Real estate has long been a trusted investment but at times when low debt and high liquidity are necessary, such as in retirement, people should be open-minded about other investment classes.

Australians love property and for good reason. National dwelling values have increased by 5.4 per cent on average across the past three decades, highlighting the value in a tangible investment that has delivered impressive returns over the long run.

As much as 57 per cent of household wealth is held in housing, but as retirement looms it might be time to embrace the advantages of more liquid asset classes, such as shares and bonds.

What is liquidity?

Liquidity refers to how easily an asset can be converted into cash when needed.

Real estate and shares and bonds offer the potential for attractive returns over time, but the difference is how readily we can tap into our investments. Converting real estate into cash can be a time-consuming process, but shares and bonds can be quickly accessed.

Portfolio diversity is important to consider but so are individual circumstances. People may need to finance treatment for unexpected health complications, travel or support for their family and a liquid investment can come in handy if something unpredictable arises.

Debt is also a factor. Real estate is often a leveraged asset but in retirement people should be as close to debt free is possible, for two reasons.

Loan repayments are obviously an additional drain on cash flow, and if a retiree’s marginal tax rate is nil, claiming interest costs as a tax deduction may no longer be beneficial.

Case study: property vs shares

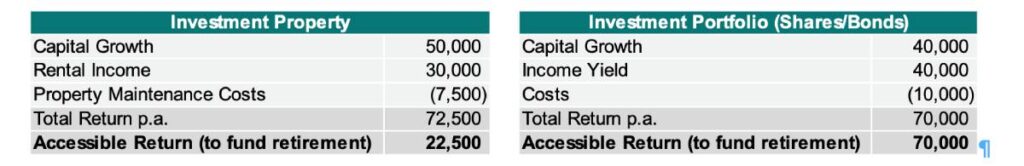

Let’s consider two retiree investment scenarios, each with a value of $1 million, and we’ve intentionally made the total return assumptions similar so that we can focus on the impact of liquidity.

| Investment property | Investment portfolio | |

| 5% pa | Capital growth | 4% pa |

| 3% (rental yield) | Yield | 4% (income yield) |

| 25% of rental yield | Annual costs | 1% value/30% income yield |

The ‘investment portfolio’ features liquid assets, with approximately 75 per cent growth assets (shares) and 25 per cent defensive assets (bonds) – similar to what would be offered in most super funds. The returns are not guarantees, or predictions, on what will occur in the future.

As the below table shows, the total return is similar for both strategies, as expected, but the biggest deviation is with ‘accessible return’, which is significantly higher in the investment portfolio.

The accessible return for the investment property is calculated as the rent of $30,000, less costs of $7500, leaving an after-costs rental amount of $22,500. The investment portfolio can fund withdrawals of up to $70,000 p.a. without depleting the capital value. The key difference is the ability to draw down an amount equivalent to the capital growth.

The retiree also has easy access to their capital of $1 million if it is invested in liquid assets, allowing the purchase of, for example, a $100,000 caravan for that long-awaited trip around Australia.

Let’s examine the debt angle here as well. Using the example above, any loan repayments on an investment property would be funded from the net rental income of $22,500.

This would further reduce the retiree’s cash flow, which affects spending on living costs and, potentially, leaves them exposed to interest rate movements, adding risk to their financial position during an interest rate hiking cycle.

Property investors can receive a tax benefit from investment debt, as the interest cost of the loan is tax deductible. The higher the marginal tax rate, the greater the tax saving. However, a retiree whose taxable income is otherwise zero is unlikely to receive any tax benefit.

Investment debt risks

While circumstances will differ from one individual to another, retirees should be wary of the risks in holding investment debt.

An investment property may produce strong capital growth but cash flow is king when planning a comfortable retirement, and liquidity should be one of the top priorities for retirees.

This may mean reviewing your investment strategy, and reallocating funds to more liquid asset classes, as you approach retirement.

A little advance planning can go a long way to ensuring retirees have enough cash flow to fund the retirement lifestyle while remaining agile enough to handle life’s unpredictable moments.

Have you had to rethink your assets in retirement or in the lead-up to retirement? Share your views in the comments section below.

Also read: Your retirement journey should fit you perfectly. Here’s how

Andrew Wilson is a principal, wealth management, at Pitcher Partners Sydney.

Andrew:

Your calculations appear to use $1 million as the investment amount not $1.5?

If I’m wrong, can you please explain?

If I’m correct, I’m glad you’re not my Financial Advisor.