes of their underperformance and how they plan to address them,” she said.

Read: Advice could drive a better retirement

“Trustees have to monitor their products closely and report important information to APRA – including relating to the movement of members and outflow of funds.”

Trustees of failed products are required to write to members by 27 September, advising them of their performance test outcome and providing the details of the ATO’s YourSuper comparison tool.

Ms Cole explained that as well as scrutinising the plans of the 13 funds that failed the test, APRA is engaging with trustees at risk of failing the performance test next year to ensure they take the steps necessary to improve performance, and to understand their contingency plans.

Read: Super changes will most help wealthy tax dodgers

The 13 failing super products

The figures show that almost one million Australian are in one of the 13 underperforming superannuation products.

Association of Superannuation Funds of Australia (ASFA) chief executive Dr Martin Fahy urged consumers to exercise caution in how they interpret the results of the performance test and think carefully before making any important decisions regarding their retirement savings.

“ASFA has long supported the orderly removal of habitually underperforming products, however, some of those called out by this test are in fact good products that have delivered excellent returns to their members over a long period of time,” Dr Fahy said.

“This is a retrospective, relative performance assessment where the so-called underperforming products are compared against top performing products.

“Any product that falls half of 1 per cent below the median is labelled as failing. What the published test results don’t tell members is why, and by how much, their fund has failed the test.”

ASFA said results of the test are potentially confusing for consumers.

Some products with high average returns over 7 per cent have failed the test, while other products with different asset allocations but also 7 per cent average returns over 10 years, have passed.

“This is the tyranny of benchmarks,” Dr Fahy said. “They fail to take account of risk, lifecycle, or ESG (environmental, social and governance) screening considerations and instead they preference hugging the index.”

ASFA questioned why APRA has not provided the transparency necessary to determine why, or by what amount, a product has fallen foul of the bright line test.

“This lack of transparency is very worrying – stamping a product with a fail, without any context, is the fastest way to spark fear and confusion among members,” said Dr Fahy.

ASFA urged consumers to consider the returns their product has delivered over five, 10 or 15 years, not just whether they have fallen one basis point below some arbitrary cut-off point in a retrospective benchmark performance test.

“Among these so-called ‘underperformers’, we have products which have doubled people’s investments over the past decade,” he said.

“The irony is that the financial performance of these so-called ‘underperforming’ products would be in the top quartile in many OECD countries.

“No one test is perfect but this one ranks products on only one measure when there are other important factors to consider, such as appropriate levels of risk for different age groups, the insurance coverage implications and whether you align with a fund’s investment ethos on issues such as climate change.

“We have long said that habitually underperforming funds should undertake an orderly exit and consumers should be protected during that process. But this test doesn’t do that. Instead, it sets an arbitrary bright line and removes from the process any role for judgement by our regulators.”

Only 2 per cent of the industry super sector was found to contain underperforming funds, while around 27 per cent of the retail sector (responsible for a massive 866,589 members) was underperforming, according to an analysis of the figures conducted by Industry Super Australia.

Industry Super Australia chief executive Bernie Dean said that during the seven-year life of the performance assessment these funds have siphoned off billions in profit from their members to be paid to the parent company, all while they were delivering lousy returns.

He said that the APRA results highlighted problems with both the Commonwealth Bank and Westpac, with the CBA sending more than $1.4 billion in dividends to its parent in the past five years, according to information given the House Economic Committee, while Westpac has received more than $220 million in profits from its BT super fund arm in the past five years.

Mr Dean said the performance tests were a useful tool for consumers but called for further measures to be introduced to stop these funds continuing to gouge their members.

“With the loopholes in the test still allowing dud funds to go on taking profits, it’s even more important that Australians find a high-quality fund run to only benefit them, with low fees and good returns,” Mr Dean said.

“Any fund that failed the test while creaming profits off the top should have to justify how it is in the best financial interest of their members – unfortunately these laws allow them to go on gouging.”

Was your super fund one of the 13 listed as an underperformer? Have you been happy with your super returns? Do you agree with ASFA’s assessment that the performance test is not an accurate guide for judging a super fund? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.