Former RBA boss Bernie Fraser has joined with 50 prominent Australians in an open plea to Malcolm Turnbull for the Government to prioritise fairness in the next Federal Budget.

Treasurer Scott Morrison may be toying with the idea of a corporate tax cut, but Bernie Fraser believes it won’t deliver the benefit to the economy for which the Government hopes.

With the Federal Budget less than a month away on 3 May, the agenda still seems quite unclear. Considering that personal income tax breaks are off the table – along with an increase to the GST – the Government is now preaching the potential benefits of reducing the 30 per cent company tax rate (CTR), saying it could encourage businesses to invest more and help to grow the economy.

This is contrary to findings from Victoria University which, in a report released yesterday, stated that Australian households would be up to $2000 per year worse off if company tax cuts were introduced.

Bernie Fraser agrees with this claim, saying to ABC Radio’s Fran Kelly yesterday that, “History shows it doesn’t work that way” and adding that such a move doesn’t guarantee new jobs and that cuts would end up reducing the Government’s ability to spend on health care, education and income support and that “would be the unkindest cut of all”.

“This kind of trade-off typifies what’s been a failure of fiscal policy by all governments over the last couple of decades,” said Mr Fraser.

He also went on to say that, should companies receive tax breaks, there would be the possibility of an increase in personal tax to cover the loss of revenue the Government will see if it’s not receiving taxes from companies.

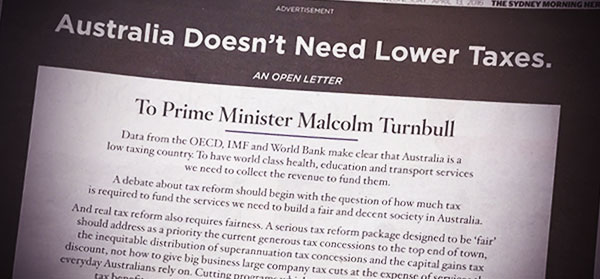

The letter, signed by such luminaries and economists as Bernie Fraser, ACTU president Ged Kearney, former federal ALP president Carmen Lawrence and Nobel prize winner Peter Doherty, was published yesterday as a full page advertisement in Fairfax newspapers, calls on Mr Turnbull “not to cut taxes at this time – and certainly not for companies”.

“A debate about tax reform should begin with the question of how much tax is required to fund the services we need to build a fair and decent society in Australia.”

“Real tax reform also requires fairness. A serious tax reform package designed to be ‘fair’ should address as a priority the current generous tax concessions to the top end of town, inequitable distribution of superannuation tax concessions and the capital gains tax discount, not how to give big businesses large company tax cuts at the expense of services that everyday Australians rely on.”

Read more at www.sbs.com.au

Listen to Bernie Fraser on ABC Radio

Opinion: Kicking us while we’re down

Having just been told that Australians need to live within their means, which is already difficult for so many, the Government’s idea of cutting company tax would seem to make that prospect even more difficult.

It’s almost as if the Coalition Government is intent on kicking households while they’re down.

Reducing the tax companies should pay may, in the long run, encourage investment and increase wages. But in the short term, we’ll be the ones forced to foot the bill. And according to Victoria University modelling, a cut to company tax will boost domestic production, but it will have a negative impact on personal incomes to the tune of $800 to $2000 each year. That’s per person, mind you.

The revenue lost to the Government will need to be offset from somewhere else. So it’s fair to say that will most likely be from cuts to other necessary services, such as health care, welfare and education. It’s worth pointing out here, too, that the Government recently announced it will increase spending on the military to the equivalent of two per cent of the economy. From where is that money coming?

You guessed it: us.

Okay, so lowering CTR may have its benefits, but they may take years or even decades. But will it encourage investment? Not according to Mr Fraser.

Although the Government claims that most of these so-called benefits will end up in the pockets of workers, it’s more likely it will go offshore to foreign interests. And any money made by management, ownership and shareholders will no doubt go back into buying shares in even more profitable companies, as it has in the past, and not necessarily into investing in more jobs or increasing wages. So who wins? The top end of town, yet again.

Cutting the company tax rate also sends another message: that the Government is intent on looking after the already wealthy. After all, why should blue collar citizens pay their tax when the big end of town gets off so lightly?

If anything, the Government should be leaning on companies to actually pay their fair share of tax. In a study undertaken by the Australian Council of Trade Unions (ACTU), 85 per cent of Australians think the Government should close corporate tax loopholes. Not surprising, when Australian Tax Office (ATO) figures show that 38 per cent of corporate entities paid no tax. Isn’t it about time Mr Turnbull made good on his promise to take on corporate tax avoidance? How does reducing the amount of tax they need to pay do that, I ask you?

“Australians are sick of being told they must live within their means and accept cuts to services while our government allows big business to skirt their responsibilities,” said ACTU president Ged Kearney.

It’s difficult to argue with that, no matter on which side of the fence you sit.

In the same ACTU survey, around nine in 10 Australians would actually like to see a national commission against corruption established that also has the power to investigate corporate tax avoidance.

The Government’s job is to provide services to the country it manages, not to make a profit. This whole preoccupation with getting back to surplus is erroneous. And when you take into consideration that households already have much bigger debt in proportion to the GDP than the Government, the hit workers will take to their yearly income will only further widen this gap.

Cutting the company tax rate is not the answer to our economic and employment woes. As Dr Janine Dixon of the Centre of Policy Studies at Victoria University so wisely points out: “Rather than using company tax cuts to bolster foreign investment, let’s not forget that Australia offers many other qualities to investors: an educated, English-speaking workforce, proximity to the Asia-Pacific region, and stable democracy. If we can retain on this list good infrastructure and public service delivery and a strong social safety net thanks to well-considered government policy, we might continue to enjoy the benefits of foreign capital inflows without sacrificing a valuable source of government revenue.”

Hopefully that provides inspiration for the Government to create tax reform that, in the words of our Prime Minister, is “about prudence, fairness and responsibility to our future generations” – claims which are, so far, ringing hollow.

What do you think about the Government potentially reducing company tax rates? Do you think it’s ‘the answer’ to create more jobs? What other ways can it encourage investment and improve job prospects for all Australians? Would you like to add your name to the list of Australians who oppose lower company tax?

Related articles:

Family home in assets test

Cuts to CGT could save budget