Of the 700 Australians who retire each day, around three in five do so with a pension account from their super fund.

That’s according to the latest APRA data that provides superannuation fund pension balances for the year ended June 2021.

According to this data, just over 350 new superannuation pension accounts are opened every day across Australia’s large super funds. Another 70 people a day will be retiring with an SMSF (self-managed super fund) and moving into a tax-free pension.

The Retirement Income Covenant, recently legislated by Parliament, required super funds to have an appropriate retirement income strategy for their members from July 2022. Regardless of the legislation, many members already need better retirement solutions. Over time, as the super system fully matures, the proportion seeking to maximise their expected retirement income from their super will increase.

How much money was in the retirement phase?

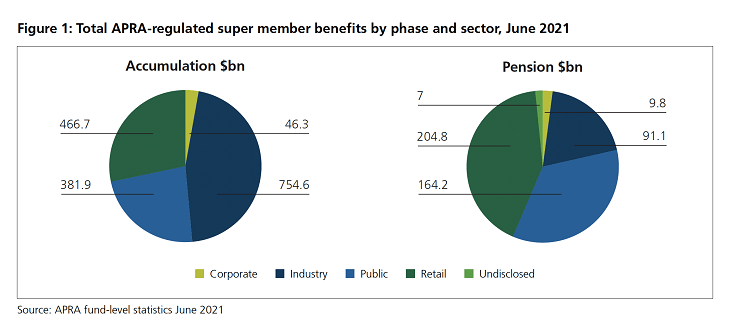

APRA-regulated funds had a total of $477 billion of member money in retirement income accounts in June 2021. A further $18 billion was represented by members with transition to retirement accounts.

The $477 billion of retirees’ money in large super funds was weighted more heavily to the retail sector (typically run by banks or other types of financial institutions). This effect is largely demographic. Industry funds typically capture members when they join the workforce and so have a younger average member base. The relatively older members in the retail sector have a greater need for advice as they approach retirement, which traditionally was more likely to be provided in that sector.

Public sector super funds also have a larger proportion of members in retirement, reflecting the sector’s more mature status.

APRA reports there were over 1.4 million pension accounts in super funds in June 2021.

The average value in a retirement pension account across all APRA-regulated sectors was over $330,000. This included a notional value for defined benefit pensions which have no account balance, but a higher-than-average retirement benefit.

The average balance varies across the sectors. The highest average balances are typically in the corporate and public sectors, where defined benefits were historically more common.

Millions of retiree accounts kept in accumulation

Average balances in industry fund pension accounts were higher than in retail funds. One explanation could be that the average age of retirees was higher in the retail sector. This could mean that those older retirees did not have the benefit of super for as many years as today’s retirees and so retired with smaller balances.

In APRA-regulated funds, there were many accounts belonging to members who were above preservation age (the age that you can access your super) that had not been rolled over into a pension account.

There were 2.6 million accounts where the member was over 65 (so had met at least one condition of release) but only 1.4 million of these were pension accounts. There were an additional 1.5 million accounts where the member was between 60 and 64 and could have met a retirement condition of release; and 250,000 of these were in a pension account.

Members in retirement who have met a condition of release pay no tax on income or withdrawals from their pension account. So there were potentially around two million accounts where tax at a headline rate of 15 per cent per annum was being levied (unnecessarily) on investment income.

The question is why? What is driving this behaviour? Is it just an oversight? A lack of engagement? Super fund inaction or older members making a conscious decision to treat accumulated super like a savings account?

The fact is, there doesn’t seem to be an answer to these questions.

While most pension accounts are held by members over 65, some are for members younger than 65 (i.e. aged 60-64) who have satisfied a condition of release. There are also those over 65 (so satisfying at least one condition of release) who have super in an account in the tax-paying accumulation phase.

It is often lower balance accounts that are left in the taxed accumulation phase. Higher balance accounts are more likely to be rolled into a pension account.

The average balance in the pension phase tends to be higher than the average for all accounts for people over 65. The table below shows the average balances in pension accounts and accounts (whether pension or accumulation) held by members over 65.

Sector Average member account balance – June 2021

Pension account Member 65+ account

Corporate $487,699 $383,645

Industry $396,655 $204,573

Public $482,164 $307,029

Retail $291,834 $207,000

Overall average $330,860 $235,870

Source: APRA Annual Superannuation Bulletin & Fund-level Statistics, June 2021

There was a significant difference between the average balance in a pension account and the average balance of all accounts (including pension accounts) for members over 65. Across the industry sectors, the difference was greatest in the industry fund sector due to the smaller proportion of pension accounts. These funds will have had a higher proportion of lower balance accounts that remained in the accumulation phase.

There was also a skew in the average pension account balances because members with low balances are more likely to withdraw all their super as a lump sum. With the Seniors and Pensioners Tax Offset (SAPTO) allowing a relatively high level of tax-free income, the benefits of tax-free super are less relevant for many retirees – hence the reason for the likely higher rates of withdrawal.

Summary

The APRA data on super fund balances show that super is delivering more than ever for new retirees.

Retirees today have had half their career (if unbroken) with 9 per cent or more of their annual income contributed to super, delivering a significant asset for their retirement.

In the coming years, retirees will have had longer in the system and they will have had more years with higher (ultimately 12 per cent) contributions.

Outcomes for members at retirement will continue to improve. The commencement of the Retirement Income Covenant will help members benefit from better retirement outcomes to match our world-class accumulation system.

The information in this report has been compiled by the Challenger Retirement Income Research team.

Jeremy Cooper is Chairman, Retirement Income, at Challenger.

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.

Important note: All the data used in this article have been extracted from APRA’s Annual Superannuation Bulletin June 2021 edition and Annual Fund-level Superannuation Statistics report June 2021 edition, issued on 31 January 2022 and 15 December 2021, respectively. The validity of the conclusions we have drawn depend on those data being accurate and our being correct.