If you’re in your 50s, you probably remember that when you started your working life, retirement by age 55 was something to aspire to. Of course, at the age you were then, 55 probably seemed like old age, and retirement a realistic option.

Fast forward 30 or 40 years and the idea of retiring before age 60 seems outlandish to most. But the prospect of retirement does at least enter the thought processes of those in their 50s, as they consider the next part of their lives.

The age of retirement has become a strong focus of many government agencies and demographers. With Australia’s population ageing, plans must be made to ensure appropriate support systems and infrastructure for retirees.

Read: Could ‘buying the dip’ boost your retirement income?

Factors such as the economic impact of the changing needs of retirees, the length of time you will live in retirement and housing requirements – particularly aged care facilities – must all be considered by those charged with mapping out Australia’s future.

One thing that has become apparent in reports prepared for the federal and state governments is that the retirement age varies between the major cities of each state. Those in the bigger cities of Sydney and Melbourne tend to retire earlier than their counterparts in Brisbane, Perth and Adelaide.

These results have been revealed in a report titled When will I retire? prepared by accounting firm KPMG. One reason suggested for the variation between capital cities is the higher cost of living in Sydney and Melbourne, which encourages older people to shift out of the city as they age to lower-cost regional areas.

Read: Five ways you could increase your retirement income

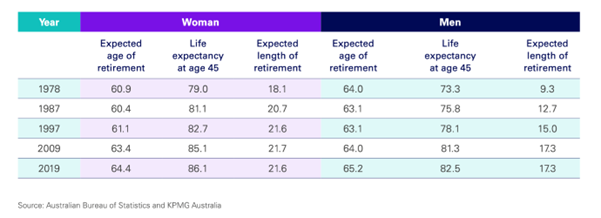

Using life expectancy data, the report displays how the expected length of retirement has changed in recent decades. While the expected retirement for women has risen only slightly over four decades (18.1 years in 1978 to 21.6 years in 2019), it has almost doubled for men in the same period, rising from 9.3 years in 1978 to 17.3 years in 2019.)

What the expected retirement age will be in the next 10 to 15 years is a matter of conjecture but the Age Pension qualification age can be used as a guide. The Age Pension eligibility age is currently 66, rising to 67 by 1 July next year. If current government proposals are accepted, the Age Pension age will be 70 by 2035, for both men and women.

Read: The bumps that could crash your retirement

The expected rise in the retirement age is predicated on a number of factors, including:

- a shift away from more physically demanding jobs towards service-based jobs

- overall increased labour force participation among women due to various policy measures that have strengthened women’s participation in the labour force during their 20s, 30s and early 40s

- increased demand for paid paternity leave (for both men and women), access to affordable childcare and early childhood education, and greater focus on gender equity within the society and in public policy

- strong labour market conditions helping to retain older workers in jobs

- changing social attitudes towards older workers

- increasing trend towards part-time work among older workers.

With life expectancy in Australia for both men and women maintaining a relatively straight-line upward trend over the past 120 years, Aussies in their 50s can reasonably expect to retire at a later age than the generations that preceded them, and also to enjoy a longer retirement.

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.