There are two basic hurdles you have to pass before you become eligible for the Age Pension – the income test and the assets test.

We will just be talking about the assets test here, because that’s our subject, but if you want to learn about the income test you can find out more here.

So back to the assets test.

What exactly is it? Well, the assets test sets out how many assets you can own and still be eligible for the Age Pension. Go above that limit and you may only get part payments or no payments at all.

Assets included in the assets test include:

- financial investments including shares and securities

- home contents, personal effects, vehicles and other personal assets

- managed investments and superannuation

- real estate

- annuities, income streams and superannuation pensions

- shares

- gifting

- sole traders, partnerships, private trusts and private companies

- deceased estates.

Centrelink also takes into account any assets you and your partner, if you have one, own overseas and any debts owed to you.

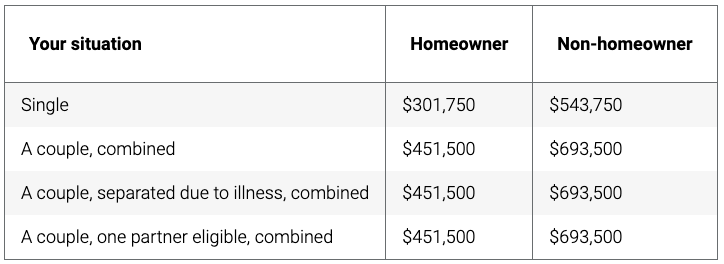

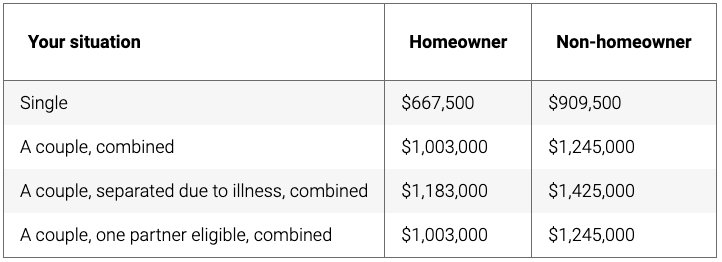

The following are the asset limits.

Limits for a full Age Pension

Limits for a part Age Pension

What’s not included in the assets test is your primary residence and up to two hectares on the same title and some funeral bonds and prepaid funerals.

Some rural landowners also have exceptions if they meet certain conditions, including:

- they have reached pension age

- have lived there for the past 20 years or more

- pass the land use test.

The land use test is about not forcing people off their land to gain a retirement income.

The Australian government does not believe older Australians on farms and rural residential areas should have to move from their principal home, where they have lived for a long time, to gain an adequate retirement income.

According to the Department of Social Security, the extended land use test is designed to enable people of Age Pension age with a long-term attachment to their land and principal home to stay in their home into their retirement. To do this, the person must make effective use of productive land to generate an income, given their capacity.

“If a person is eligible to have the extended land use test applied they can have the area of land adjacent to the principal home, that is more than two hectares and held on one title document, exempt from the assets test provided they are making effective use of the land,” the ruling states.

If your eligibility for the Age Pension does rely on the assets test, it’s worth noting the Department of Social Services reviews these limits and cut off points in March, July and September each year.

It’s a good idea to check these dates as you may sneak under the limit.

If your asset level changes, say for example if you sell your principal home, you must let Centrelink know within 14 days.

You can let Centrelink know through your myGov account if you have one or through:

If you don’t have access to a self service option, you can call the Older Australians line on 132 300. The hours are Monday to Friday 8am to 5pm.

If you purposely hide assets or lie about them, Centrelink may charge you with fraud.

How to reduce your assets to pass the assets test

There are a few simple ways. You can look into funeral bonds or prepaid funerals. As well as reducing your assets, it may give you and your family peace of mind.

You can revalue your assets. Unless your vehicles and personal assets such as furniture and jewellery are of exceptional quality, chances are they are worth a fraction of their original value. Centrelink only considers ‘market price’, so you can value them at what you could expect to sell them for on Facebook marketplace or a garage sale.

If you spend a little time online you will find even stunning antiques are only selling for a few hundred dollars each.

As your principal home is exempt from the assets test you can pay for some renovations. This would transfer any cash you have into your house, increasing its value and decreasing your bank account.

You can gift money or assets. However, the government doesn’t like you just giving money away to qualify for the Age Pension, there are some strict rules.

The maximum allowable value of the gift is the same if you’re a single person or a couple. They are both:

- $10,000 in one financial year

- $30,000 over five financial years – this can’t include more than $10,000 in a single financial year.

Centrelink doesn’t just consider financial gifts, it also takes into consideration the value of gifts such as a car.

Do you regularly update your asset value? What’s your best tip to reduce the value of your assets? Why not share it in the comments section below?

Also read: Deeming rate freeze is coming to an end. What steps should you be taking?

A comment and a question….

Firstly the whole thing sucks. It makes the system overly complicated and punishes those of us who saved money and planned for our retirement. We get nothing at all, not even the benefits of having a pension card. Aus is one of the few countries that sticks to this draconian system. OK that’s said.

Secondly we plan to go overseas to spend most of our retirement, somewhere it is cheaper than Aus and our savings will last longer. We budget to run out of money on day dot (no kids to leave anything to) but if the plans go awry and if we get below the asset cut off can we return to Aus and get support from the pension system? Do we have to be here for x months prior to that happening? Anyone know?

Your pension age already & Australian Citizens with at least 10 years working life ..you simply apply for the Pension when you arrive back in Australia. It can take 2 / 3 months for the payments to commence though. Provided you meet the Income & Assets thresholds mentioned above , you should be fine.

Set up a MyGov account before you go so the process is easier when you get back .

If you move to a country that has a Social Security agreement with Australia ( there’s 37 of them) you can actually apply form there.

If you have the full 35 year work life in Australia you’d get the maximum payment.

That’s the basic situation …..but everyone has different circumstances.

The OAP is portable. You just need to meet the qualifications for portability and one of the qualifications if living in a country that hasn’t a social security agreement with Australia is you must be living in Australia for 2 years before your pension becomes portable. Most people stay in Australia and work up until they receive the OAP before moving overseas. Otherwise you’ll be self funded. It all depends on your personal situation etc. It’s on the Centrelink website. Some countries have a social security agreement with Australia so will depend on the country you intend to live.

I suggest you join a Facebook group in the country you are considering. Google “Australians in XYZ” or “Australian Expats in XYZ” and you should find the appropriate site. They will have the answers to any questions you may have.

If you get the OAP in Australia and meet all the portability requirements you will still get the full basic part of the pension you get in Australia. The only parts you loose after 6 weeks overseas is the electricity supplement and part of the pension supplement.

Jan,Thankyou for your simple evaluation of the assets test.

In October last year my assets fell a few thousand below the assets test and my wife and I applied for a small pension.

It is now coming up to 4 months and Centrelink estimated date for reply was first week in December and no reply.

I need to spend about about $20,000 on house maintenance but am in limbo because I want to know our position moving forward.

I can’t update our finances on my govt because Centrelink freeze access to my gov when they are assessing pension requests.

It really is poor form by the Govt.thanks again.

I am now going to reading the deeming article

What a ridiculous, costly and unfair system! It’s disgusting. You buy a luxury mansion and you get a pension. You are well enough off to give your kids millions 5 years before retirement, you get a pension. You spend like a drunken sailor, you get a pension. But save, plan, and settle for a modest home – stuff you! Eke out a living on less income than the OAP to make your savings last 30 years, or draw it out and spend up big and get a taxpayer-funded reward.

Fred and Jane bought a luxury caravan and travelled around OZ then took a trip abroad, while Jane’s Dad pined away in an aged care home at taxpayer expense. Fred and Jane came home to get a full pension.

Jack and Jill postponed travel and took Jill’s dad into their home, caring for him for 15 years. By the time he died, they had gone thru most of their savings because they couldn’t get a pension while they had savings in the bank. Now he’s gone, but so has most of their money so the travel they planned is not possible. Great incentive to offload your loved ones onto the government and be totally selfish! What a stupid, uneconomical, unfair and immoral system it is.

Agree. If I sell my house (single person) there is only $242,000 extra allocated on your asset base. The rest (ie , difference between $242,000 and what house sold for ie $600,000 is added to your assets, which would in most cases, mean NO pension. We are really penalised (as others have said) to be financially savvy. No wonder people move overseas .