Retiree living costs are rising at their fastest pace in a decade, according to the latest Association of Superannuation Funds of Australia (ASFA) figures, which reveal the biggest annual increase in retiree budgets since 2010.

For a comfortable retirement, says the ASFA, couples aged around 65 need to spend $63,799 per year and singles $45,239 – up by 0.9 per cent compared with the previous quarter.

“Australian retirees are now facing significant pressure on their budgets, given a range of unavoidable price hikes including petrol and council rates,” said ASFA deputy chief Glen McCrea.

“It’s critical that future retirees are able to build sufficient retirement savings to ensure they can have dignity, health, vitality and connection in retirement. Moving Australia to the 12 per cent Superannuation Guarantee (SG) setting is an important step towards ensuring future generations can be confident to meet the financial challenges of retirement.”

The ASFA ‘standard’ is widely considered the benchmark for the cost of retirement, yet its calculations are based on averages.

Read: Rising costs wipe out Age Pension increase

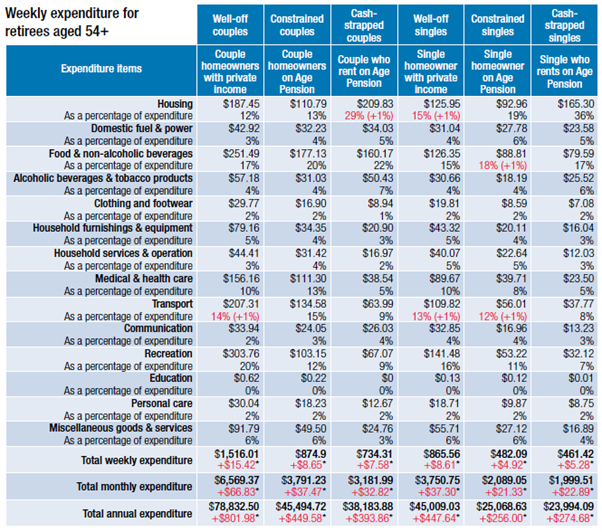

The release of the YourLifeChoices Retirement Affordability Index (RAI) on 7 November, produced by YourLifeChoices and The Australia Institute and based on median calculations, is the only table that reflects the actual cost of retirement. It also accounts for retirees aged 54 and over, rather than only those over 65.

According to The Australia Institute senior economist Matt Grudnoff, inflation in the September quarter was largely driven by international factors.

Read: Age Pension increase to be ‘wiped out’ by rising grocery costs

“With the world reopening after the pandemic, bottlenecks in production and transport have emerged as businesses try to ramp up production following the lockdowns,” he says.

“Demand for oil has also pushed up the price of automotive fuels. Transport was up because oil prices continue to rise, pushing petrol prices higher (+7.1 per cent).

“Automotive fuels have reached record levels, surpassing the previous high set in March 2014.”

The price of housing increased (+1.7 per cent) in the last quarter, due to rising building costs. New dwellings purchased by owner-occupiers also rose 3.3 per cent.

“This has been caused by strong demand in construction, which has enabled builders to pass through increases in their costs,” says Mr Grudnoff.

Read: ‘Logic-defying’ property prices good news for older Aussies

Cash-strapped singles experienced the biggest increase in prices (+1.2 per cent) because of the increase in the cost of housing. All other cohorts saw an increase of 1 per cent, largely driven by a combination of transport costs and housing.

Where did you notice the biggest price increases in the last quarter? What has been responsible for the biggest hole in your pocket over the past year? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.