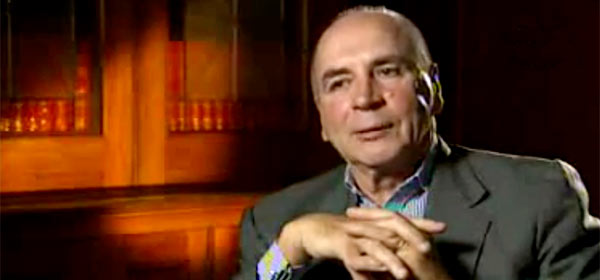

The former Reserve Bank governor’s long-awaited review of superannuation governance has created some controversy, with the findings of The Fraser Governance Review finding in favour of the status quo.

Bernie Fraser, himself a former director of several large industry super funds, said he found no grounds for legislation that would require a minimum number of independent directors to sit on super fund boards.

He believes that there is no need to mandate a quota of independent directors, because it was “far from self-evident” that doing so would deliver better performance.

“As some seem to think, is any benchmark really a secondary consideration alongside an unshakeable belief that “representative” directors of employers and members couldn’t possibly be as good as “independent” directors?” wrote Mr Fraser.

Mr Fraser said the current model is not broken, as evidenced by the consistent annual outperformance by 1.5 to 2 per cent of not-or-profit funds (NPF) over for-profit funds.

“The net returns to members of NFP funds – collectively and separately – have consistently and significantly exceeded returns to members of retail funds,” said Mr Fraser.

Instead, he recommends that a mandatory code of conduct be introduced across the entire super sector and for funds to recruit for their boards people with the proper skills, commitment and values rather than favouring independence.

“You’ve only got to look at the arithmetic,” said Mr Fraser. “If you’ve got nine directors sitting around a table, and the government proposal is to pick the chair out of one third of them, which is only three, I would say that’s not very sensible.”

The Coalition had previously tried to introduce laws that would require super funds to have one-third independent directors plus an independent chair.

Financial Services Minister Kelly O’Dwyer doesn’t agree with Mr Fraser’s findings, claiming that industry funds are using the review “to kill legislation″ for superannuation reforms that the Coalition has been working on for years.

“The Turnbull Government remains committed to legislation to improve the accountability of boards and member outcomes regardless of whether they are retail, industry or corporate funds,” said Ms O’Dwyer.

“There is nothing in this report that negates the need for legislation to lift the standard of accountability, transparency and choice across the entire superannuation sector.”

In 2010, the Cooper Review commissioned by Labor, and the Coalition’s 2014 Financial Systems Inquiry both recommended an increased quota of independent directors on industry super fund boards.

Read more at Industry Super Australia

Do you agree that we need more independent directors on super fund boards, or is the Government merely trying to defend the exhorbitant fees charged by the ‘for-profit’ funds? What do you think of Mr Fraser’s findings?

Related articles:

Is your super fund in the top 10?

Busting the biggest retirement myth

Make super fairer in two minutes