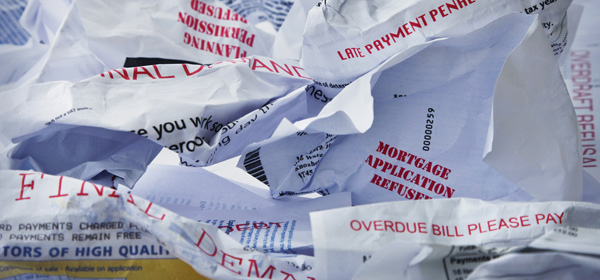

Origin Energy has paid penalties of $40,000 relating to its alleged failure to provide hardship assistance to a residential customer, and its alleged wrongful disconnection of their premises in NSW in 2015.

The issue highlights the need for Australian energy consumers to understand their rights if they find themselves in financial hardship.

The retail law and retail rules (which apply in NSW, the ACT, Tasmania, Queensland and South Australia) set out key protections and obligations for energy customers and the retail and distribution businesses where they buy their energy.

The Australian Energy Regulator (AER), which issued the recent infringement notices to Origin Energy, monitors and enforces compliance with the retail law and the retail rules.

Under the National Energy Retail Law, a retailer must maintain and implement a customer hardship policy for its residential customers.

Hardship programs typically contain a range of support measures, including a ban on retailers disconnecting a hardship customer for non-payment if they are adhering to a payment plan.

The program’s purpose is to help them identify customers experiencing payment difficulties and help them better manage their energy bills.

At minimum, a retailer’s hardship policy must include:

- processes to identify customers experiencing payment difficulties due to hardship;

- processes for early response by the retailer;

- offering of flexible payment options (including payment plans and Centrepay);

- processes to identify appropriate concessions and financial counselling services;

- processes to review customers’ market retail contracts; and

- programs to assist customers in improving their energy efficiency.

The National Energy Retail Rules specifically outline the steps a retailer must take before it can disconnect a customer’s premises for non-payment.

Customers experiencing payment difficulties have a range of additional protections from disconnection, as under the retail rules if a customer is on a hardship program or is a residential customer adhering to a payment plan, they cannot be disconnected.

Disconnection of a customer’s premises for non-payment must be a last resort option for retailers. The AER encourages customers who are worried about paying their energy bill on time to contact their retailer as soon as possible.

Unfortunately, these hardship provisions are not always followed, as appears to be the case with this latest Origin infringement.

AER Chair Paula Conboy said the regulator was particularly concerned that even after the customer provided information to Origin about ongoing financial difficulties, and the same information was provided by a volunteer from a charitable organisation on the customer’s behalf, Origin failed to offer hardship assistance.

“Origin’s hardship policy states: ‘If we’re on the phone with a customer who seems to be experiencing hardship, we’ll transfer them to our Power On (hardship) team right away’. But the customer was never transferred to Origin’s hardship team or registered on the hardship program.

“It is not acceptable that a customer wanting, but struggling, to pay their bills is not given the assistance that is their right under the National Energy Retail Law,” Ms Conboy said.

It is also alleged that Origin failed to follow the proper process before disconnecting the customer’s premises for non-payment of his energy bill in November 2015.

In this case, Origin did not take into account the customer’s efforts to settle his debt, failed to offer the customer a payment plan arrangement, and failed to use its best endeavours to contact the customer before disconnection.

“Disconnection of a customer’s premises should be the last resort for retailers, especially for vulnerable customers. Protecting vulnerable customers is an ongoing priority for the AER and retailers who fail to adequately assist customers experiencing difficulties paying their energy bills, or disconnect vulnerable customers without following the proper process, may face enforcement action from the AER,” Ms Conboy said.

Has your energy provider ever threatened you with disconnection? How did you handle the situation?

Related articles:

Hardship register to help those in debt

Help with financial hardship

Pension advance payments