Updated: The granny flat has been around for years and can be a completely viable living option for a family member or loved one who needs a little extra assistance and no longer wants to live by themselves.

A granny flat arrangement can offer a level of independence and a real alternative to retirement villages, and can be more attractive than permanent residential aged care.

If you did a quick poll on the street and asked what people believe is a granny flat, you’re likely to get a few different answers and, surprisingly, there are a few more meanings than you may think.

A granny flat is typically considered to be a self-contained unit either attached to a home or in the backyard.

A granny flat interest, as defined by Centrelink, is a bit different as Centrelink is concerned with what type of agreement for life has been established – not so much a description of the real estate.

Centrelink considers a granny flat interest as one where someone ‘pays’ for a life interest or life tenancy, and the life interest or life tenancy is in a private residence that will be the person’s principal home.

Until legislation passed in June 2021, many families were reluctant to document the changing of money as it likely meant a possible unwanted immediate capital gains tax event for the recipient of the gift.

This was leaving the older person in a vulnerable position should it not work out or the owner of the property suffers an event such as divorce, bankruptcy or a legal claim. The house may be at risk as it could form part of that person’s assets, which then become available to creditors or part of divorce settlements.

Anyone considering granting a granny flat interest by handing over money or titles must have a specialist lawyer explain and document the agreement. You will need to consider that you will lose control over these funds, as ownership will now be controlled by another person.

If family relationships break down, you may find the life interest you’ve been granted is no longer honoured. Legal action may then be required to have it enforced.

If, later, you need to move to residential aged care, you may not have sufficient assets to pay for entry.

This may restrict your choice and access to what you consider ‘appropriate’ care. If you are working through this with your financial planner and he/she isn’t across the aged care landscape, it’s important you find someone who is. It’s a complicated area and it’s easy to make a mistake.

If a need to move to residential aged care is reasonably foreseeable within the next five years, it’s possible that the granny flat interest could still be counted as an assessable asset owned by you when determining how much you need to pay to enter care.

You should discuss your individual circumstances with your local Centrelink/Department of Veteran Affairs office and/or seek advice.

How is a granny flat interest valued?

The value of a granny flat interest is the amount paid or transferred by someone if they:

- transfer the title of their home to a person and receive a life interest in return, or

- pay for the construction of accommodation on another person’s property and receive a life interest in return, or

- purchase a property in another person’s name in return for a life interest.

The Department of Social Services deprivation rules do not apply in these situations.

However, where assets are transferred in addition to one of the situations above, the Social Security Act determines the granny flat interest to be valued at a different amount under the ‘reasonableness test’ rules.

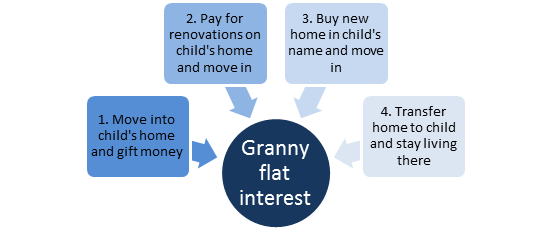

Four simple ways a granny flat interest works

Case study

Sara* turned 80 this year and moved interstate to live with her only child Noami* and family. She is a widow but reasonably independent with no major health issues. After selling her apartment in Brisbane, Sara has surplus funds of about $680,000, which she could consider gifting to her daughter, Noami.

In this case, the family has a suitable room for her in their house on the Gold Coast, so no construction or purchasing is required.

Therefore, for Sara we (Phillips Wealth Partners) needed to work out how much she could gift and create a granny flat interest and still maintain all of her current Age Pension.

Centrelink considers there to be two ways to have a lifetime right in a property:

- life tenancy – the right to live in the property

- life interest – the right to use and benefit from the property as the person wishes.

There are broadly two methods for valuing a granny flat right:

- amount paid or value of asset/s transferred is accepted as the value of the right

- Centrelink/DVA determines the value using a formula based method (the ‘reasonableness test’).

Sara has assets of:

- cash savings – $10,000

- cash from property sale $680,000

- shares – $100,000.

She is in receipt of a full Age Pension.

What is a reasonable amount for a granny flat interest for Sara?

Because Sara is providing cash, the reasonable amount is determined by using the combined annual partnered Age Pension multiplied by the conversion factor.

Today this is $42,988 x 9.41 (based on age, conversion table available here), which equals $404,517.

Therefore, Sara can create a granny flat interest with $404,517 without losing any Age Pension.

Centrelink also uses a figure called the extra allowable amount to determine whether you would then be considered a homeowner for Age Pension purposes.

The extra allowable amount is the difference in the lower asset thresholds for a homeowner couple and a non-homeowner couple, that is currently $693,500 minus $451,500, which equals $242,000.

Therefore, Sara could also consider establishing a granny flat interest of an additional $242,000 and would not be penalised by any gifting rules.

While there is no formal requirement that the arrangement be in writing in order for it to be recognised by Centrelink, it is required under tax law to be eligible for concessions in certain circumstances for Noami.

That’s a win-win for everyone.

Have you considered living in a granny flat? Have you investigated the pros and cons with a financial adviser? Share your experience in the comments section below.

Also read: Granny flat solution to housing crisis?

* Not their real names.

Craig Phillips is the director and a senior financial adviser at Phillips Wealth Partners.

General advice warning: This information is of a general nature only. Whilst every care has been taken to ensure the accuracy of the material, Fintegrity WeaIth Advisers Pty Ltd and Phillips Wealth Partners will not bear responsibility or liability for any action taken by any person, persons or organisation on the purported basis of information contained herein. No person, persons or organisation should invest monies or take action on reliance of the material contained herein but instead should satisfy themselves independently of the appropriateness of such action.

Also another danger which a close friend is experiencing. Owned outright a beautiful 3BR home, large grounds, big pool & entertainment area, with a ‘sort of’ granny flat underneath. Some years ago, single mum daughter of 1, living way above her means, begged to live in unit before she got evicted from her previous place. Mum reluctantly relented, let them move in, saying ‘for a few months, to get back on her feet’. She then spent a large amount of money to convert the unit into a nice liveable unit.

2 years later, daughter gets pregnant to dead beat non working guy, who moves in. Not long before they’re complaining that 4 people cannot live in cramped unit, so they swap. Disaster! They refuse to pay rent – saying ‘if there’s no mortgage, why should we’? They do nothing around the house, nothing. Not even take out bin, and complain that the inside locked garage should be for one of their expensive cars. Agreement has been they pay electricity bill, which is in her name. But as she is now on pension, getting power pension rebate, they are rubbing their hands at how little ‘their’ power bill is.

For nearly 5 years, they have paid no rent, both are on Centrelink payments, he will only work no more than 10 hours a week to give him more time to go out on his boat. Other family members are just as appalled at this, and when she made mention of wanting to sell, first cry was ‘what about us’? She is literally handing these bludgers around a grand a week, and all they can do is complain.

She now totally regrets anything to do with a granny flat, especially if it involves family.

😢😢😢😢