Australia’s retirement system may have taken a dip in 2020, but our pension market is the most successful in the world, according to latest Global Pension Assets study conducted by risk advisers Willis Towers Watson.

Australia’s superannuation system has assets under management that increased by 11.3 per cent a year over the 20 years to 2020.

And, with assets growing at an average annual rate of 8.7 per cent over the past decade, we had the strongest growth rate in pension assets among comparable countries in that time.

The US, Italy and Ireland had growth rates of 7.9 per cent, 7.8 per cent and 7 per cent respectively.

While this success may be cause for celebration, it doesn’t mean your fund averaged a return of 11.3 per cent over 20 years.

Read more: Australian pension system worsens on global index

The total funds under management in our superannuation system increased by that amount. And it’s not just investment success pushing this total. It includes fund returns and rising contribution levels made by the increasing numbers entering a growing workforce.

“The critical features in this success have been government-mandated pension contributions, a competitive institutional model and the dominance of DC [defined contribution],” explained Willis Towers Watson pension think tank Thinking Ahead Institute.

The system has grown because the rate of compulsory employee contributions – currently set at 9.5 per cent and legislated to rise to 12 per cent by 2025 – increased from 9 per cent to 9.5 per cent in the past 20 years.

It also benefited from workers being able to choose their funds – meaning funds had a strong incentive to perform highly – and the nation’s super bottom line is based on defined contributions, not defined benefits.

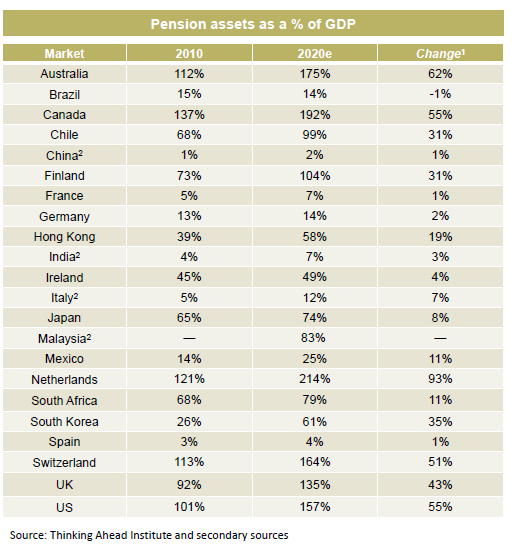

Willis Towers Watson research revealed that Australia’s super system grew from 151 per cent of GDP to 175 per cent in 2020 alone.

“Australia’s performance, where assets rose to 175 per cent of GDP (up from 151 per cent the year before) was particularly impressive, considering [there were] over $36 billion in outflows because of the early access to super scheme,” said Willis Towers Watson investment strategy chief Jessica Melville.

“While early release supported members in their time of need during the pandemic, Australian funds have shown considerable resilience and they will continue to play a significant role in the nation’s recovery.”

Read more: How did your super fund perform in 2020?

Chief economist at Industry Super Australia, Dr Stephen Anthony, said two factors were responsible for the big increase in the industry’s size relative to the overall economy.

He said overall GDP had declined because of the pandemic, so the relative position of super was stronger. Also playing a part was a stronger than expected sharemarket recovery from the pandemic, which had bumped average balanced superannuation accounts by up to 18 per cent since April.

Australia’s super system capitalised on this recovery because local funds are more exposed to shares than their international counterparts.

Australia has 48 per cent of pension assets in equities compared to 44 per cent for Canada, and 47 per cent for the US, with most other countries investing around 30 per cent.

Alternative assets in the system, which now account for 24 per cent of total assets, are also driving strong returns.

“Bond rates have been falling for some time and the industry funds saw early that they could get bond-type returns from assets like infrastructure and property, so they moved,” said Dr Anthony.

Read more: Government bonds explained: How they work and how to buy them

Nicki Hutley, partner with Deloitte Access Economics, told The New Daily that super’s performance and size is good news for the economy.

“Some countries like the US notionally save for retirement through the government. But it is spent on other things and some of their pension systems are completely underfunded,” said Ms Hutley.

“If you are investing large amounts into the superannuation system, the main thing is that you have confidence in the system, which we do.

“If you invest through the private sector, it is generally more efficient than if done through the government and in our system there is a lot of scrutiny.

“If people saved for themselves instead of through superannuation it could be spent on consumption rather than invested. So you could argue that we have a lot more investment in things like infrastructure because of superannuation.”

How has your fund performed in the past 20 years? Did it bounce back strongly by the end of 2020?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.