While Medicare takes care of a portion of your private in-hospital medical expenses, it was never designed to pay for everything. This is why Australians have private health insurance in the first place – to foot the bill for the rest.

Unfortunately, there’s still a big problem. Lots of us with health cover – particularly our older Aussies who are most likely to need elective surgery – are getting hit with huge gap fees after hospital treatments.

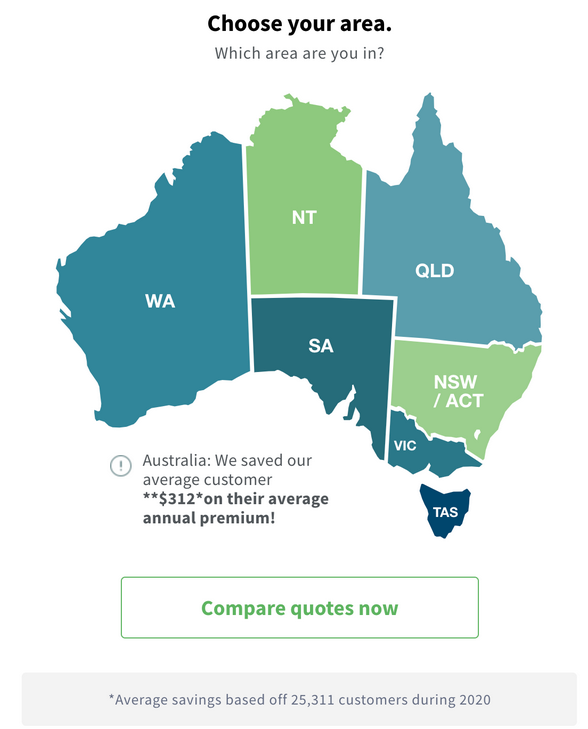

It’s disappointing to hear each story about people being hit with high out-of-pocket expenses because there are plenty of known and no-gap policies available. We know because we help people sign up to them every day, often to a cheaper policy as well.

The highest gap fee average for treatment in the 12 months from March 2020 was $485. During the same period, the average gap fee rose by a shocking 8.3%* and sadly it tends to be our older Australians who are more vulnerable to these excessive costs.

They’re regularly stung with these costs at the worst possible time and even though doctors and health insurers are meant to inform patients about gap costs, it can often come as a nasty unexpected surprise. After all, you don’t expect your health policy to end up costing you more money.

That’s why many Australians are taking matters into their own hands, by using Health Insurance Comparison to compare policies side-by-side and switching to a “known or no-gap” option.

So when treatment is received from a participating doctor or specialist, your out-of-pocket gap costs are reduced or eliminated.

Take back control of your health cover

We make it straightforward to find out what your policy actually covers you for and how it stacks up against other options.

Our experts can help talk you through the specifics of the policy and we can even take care of all the paperwork. Making the switch is simple and puts the power back in your hands.

It’s never been easier to understand what you’re paying for and why you’re paying for it and our service is completely free to use. Stop worrying about large gap fees and say hello to a better policy for your needs.

This article is opinion only and should not be taken as medical or financial advice. Check with a financial professional before making any decisions.

*APRA, Quarterly Private Health Statistics, March 2021