Superannuation has continued its recovery, with funds recording an 11th consecutive month of growth, but older Aussies are missing out on the full benefits.

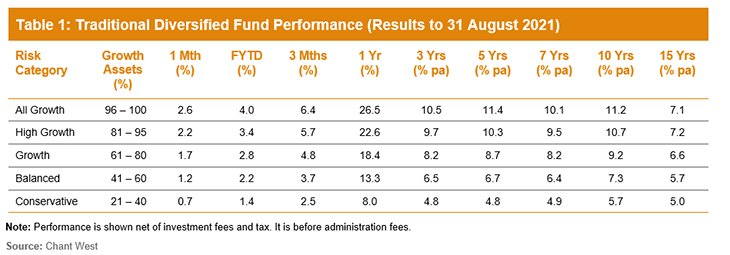

Superannuation research house Chant West revealed that the median growth fund (61 to 80 per cent invested in growth assets) lifted 1.7 per cent in August, taking the cumulative returns for the first two months of the financial year to 2.8 per cent.

Funds with 81 to 95 per cent invested in growth assets grew 2.2 per cent in August and have lifted 3.4 per cent for the first two months of the period.

Read: More Aussies retiring with a mortgage

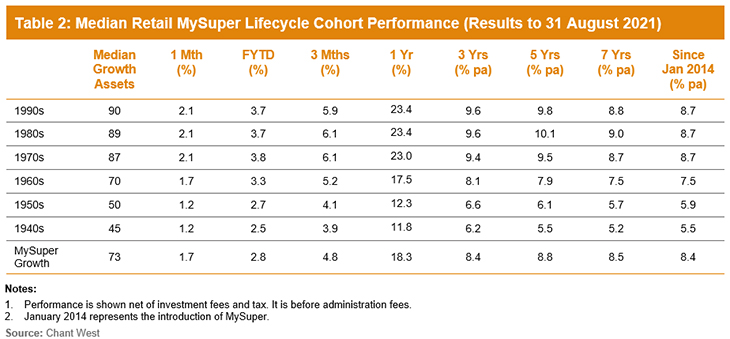

However, according to Chant West research manager Mano Mohankumar older Australians, particularly those born in the 1960s or earlier, have not enjoyed the fruits of the recovery as much as younger generations.

He explained that as a result of the strong recovery since the end of March last year, lifecycle superannuation products that have the higher allocations to growth assets have done the best, and this rewarded younger generations over the older cohort.

Those born in the 1960s or earlier are relatively less exposed to growth assets, which results in them underperforming the MySuper growth median over longer periods of time, Mr Mohankumar said.

Read: Concessions help wealthiest Australians avoid tax

The above table shows that someone born in the 1960s, who had a lifecycle superannuation product, would only have about 70 per cent dedicated to median growth assets, seeing a return of 1.7 per cent for August, while those born in the 1970s or earlier would have seen 2.1 per cent growth for the month.

The difference is even more stark when you compare the performance over a full year. Someone born in the 1960s would have seen 17.5 per cent, while someone born in the 1970s would have seen growth of 23 per cent.

According to Chant West, capital preservation is more important at those older ages, so while they miss out on the full benefits in rising markets, older members in retail lifecycle options are better protected in the event of a market downturn.

Mr Mohankumar said all growth assets continued to benefit from the ongoing share market rally in August.

Read: 13 worst super funds revealed

“The remarkable rally over the past 17 months has propelled growth fund performance to an impressive 29 per cent since the COVID-induced low point at end-March 2020.

“Not only have we recovered all the losses incurred in the early COVID period, but we’re now sitting about 14 per cent above the pre-COVID crisis high that was reached at the end of January 2020. And that has all occurred while the pandemic continues to cause massive disruptions to lives and economies.

“The main drivers of growth fund performance are listed shares and they were up again in August,” Mr Mohankumar said. “Australian shares rose 2.6 per cent over the month while international shares advanced 2.7 per cent in hedged terms and 3.1 per cent unhedged.”

How has your super performed in August? How much of your money is invested in growth assets and how important is capital preservation in your super strategy? Why not share your thoughts in the comments section below?

If you enjoy our content, don’t keep it to yourself. Share our free eNews with your friends and encourage them to sign up.